Florida State Tax Lien Search

Florida State Tax Lien Search - If the debtor is a business entity, the debtor’s assigned department of state document number is. Enter a stipulated payment agreement. Pay the amount in full. You can search our database by: For copies of your own tax records , send a written. You can search for liens on our website. Search records corporations, limited liability companies, limited partnerships, and trademarks. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. To resolve your tax liability, you must do one of the following:

You can search for liens on our website. Enter a stipulated payment agreement. For copies of your own tax records , send a written. You can search our database by: If the debtor is a business entity, the debtor’s assigned department of state document number is. To resolve your tax liability, you must do one of the following: Search records corporations, limited liability companies, limited partnerships, and trademarks. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Pay the amount in full.

You can search for liens on our website. Enter a stipulated payment agreement. Pay the amount in full. If the debtor is a business entity, the debtor’s assigned department of state document number is. Search records corporations, limited liability companies, limited partnerships, and trademarks. For copies of your own tax records , send a written. To resolve your tax liability, you must do one of the following: The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. You can search our database by:

Property Tax Lien Search Nationwide Title Insurance

To resolve your tax liability, you must do one of the following: The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. You can search for liens on our website. For copies of your own tax records , send a written. If the debtor is a.

Tax Lien Texas State Tax Lien

You can search for liens on our website. If the debtor is a business entity, the debtor’s assigned department of state document number is. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. You can search our database by: To resolve your tax liability, you.

Tax Lien California State Tax Lien

Enter a stipulated payment agreement. You can search for liens on our website. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. You can search our database by:

Tax Lien Certificate Investment Basics

If the debtor is a business entity, the debtor’s assigned department of state document number is. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Enter a stipulated payment agreement. For copies of your own tax records , send a written. You can search for.

