Filing Bankruptcy In Pa

Filing Bankruptcy In Pa - Debtors, both individuals and businesses, can obtain relief from their debts by. By filing for bankruptcy, you may: Documents due at time of filing of bankruptcy petition. To begin the bankruptcy process you must itemize your current income sources; Notice to individual debtor with. Get most or all of your bills discharged (wiped out); Major financial transactions for the last two years; Get to keep most or all of your property which. Pennsylvania, like all states, follows u.s. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can.

Documents due within 14 days. Pennsylvania, like all states, follows u.s. Get to keep most or all of your property which. Documents due at time of filing of bankruptcy petition. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. By filing for bankruptcy, you may: Debtors, both individuals and businesses, can obtain relief from their debts by. Get most or all of your bills discharged (wiped out); Major financial transactions for the last two years; To begin the bankruptcy process you must itemize your current income sources;

Pennsylvania, like all states, follows u.s. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. By filing for bankruptcy, you may: Documents due at time of filing of bankruptcy petition. To begin the bankruptcy process you must itemize your current income sources; Get most or all of your bills discharged (wiped out); Debtors, both individuals and businesses, can obtain relief from their debts by. Get to keep most or all of your property which. Major financial transactions for the last two years; Documents due within 14 days.

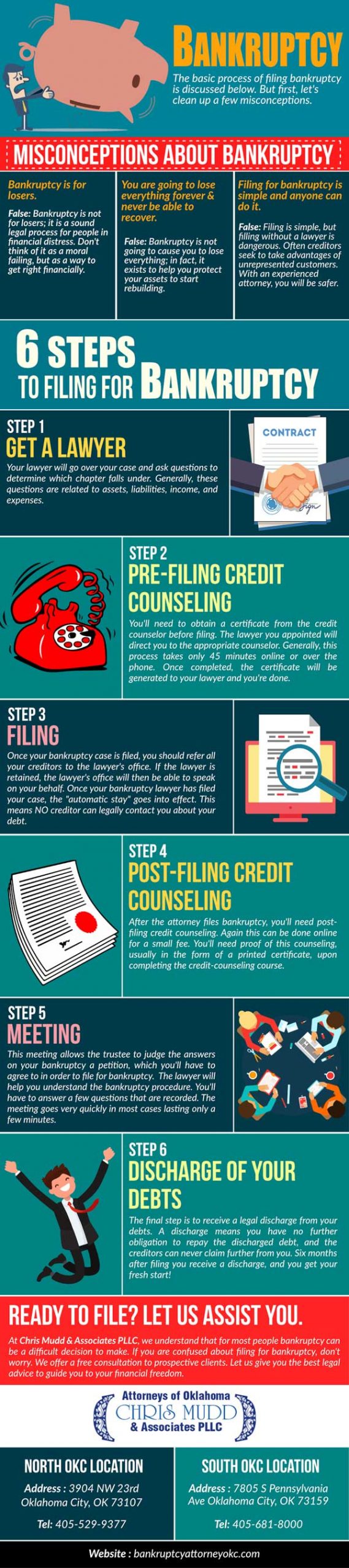

6 Steps To Filing for Bankruptcy Best Infographics

Documents due at time of filing of bankruptcy petition. Debtors, both individuals and businesses, can obtain relief from their debts by. Get to keep most or all of your property which. Documents due within 14 days. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can.

Filing for bankruptcy how does it work? Finserving

Notice to individual debtor with. Major financial transactions for the last two years; Documents due within 14 days. Debtors, both individuals and businesses, can obtain relief from their debts by. Pennsylvania, like all states, follows u.s.

Common Misconceptions About Filing Bankruptcy Cornwell Law Firm

Get to keep most or all of your property which. Get most or all of your bills discharged (wiped out); Debtors, both individuals and businesses, can obtain relief from their debts by. Documents due at time of filing of bankruptcy petition. Major financial transactions for the last two years;

filing for bankruptcy Law Firm of Ryan D. Baxter

Documents due within 14 days. To begin the bankruptcy process you must itemize your current income sources; Major financial transactions for the last two years; Debtors, both individuals and businesses, can obtain relief from their debts by. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can.

Bankruptcy Filing

In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. Major financial transactions for the last two years; Notice to individual debtor with. Documents due within 14 days. By filing for bankruptcy, you may:

How to File for Bankruptcy in Pennsylvania RecordsFinder

Documents due at time of filing of bankruptcy petition. Major financial transactions for the last two years; Notice to individual debtor with. Get to keep most or all of your property which. Debtors, both individuals and businesses, can obtain relief from their debts by.

What Costs are Associated with Filing for Bankruptcy in PA?

By filing for bankruptcy, you may: Major financial transactions for the last two years; Documents due within 14 days. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. To begin the bankruptcy process you must itemize your current income sources;

Filing Bankruptcy

By filing for bankruptcy, you may: Documents due within 14 days. Debtors, both individuals and businesses, can obtain relief from their debts by. Pennsylvania, like all states, follows u.s. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can.

Should You Consider Filing For Bankruptcy? Tax Relief Center

Major financial transactions for the last two years; Get to keep most or all of your property which. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. By filing for bankruptcy, you may: Documents due at time of filing of bankruptcy petition.

Bankruptcy Filing Free of Charge Creative Commons Chalkboard image

Documents due within 14 days. Get most or all of your bills discharged (wiped out); Documents due at time of filing of bankruptcy petition. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. Debtors, both individuals and businesses, can obtain relief from their debts by.

Major Financial Transactions For The Last Two Years;

Pennsylvania, like all states, follows u.s. Notice to individual debtor with. In this complete guide to filing for bankruptcy in pennsylvania, you’ll learn about the differences between chapters 7 and 13, debts you can. Get most or all of your bills discharged (wiped out);

Debtors, Both Individuals And Businesses, Can Obtain Relief From Their Debts By.

Documents due at time of filing of bankruptcy petition. By filing for bankruptcy, you may: To begin the bankruptcy process you must itemize your current income sources; Get to keep most or all of your property which.