Federal Tax Lien

Federal Tax Lien - Findlaw explains tax liens and options for. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill.

A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically. Findlaw explains tax liens and options for. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill.

A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. Findlaw explains tax liens and options for.

Federal Tax Lien February 2017

A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically. Findlaw explains tax liens and options for.

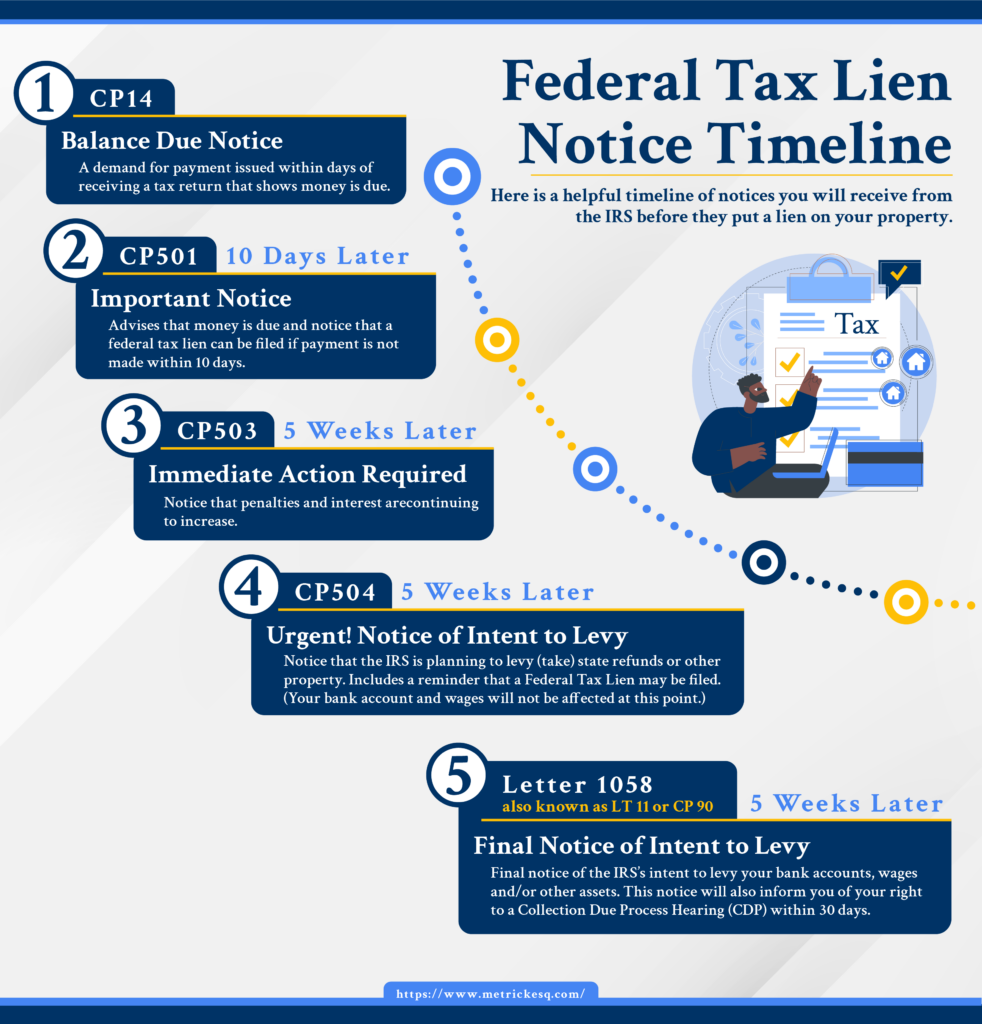

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. Findlaw explains tax liens and options for. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically.

Federal tax lien on foreclosed property laderdriver

A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. The federal tax lien arises automatically. Findlaw explains tax liens and options for. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises.

Federal Tax Lien Federal Tax Lien Payment

A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. Findlaw explains tax liens and options for. The federal tax lien arises automatically.

Federal Tax Lien February 2017

A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. Findlaw explains tax liens and options for. The federal tax lien arises automatically. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill.

Federal Tax Liens and Lien Resolution

Findlaw explains tax liens and options for. The federal tax lien arises automatically. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises.

Federal Tax Lien Definition and How to Remove

The federal tax lien arises automatically. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. Findlaw explains tax liens and options for.

Title Basics of the Federal Tax Lien SnapClose

A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically. Findlaw explains tax liens and options for. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill.

Federal tax lien on foreclosed property laderdriver

A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. Findlaw explains tax liens and options for. The federal tax lien arises automatically. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises.

Federal Tax Lien Steps to Eliminate a Tax Lien Legal Tax Defense

Findlaw explains tax liens and options for. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill. The federal tax lien arises automatically. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises.

The Federal Tax Lien Arises Automatically.

Findlaw explains tax liens and options for. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. A tax lien is a claim attached to property due to a taxpayer's failure to pay their tax bill.