Does Llc Protect Sole Proprietor In Tax Lien

Does Llc Protect Sole Proprietor In Tax Lien - If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. While the federal tax lien will not encumber the property of the llc since that property is owned by the llc and not by the taxpayer who. You are personally liable for your business debts under the following circumstances, which we cover below: Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with. You are a sole proprietor or.

In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with. Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. While the federal tax lien will not encumber the property of the llc since that property is owned by the llc and not by the taxpayer who. You are personally liable for your business debts under the following circumstances, which we cover below: If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. You are a sole proprietor or.

You are a sole proprietor or. If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. You are personally liable for your business debts under the following circumstances, which we cover below: While the federal tax lien will not encumber the property of the llc since that property is owned by the llc and not by the taxpayer who. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with.

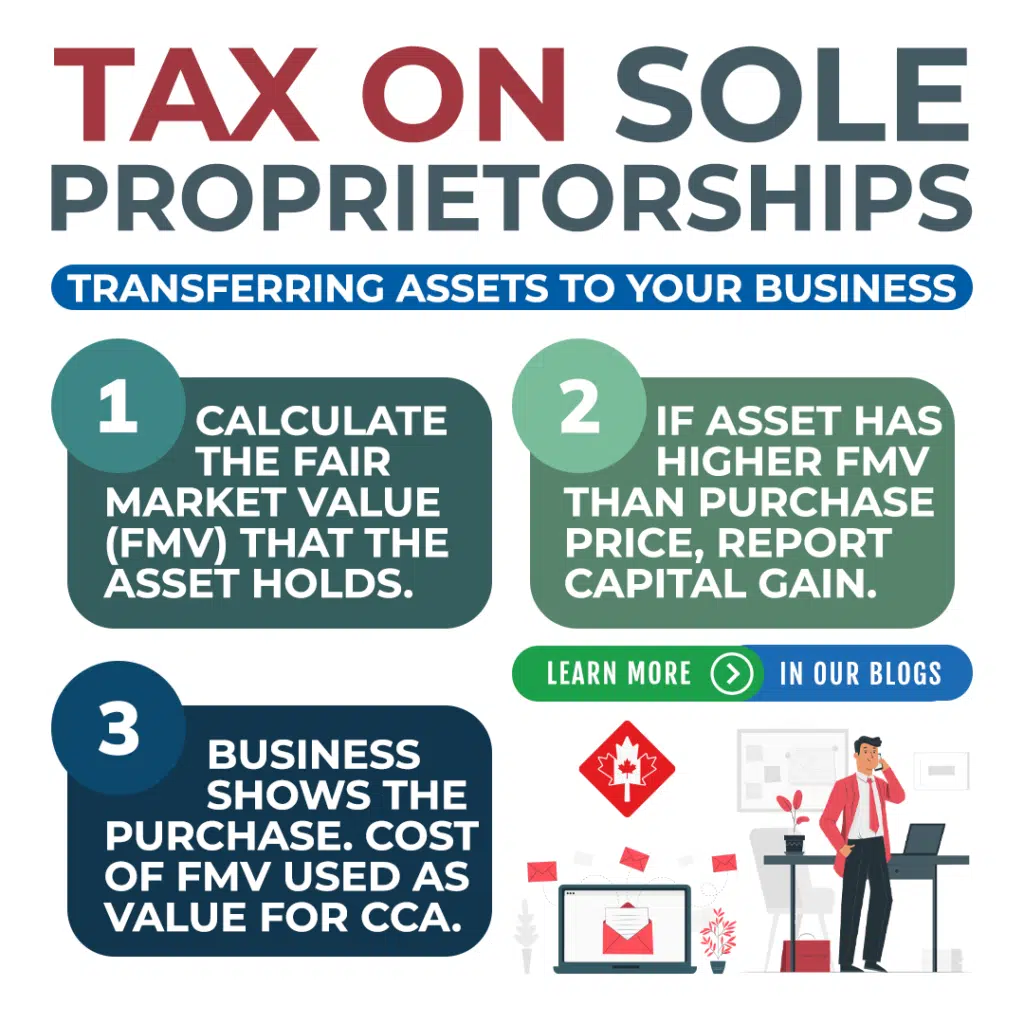

15 Tax Saving Tips For Sole Proprietorship Business Save Tax

You are a sole proprietor or. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with. If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. While the federal tax lien will not encumber.

