Form 8615 Line 6

Form 8615 Line 6 - On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. Form 8615 is used to figure your child’s tax on unearned income. If the child files form 2555, see the instructions. For 2020, a child must file form 8615 if all of the following conditions apply: If you are not required to file this form follow the steps to. For tax purposes, the child's age is the age on.

If the child files form 2555, see the instructions. If you are not required to file this form follow the steps to. On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. For 2020, a child must file form 8615 if all of the following conditions apply: For tax purposes, the child's age is the age on. Form 8615 is used to figure your child’s tax on unearned income.

Form 8615 is used to figure your child’s tax on unearned income. On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. If you are not required to file this form follow the steps to. For tax purposes, the child's age is the age on. If the child files form 2555, see the instructions. For 2020, a child must file form 8615 if all of the following conditions apply:

2016 Form 8615 Edit, Fill, Sign Online Handypdf

On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. If you are not required to file this form follow the steps to. Form 8615 is used to figure your child’s tax on unearned income. If the child files form 2555, see the instructions. For 2020, a.

Form 8615 Line 5 Worksheet

If you are not required to file this form follow the steps to. For tax purposes, the child's age is the age on. Form 8615 is used to figure your child’s tax on unearned income. For 2020, a child must file form 8615 if all of the following conditions apply: If the child files form 2555, see the instructions.

