Fincen Form 114

Fincen Form 114 - Make a copy of the certification form and maintain the entity’s financial institution where the account is established. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Individuals can satisfy their filing obligation by. The electronic version of the fbar is currently available and must be filed. To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. Who must file the fbar? How do i file the fbar?

Individuals can satisfy their filing obligation by. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. Who must file the fbar? The electronic version of the fbar is currently available and must be filed. You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Make a copy of the certification form and maintain the entity’s financial institution where the account is established. How do i file the fbar? To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable.

Who must file the fbar? A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. Individuals can satisfy their filing obligation by. To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. How do i file the fbar? You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. The electronic version of the fbar is currently available and must be filed. Make a copy of the certification form and maintain the entity’s financial institution where the account is established.

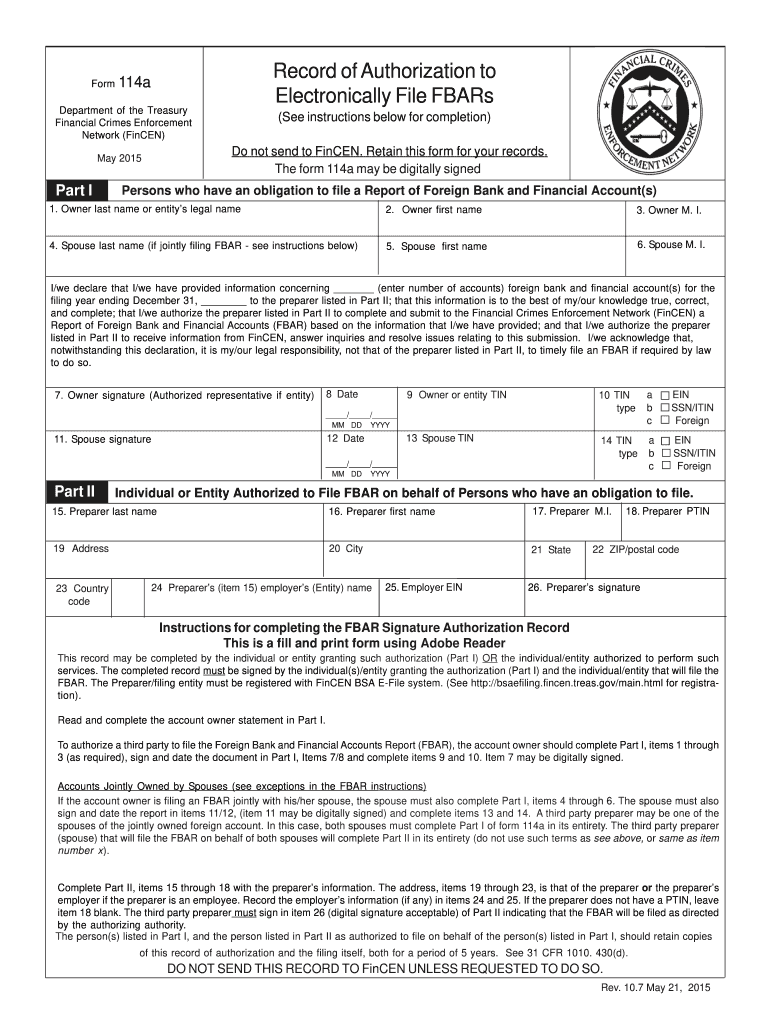

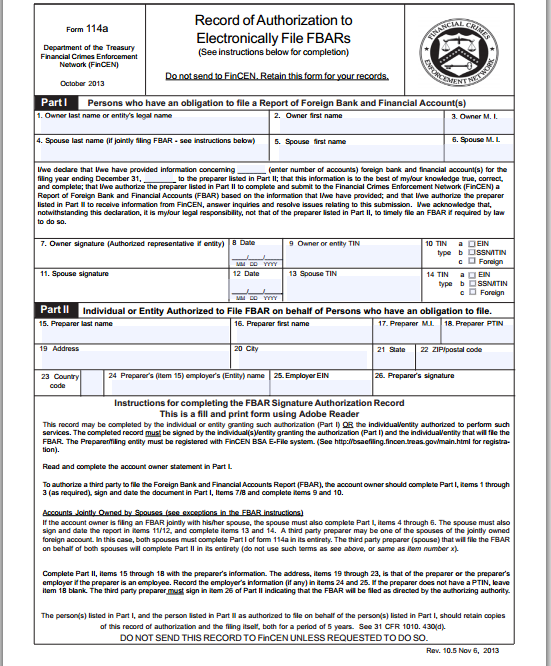

Form 114a Fill out & sign online DocHub

To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. Who must file the fbar? A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate.

FinCEN Form 114 Ten Things You Need to Know MyExpatTaxes

Make a copy of the certification form and maintain the entity’s financial institution where the account is established. To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. Who must file the fbar? A united states person that has.

FBAR Filing (FinCEN Form 114) Complete Step By Step Instructions

How do i file the fbar? The electronic version of the fbar is currently available and must be filed. You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Make a copy of the certification form and maintain the entity’s financial institution where the account is established..

FinCEN Form 114 How to File the FBAR

To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. A united states person that has.

Fillable Online FinCEN Form 114 Fax Email Print pdfFiller

To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. The electronic.

New FBAR Form in 2019! (FinCEN Form 114) Cantucky

You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. Make a copy of the certification.

IRs Foreign Bank Account Reporting, FBAR Instructions and Amnesty

How do i file the fbar? You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Individuals can satisfy their filing obligation by. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate.

Fillable Online FinCEN Form 114 Everything You Need to Know to File

A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. The electronic version of the fbar is currently available and must be filed. Individuals can satisfy their filing obligation by. To file the fbar as an individual, you must personally and/or jointly own.

Fincen Form 114 Sample Fill and Sign Printable Template Online US

You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Who must file the fbar? Individuals can satisfy their filing obligation by. How do i file the fbar? To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that.

FinCEN Form 114 2024 2025

Make a copy of the certification form and maintain the entity’s financial institution where the account is established. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. Who must file the fbar? You report the accounts by filing a report of foreign.

The Electronic Version Of The Fbar Is Currently Available And Must Be Filed.

To file the fbar as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an fbar (fincen report 114) for the reportable. Make a copy of the certification form and maintain the entity’s financial institution where the account is established. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the. Individuals can satisfy their filing obligation by.

How Do I File The Fbar?

Who must file the fbar? You report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114.