Form 5081 Michigan

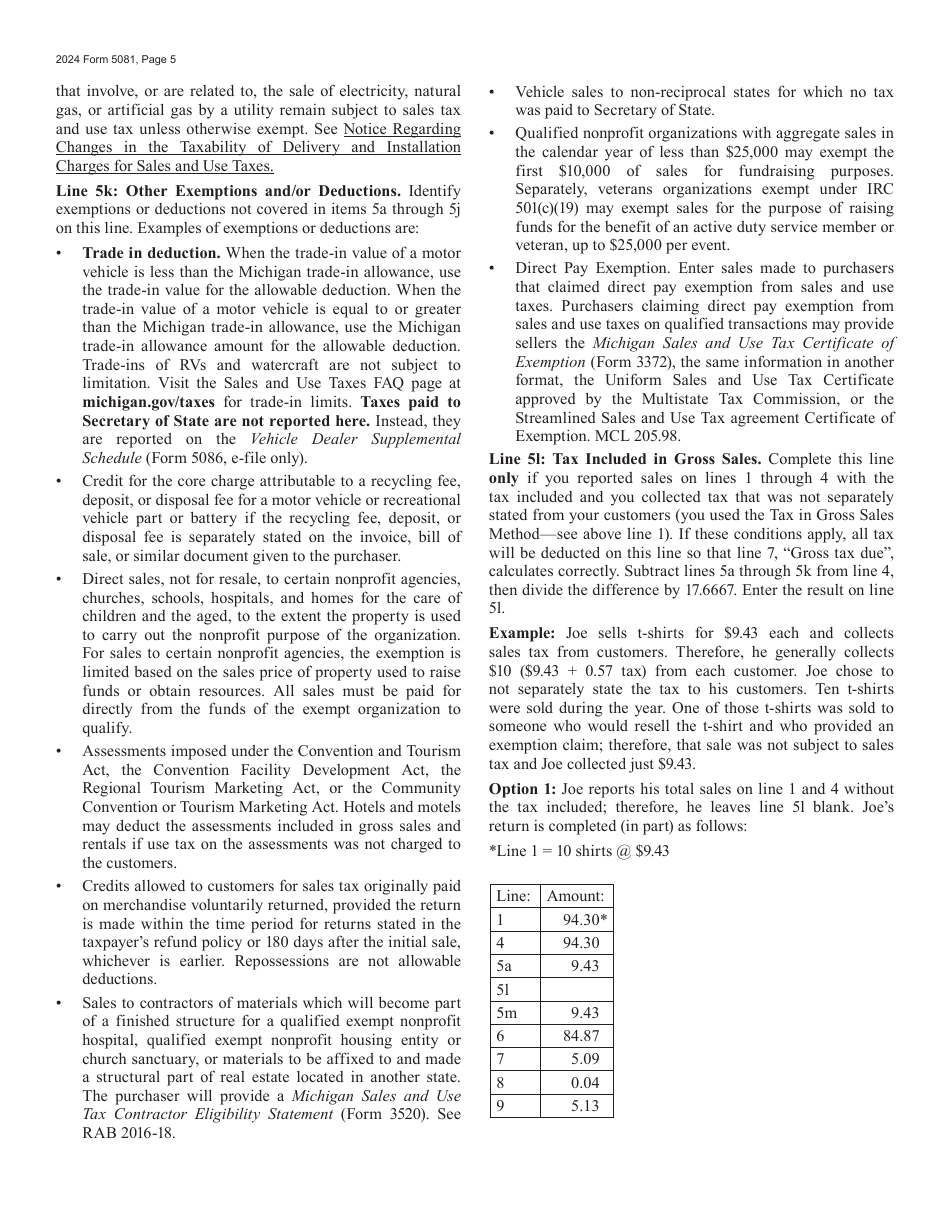

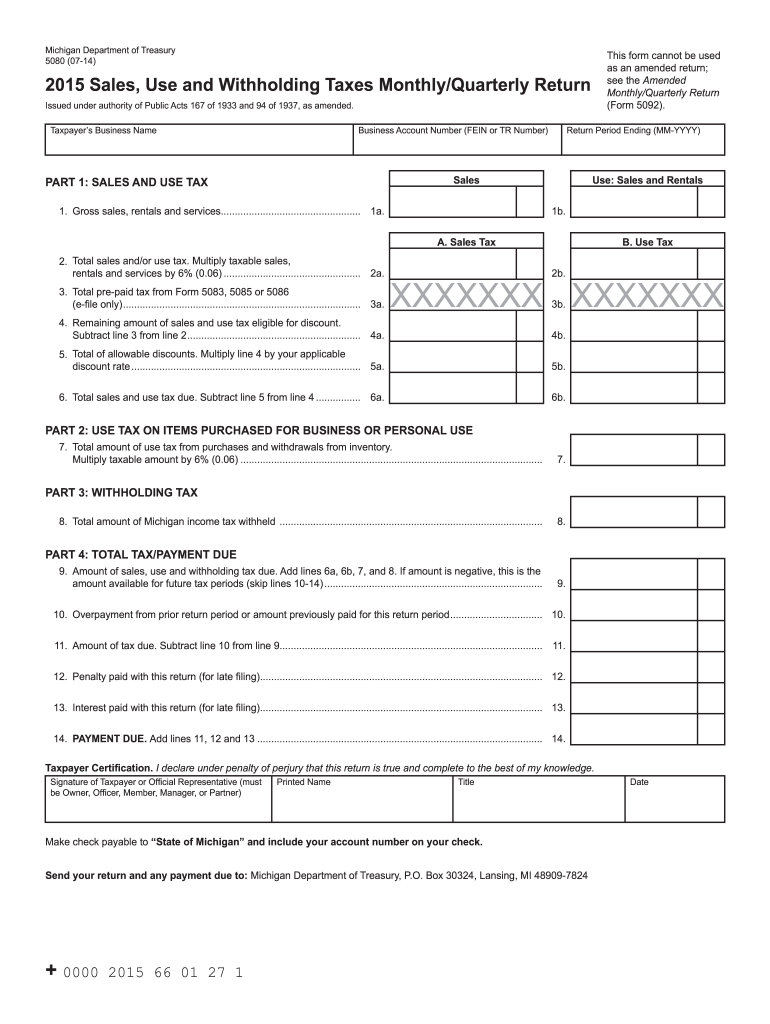

Form 5081 Michigan - Click the link to see the 2024 form instructions. File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Find out the reporting requirements,. This is a return for sales tax, use tax and/or withholding tax. Who should file form 5081? Sign up to file, pay and manage your business tax account online. Visit the help center for mto tutorials, faqs, mto services, compatibility. Click the link to see. Alternatively, make check payable to “state of. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto to file or 2023, sales, use and withholding.

Who should file form 5081? This is a return for sales tax, use tax and/or withholding tax. File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Sign up to file, pay and manage your business tax account online. Click the link to see. Alternatively, make check payable to “state of. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto to file or 2023, sales, use and withholding. Visit the help center for mto tutorials, faqs, mto services, compatibility. Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. Click the link to see the 2024 form instructions.

Click the link to see the 2024 form instructions. This is a return for sales tax, use tax and/or withholding tax. Visit the help center for mto tutorials, faqs, mto services, compatibility. Sign up to file, pay and manage your business tax account online. Click the link to see. Find out the reporting requirements,. Who should file form 5081? File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto to file or 2023, sales, use and withholding. Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan.