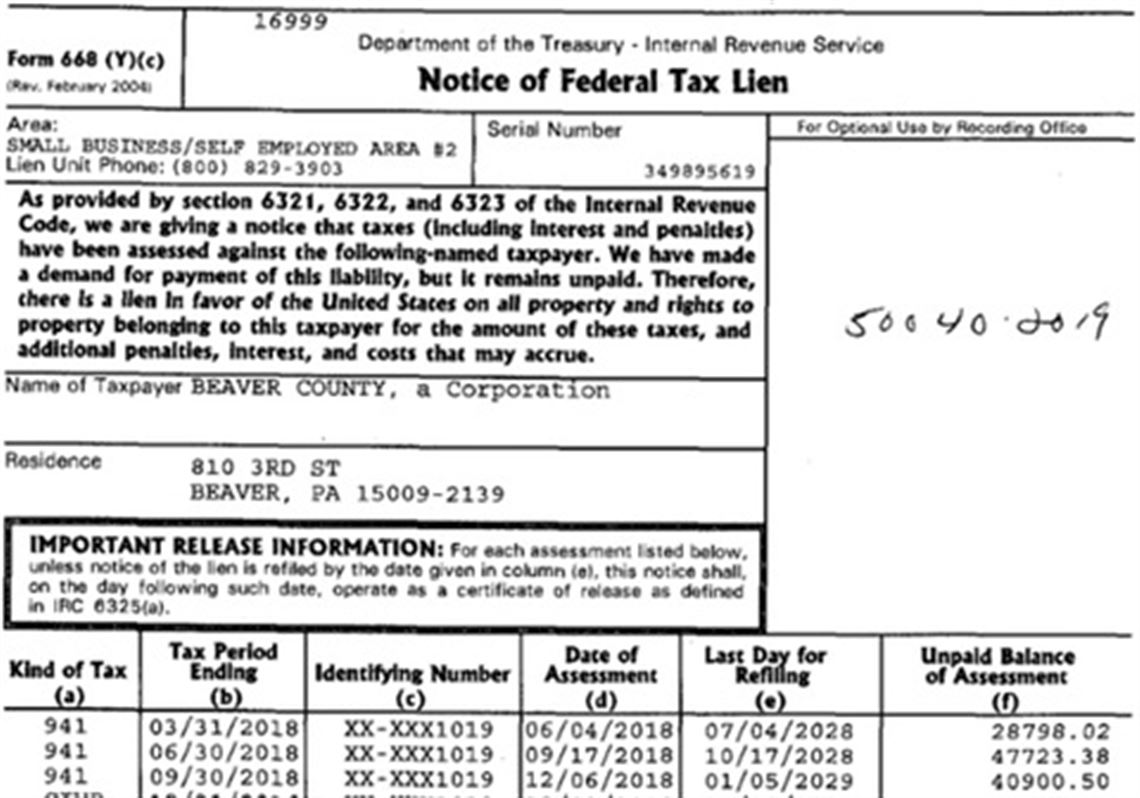

Pennsylvania state tax liability and lien

For copies of your own tax records , send a written. You can search for liens on our website. Search records corporations, limited liability companies, limited partnerships, and trademarks. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Pay the amount in full.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. Enter a stipulated payment agreement. You can search our database by: Pay the amount in full.

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

Pay the amount in full. You can search our database by: For copies of your own tax records , send a written. You can search for liens on our website. Enter a stipulated payment agreement.

Tips On Dealing With A State Tax Lien Legal News Letter

To resolve your tax liability, you must do one of the following: Pay the amount in full. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Search records corporations, limited liability companies, limited partnerships, and trademarks. You can search our database by:

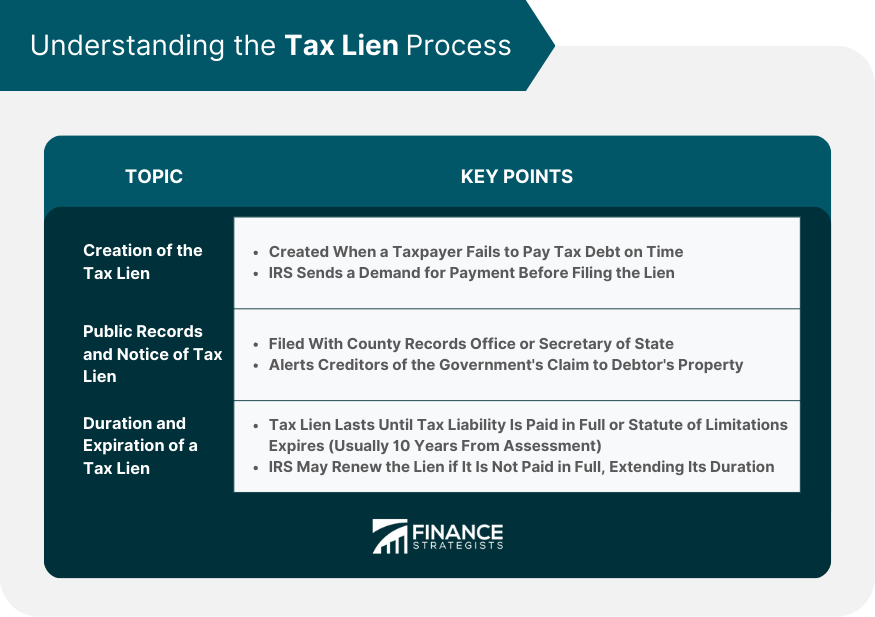

Tax Lien Definition, Process, Consequences, How to Handle

For copies of your own tax records , send a written. You can search for liens on our website. Enter a stipulated payment agreement. Pay the amount in full. To resolve your tax liability, you must do one of the following:

3 Ways to Remove a Tax Lien from your Credit Report

You can search for liens on our website. To resolve your tax liability, you must do one of the following: Enter a stipulated payment agreement. You can search our database by: The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the.

You Can Search Our Database By:

For copies of your own tax records , send a written. To resolve your tax liability, you must do one of the following: If the debtor is a business entity, the debtor’s assigned department of state document number is. You can search for liens on our website.

Pay The Amount In Full.

Enter a stipulated payment agreement. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Search records corporations, limited liability companies, limited partnerships, and trademarks.