Federal Tax Lien Statute Of Limitations

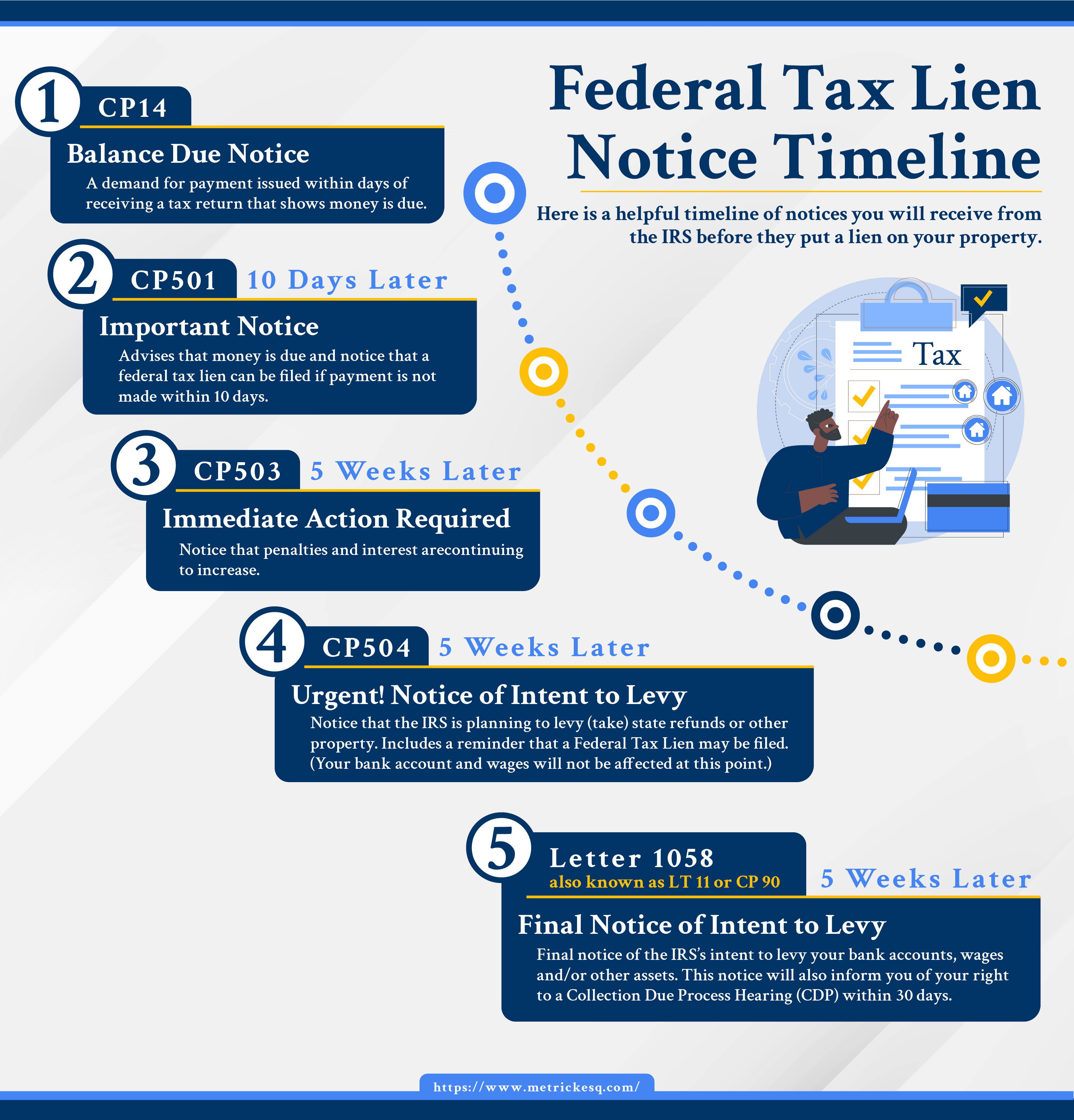

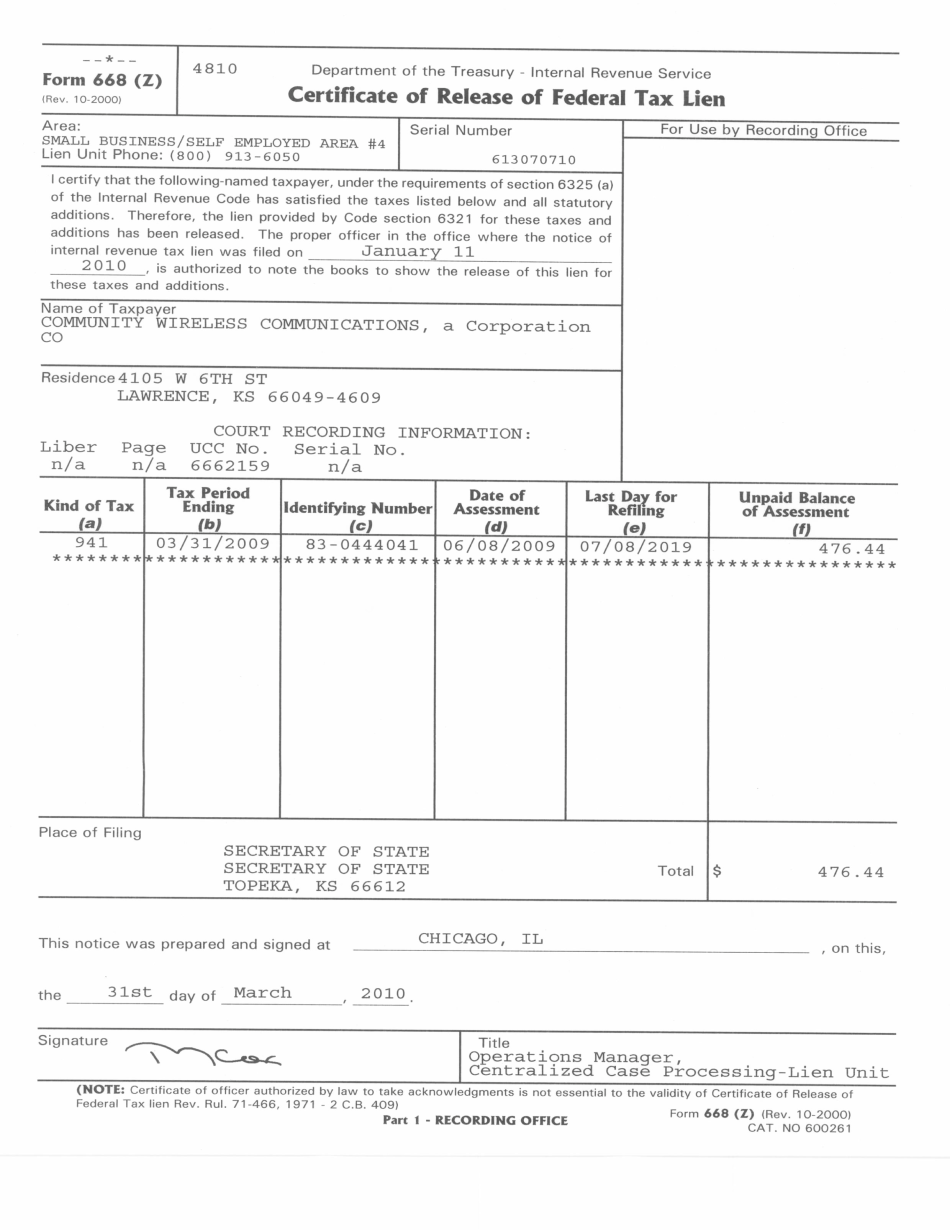

Federal Tax Lien Statute Of Limitations - Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary on which they were placed. The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed and a notice and demand for. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. After this date, the agency can no longer attempt to collect past. The federal tax lien statute of limitations is the amount of time the irs has to collect back taxes before it expires. For example, if a tax lien is filed on. When does the statute of limitations expire? When the statutory period expires, we can no.

After this date, the agency can no longer attempt to collect past. When the statutory period expires, we can no. The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed and a notice and demand for. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. When does the statute of limitations expire? For example, if a tax lien is filed on. The federal tax lien statute of limitations is the amount of time the irs has to collect back taxes before it expires. Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary on which they were placed.

Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary on which they were placed. When does the statute of limitations expire? For example, if a tax lien is filed on. After this date, the agency can no longer attempt to collect past. When the statutory period expires, we can no. The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed and a notice and demand for. The federal tax lien statute of limitations is the amount of time the irs has to collect back taxes before it expires. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration.

Is There a Statute of Limitations for a IRS Tax Lien? Clean Slate Tax

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. For example, if a tax lien is filed on. When does the statute of limitations expire? When the statutory period expires, we can no. The federal tax lien statute of.

Federal Tax Lien Statute Of Limitations Get What You Need For Free

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary on which they were placed. When does the.

Tax Debt Is There a Statute of Limitations for an IRS Tax Lien

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. For example, if a tax lien is filed on. The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed.

Irs tax lien statute of limitations Fill online, Printable, Fillable