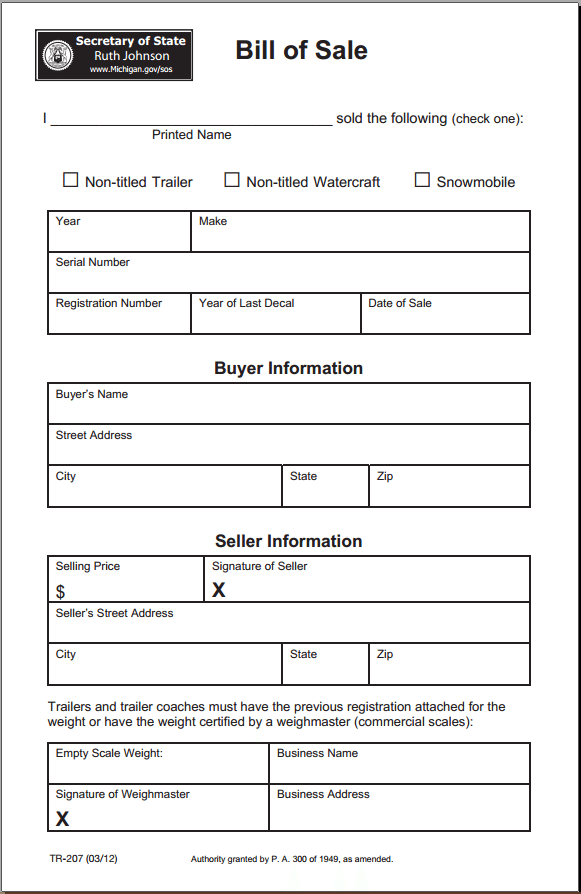

Download Free Michigan Bill Of Sale Form Form Download

Alternatively, make check payable to “state of. Visit the help center for mto tutorials, faqs, mto services, compatibility. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto to file or 2023, sales, use and withholding. Who should file form 5081? Click the link to see the 2024 form instructions.

Form 5081 Download Fillable PDF or Fill Online Sales, Use and

File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Click the link to see the 2024 form instructions. Alternatively, make check payable to “state of. Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. Who should file form 5081?

