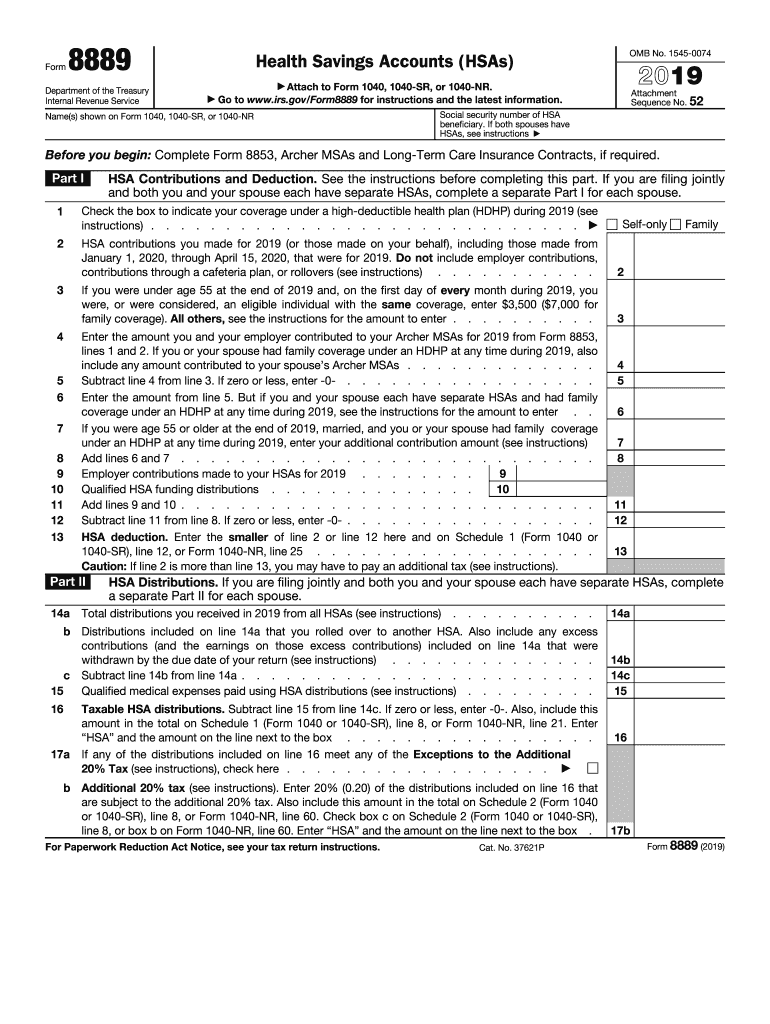

Form 8889 Sample

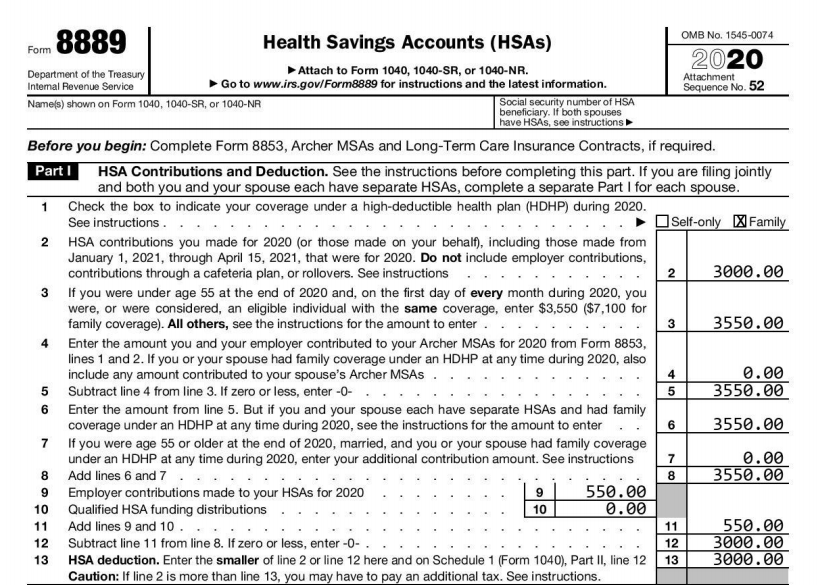

Form 8889 Sample - Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Report health savings account (hsa) contributions (including those made on your behalf and employer. This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual.