When the statutory period expires, we can no. When does the statute of limitations expire? The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. The federal tax lien statute of limitations is the amount of time the irs has.

Title Basics of the Federal Tax Lien SnapClose

When does the statute of limitations expire? Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary on which they were placed. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of.

What is the Statute of Limitations in Federal Tax Cases? Silver Law PLC

When the statutory period expires, we can no. The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed and a notice and demand for. For example, if a tax lien is filed on. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes.

Is There a Statute of Limitations for Federal Tax Liens? EPGD

When the statutory period expires, we can no. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary.

Federal Tax Lien Statute Of Limitations Get What You Need For Free

When the statutory period expires, we can no. The federal tax lien statute of limitations is the amount of time the irs has to collect back taxes before it expires. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration..

A Detailed Breakdown The Federal Tax Lien Statute of Limitations

When the statutory period expires, we can no. For example, if a tax lien is filed on. After this date, the agency can no longer attempt to collect past. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration. The.

Federal Tax Lien Statute Of Limitations Get What You Need For Free

The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed and a notice and demand for. When does the statute of limitations expire? The federal tax lien statute of limitations is the amount of time the irs has to collect back taxes before it expires. Unless action is taken.

The Federal Tax Lien Continues Until The Liability For The Amount Assessed Is Satisfied Or Becomes Unenforceable By Reason Of Lapse Of Time, I.e., Passing Of The Collection Statute Expiration.

For example, if a tax lien is filed on. After this date, the agency can no longer attempt to collect past. Unless action is taken by the irs to refile a lien, federal tax liens typically expire 30 days after the tenth anniversary on which they were placed. The statute of limitations for collecting on a tax debt is ten years, which starts running when the liability is assessed and a notice and demand for.

When The Statutory Period Expires, We Can No.

The federal tax lien statute of limitations is the amount of time the irs has to collect back taxes before it expires. When does the statute of limitations expire?