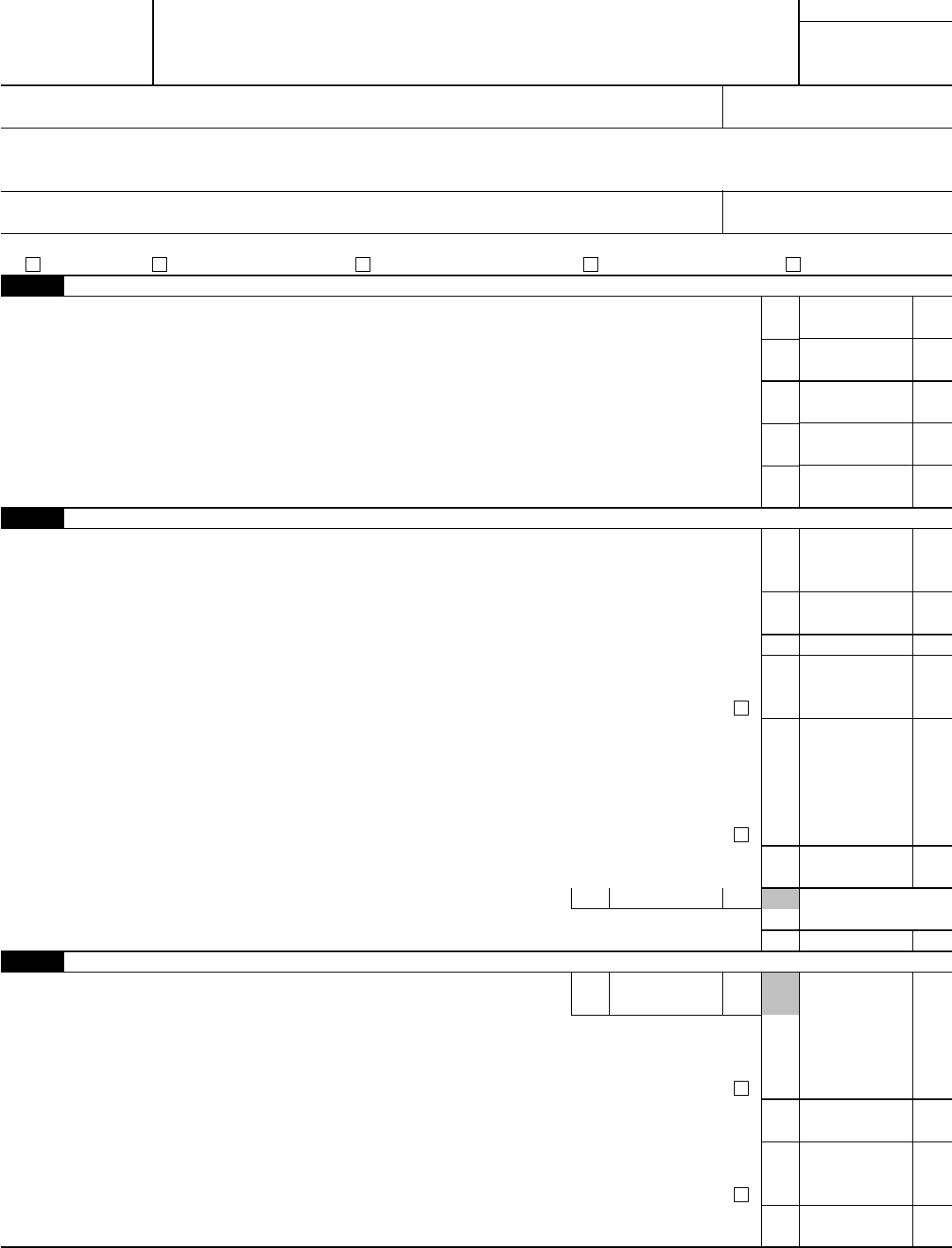

Form 8615Tax for Children Under Age 14 With Investment of More

On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. Form 8615 is used to figure your child’s tax on unearned income. If you are not required to file this form follow the steps to. If the child files form 2555, see the instructions. For 2020, a.

Irs Form 8615 Printable Printable Forms Free Online

On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. If the child files form 2555, see the instructions. For 2020, a child must file form 8615 if all of the following conditions apply: Form 8615 is used to figure your child’s tax on unearned income. If.

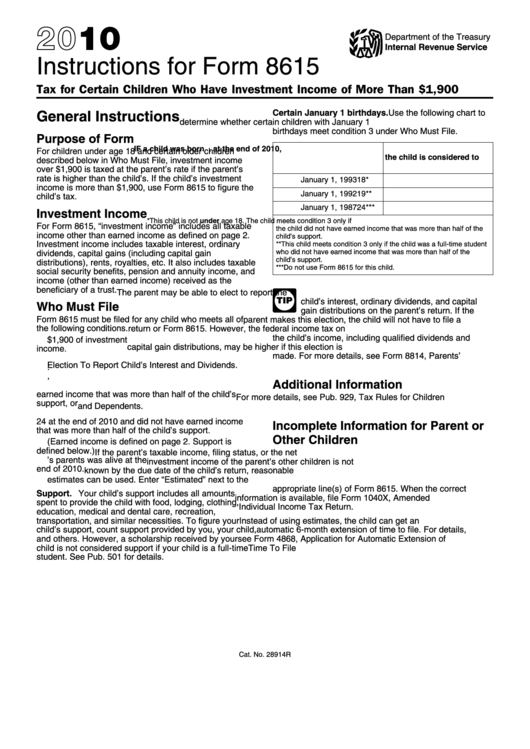

IRS Form 8615 Instructions

For tax purposes, the child's age is the age on. Form 8615 is used to figure your child’s tax on unearned income. If the child files form 2555, see the instructions. For 2020, a child must file form 8615 if all of the following conditions apply: If you are not required to file this form follow the steps to.

Don’t Miss Out On These Facts About the Form 8615 TurboTax by wireit

Form 8615 is used to figure your child’s tax on unearned income. On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. If you are not required to file this form follow the steps to. For 2020, a child must file form 8615 if all of the.

What Is Form 8615 Used For?

For tax purposes, the child's age is the age on. If the child files form 2555, see the instructions. For 2020, a child must file form 8615 if all of the following conditions apply: On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. Form 8615 is.

Instructions For Form 8615 Tax For Certain Children Who Have

If the child files form 2555, see the instructions. Form 8615 is used to figure your child’s tax on unearned income. For 2020, a child must file form 8615 if all of the following conditions apply: For tax purposes, the child's age is the age on. If you are not required to file this form follow the steps to.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

If you are not required to file this form follow the steps to. On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. Form 8615 is used to figure your child’s tax on unearned income. If the child files form 2555, see the instructions. For 2020, a.

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Form 8615 is used to figure your child’s tax on unearned income. If the child files form 2555, see the instructions. On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. For tax purposes, the child's age is the age on. If you are not required to.

For 2020, A Child Must File Form 8615 If All Of The Following Conditions Apply:

On the hrb form 8615, i just see line 6 as requesting this directly, not referencing the 8615 worksheet, but yes, parent's taxable. If you are not required to file this form follow the steps to. If the child files form 2555, see the instructions. For tax purposes, the child's age is the age on.