Florida Tax Lien Certificate Sales

Florida Tax Lien Certificate Sales - A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds on online tax certificate sale/auction.

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. In an online tax certificate sale, bids are transmitted and received. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. The hillsborough county tax collector holds on online tax certificate sale/auction.

When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds on online tax certificate sale/auction. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes.

Tax Lien Certificates in Florida Over 1 Million Available!

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds on online tax certificate sale/auction. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in.

Investing In Florida Tax Lien Certificate School

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds on online tax certificate sale/auction. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in.

Investing in Florida Tax Lien Certificates

When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds on online tax certificate sale/auction. A tax certificate is an enforceable first lien against a property.

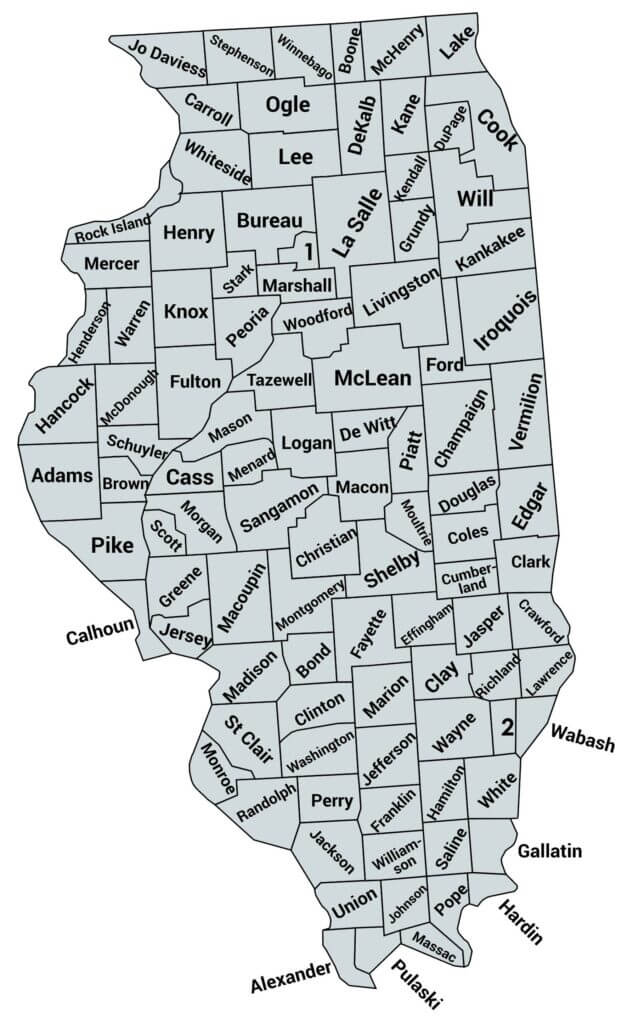

The Essential List Of Tax Lien Certificate States Tax Lien

The hillsborough county tax collector holds on online tax certificate sale/auction. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale,.

Florida County Held Tax Lien Certificates PDF Tax Lien Foreclosure

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. In an online tax certificate sale, bids are transmitted and received. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. The hillsborough county tax collector holds.

Fillable Online County Tax Lien Certificate Purchase Agreement

In an online tax certificate sale, bids are transmitted and received. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. The hillsborough county tax collector holds on online tax certificate sale/auction. A tax certificate is an enforceable first lien against a property.