This is a distribution from a health flexible spending arrangement (fsa) or health. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return.

If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. This is a distribution from a health flexible spending arrangement (fsa) or health.

Irs Form 8889 For 2024 Carol Aundrea

Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. If you contribute to an.

Form 8889 2023 Printable Forms Free Online

Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. This is a distribution from a health flexible spending arrangement (fsa) or health. Individual taxpayers with.

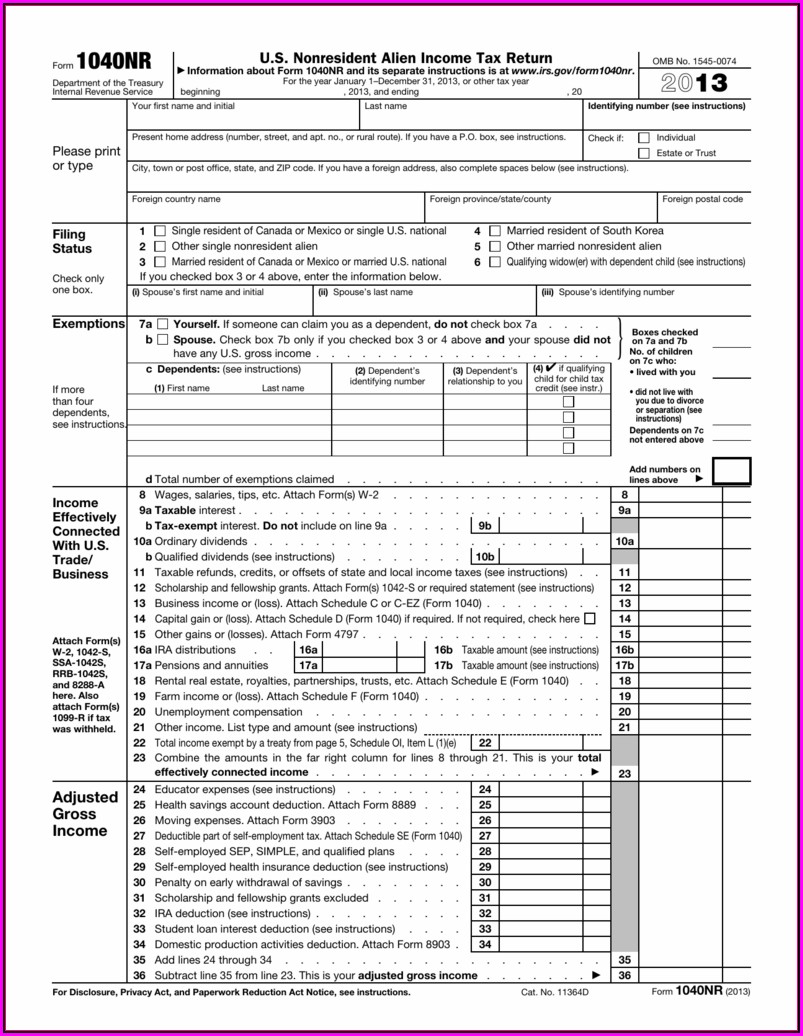

Irs Form 8889 Instructions 2013 Form Resume Examples goVLq1N2va

This is a distribution from a health flexible spending arrangement (fsa) or health. Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. Figure amounts you must include in income and additional tax you may owe.