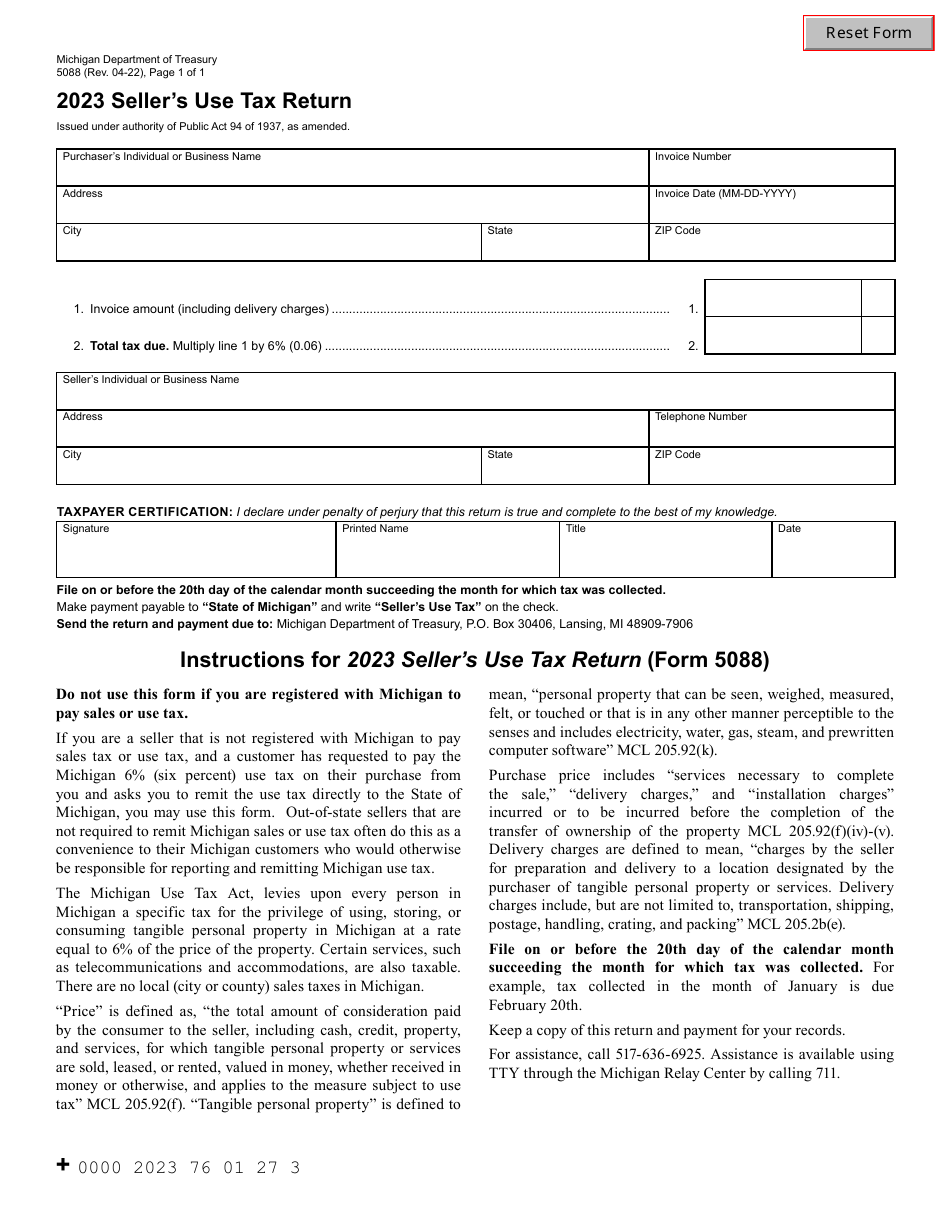

Form 5088 2023 Fill Out, Sign Online and Download Fillable PDF

File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Who should file form 5081? Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. This is a return for sales tax, use tax and/or withholding tax. Alternatively, make check payable to “state of.

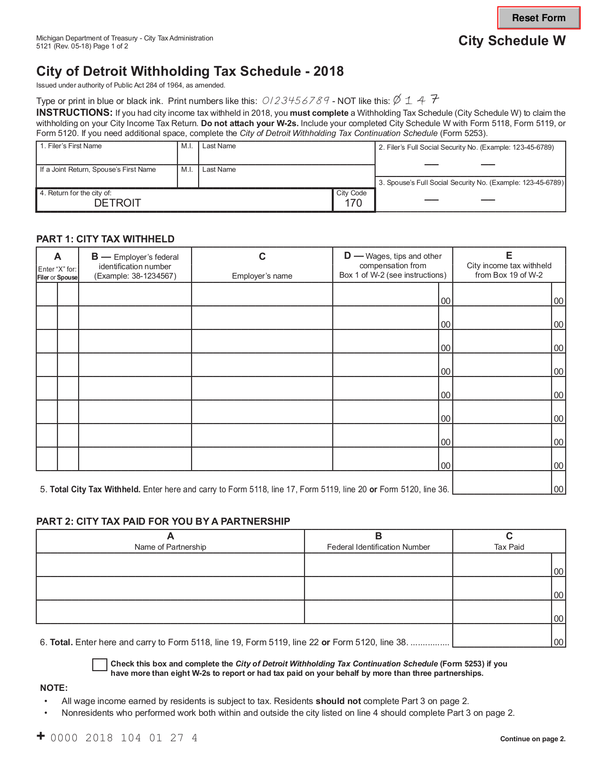

Michigan Withholding Tax 2024 Merle Stevana

Click the link to see the 2024 form instructions. Click the link to see. This is a return for sales tax, use tax and/or withholding tax. Visit the help center for mto tutorials, faqs, mto services, compatibility. File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov.

Printable Form 5081 Michigan Printable Forms Free Online

Find out the reporting requirements,. File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto to file or 2023, sales, use and withholding. Click the link to see. Visit the help center for mto tutorials, faqs, mto services, compatibility.

807_261955_7 michigan.gov documents taxes

Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. Find out the reporting requirements,. Alternatively, make check payable to “state of. File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Click the link to see.

Blank Michigan Form 165 Fill Out and Print PDFs

Click the link to see the 2024 form instructions. This is a return for sales tax, use tax and/or withholding tax. Who should file form 5081? Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. Find out the reporting requirements,.

5081 Form 2024 Nicol Anabelle

Sign up to file, pay and manage your business tax account online. Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. Visit the help center for mto tutorials, faqs, mto services, compatibility. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto.

Fillable Online MI 5081 20212022 Fill out Tax Template OnlineUS

Who should file form 5081? File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Find out the reporting requirements,. If you received a letter of inquiry regarding annual return for the return period of 2023, visit mto to file or 2023, sales, use and withholding. Learn how to complete form 5081, the annual return for sales.

Sign Up To File, Pay And Manage Your Business Tax Account Online.

Find out the reporting requirements,. Visit the help center for mto tutorials, faqs, mto services, compatibility. Click the link to see. Who should file form 5081?

If You Received A Letter Of Inquiry Regarding Annual Return For The Return Period Of 2023, Visit Mto To File Or 2023, Sales, Use And Withholding.

Learn how to complete form 5081, the annual return for sales tax, use tax and withholding tax in michigan. File and pay this return for free on michigan treasury online at mto.treasury.michigan.gov. Click the link to see the 2024 form instructions. Alternatively, make check payable to “state of.