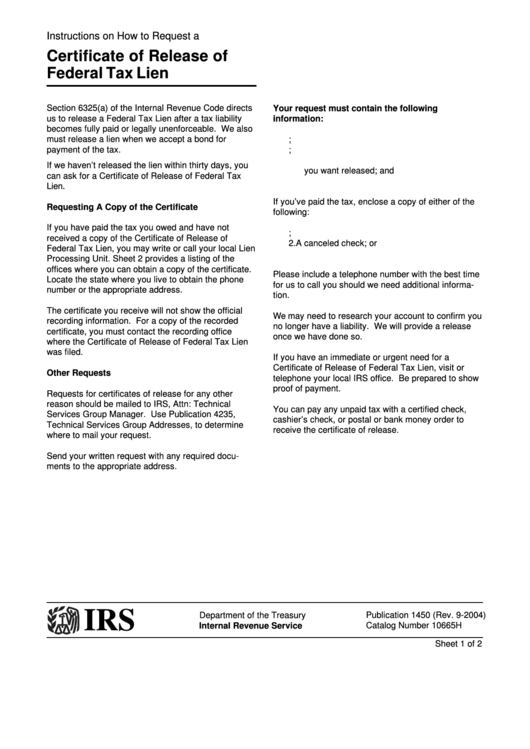

Instructions To Request A Certificate Of Release Of Federal Tax Lien

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. The hillsborough county tax collector holds on online tax certificate sale/auction. In an online tax certificate sale, bids are transmitted and received. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in.

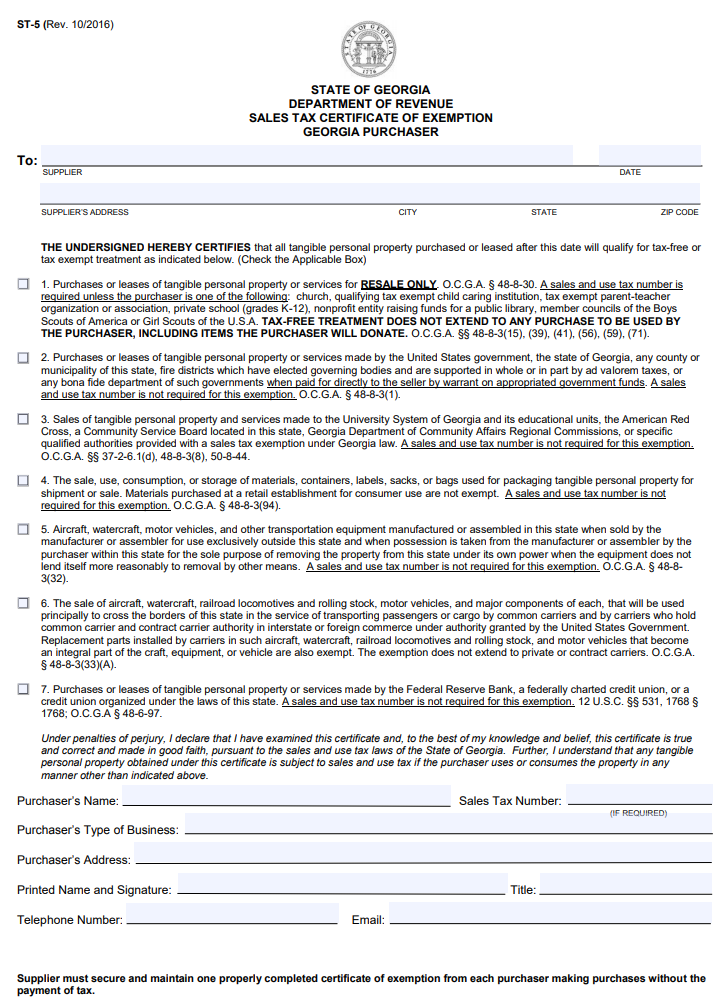

Sales Tax Exemption Certificate

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds.

Tax Lien Certificates in Florida Over 1 Million Available!

In an online tax certificate sale, bids are transmitted and received. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. The hillsborough county tax collector holds on online tax certificate sale/auction. A tax certificate is an enforceable first lien against a property.

Florida Sales And Use Tax Certificate Of Exemption Form

When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale, bids are transmitted and received. The hillsborough county tax collector holds on online tax certificate sale/auction. A tax certificate is an enforceable first lien against a property.

The Hillsborough County Tax Collector Holds On Online Tax Certificate Sale/Auction.

A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. When property taxes remain unpaid for a specific period of time (usually by april 1st of the year following the year in which the taxes are owed),. In an online tax certificate sale, bids are transmitted and received.