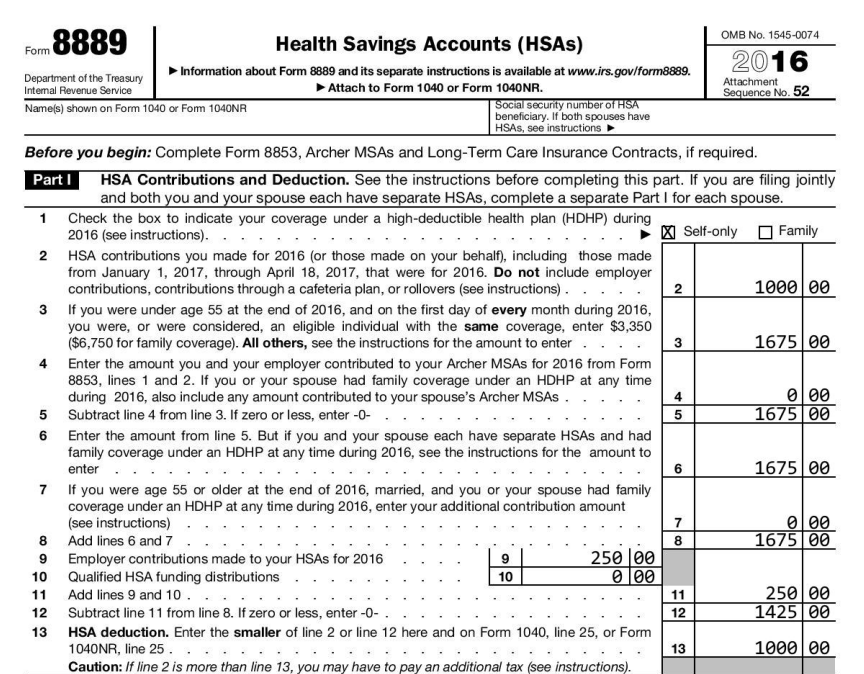

2016 HSA Form 8889 Instructions and Example HSA Edge

Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account.

Fill Free fillable Form 8949 Sales and Other Dispositions of Capital

If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. This is a distribution from a health flexible spending arrangement (fsa) or health. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. Report health savings account.

Irs Form 8889 For 2024 Carol Aundrea

Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. If you contribute to an.

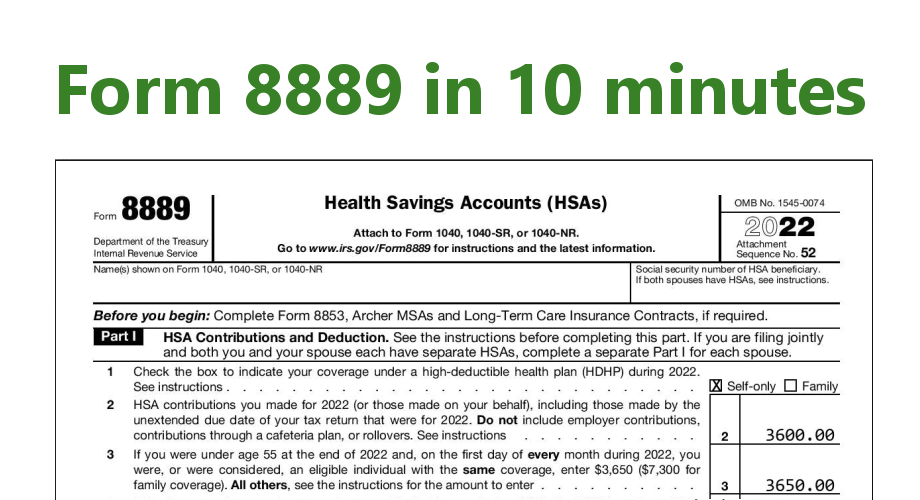

How to file HSA Form 8889 YouTube

Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. This is a distribution from a health flexible spending arrangement (fsa) or health. Report health savings.

2019 Form IRS 8889 Fill Online, Printable, Fillable, Blank pdfFiller

Report health savings account (hsa) contributions (including those made on your behalf and employer. This is a distribution from a health flexible spending arrangement (fsa) or health. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Figure amounts you must include in income and additional tax.

Form Fillable V5 Character Sheet Printable Forms Free Online

This is a distribution from a health flexible spending arrangement (fsa) or health. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Report health savings account (hsa) contributions (including those made on your behalf and employer. Individual taxpayers with a high deductible health insurance plan (hdhp).

How to file HSA tax Form 8889 Irs Forms, Health Savings Account, Hsa

If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Report health savings account (hsa) contributions (including those made on your behalf and employer. This is.

Report Health Savings Account (Hsa) Contributions (Including Those Made On Your Behalf And Employer.

Individual taxpayers with a high deductible health insurance plan (hdhp) can use a health savings account (hsa) to lower their. If you contribute to an hsa, or take a distribution, you need to complete and file irs form 8889 with your tax return. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. This is a distribution from a health flexible spending arrangement (fsa) or health.