Filing Taxes as a Sole Proprietor Advanced Tax Services

In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with. You are a sole proprietor or. If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. While the federal tax lien will not encumber.

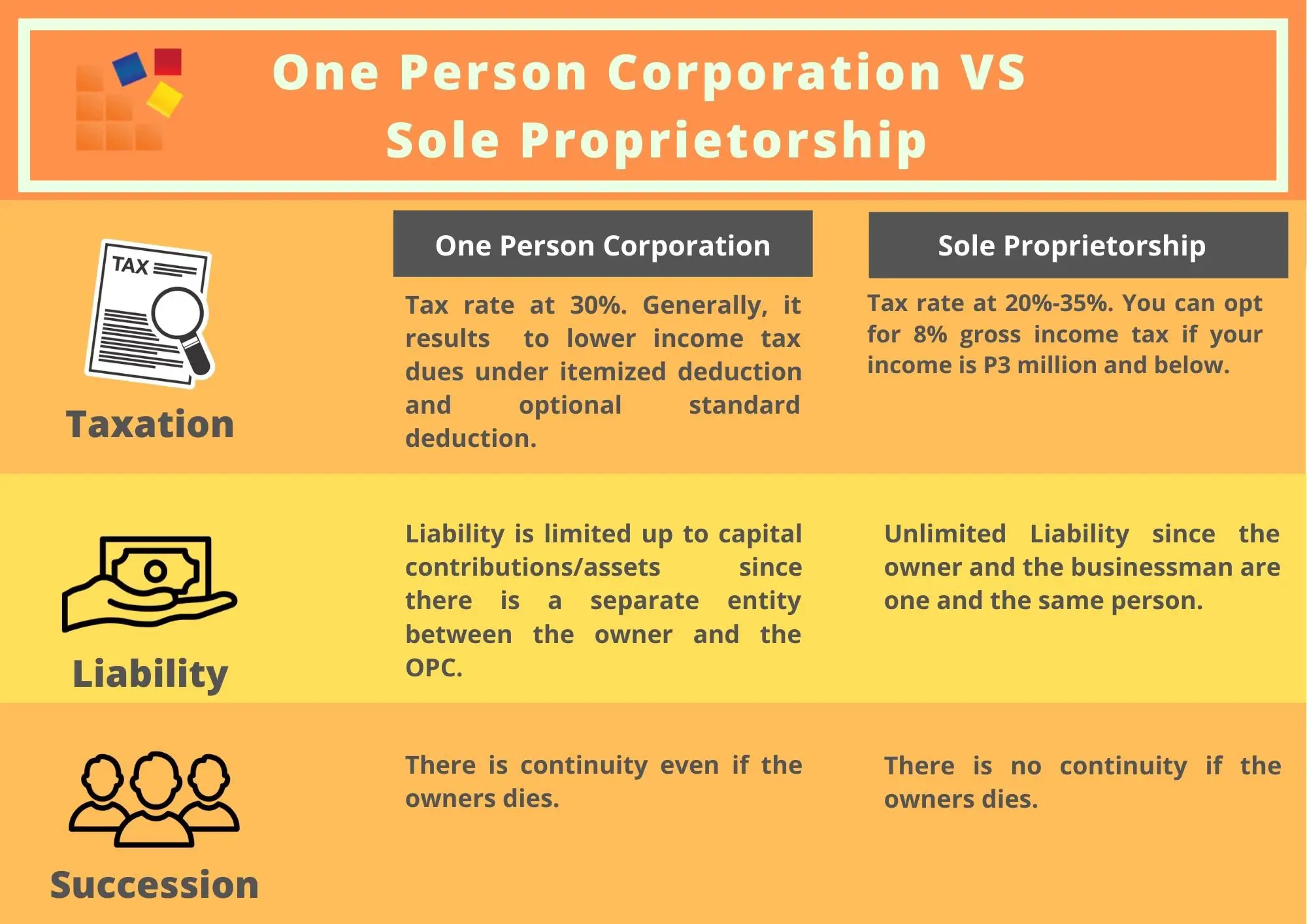

Difference Between Llc And Sole Proprietor

You are a sole proprietor or. Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. You are personally liable for your business debts under the following circumstances, which we cover below: If the single member llc is respected as a separate legal entity apart from its.

Does Sole Proprietor Pay To Franchise Tax Board

While the federal tax lien will not encumber the property of the llc since that property is owned by the llc and not by the taxpayer who. You are a sole proprietor or. Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. You are personally liable.

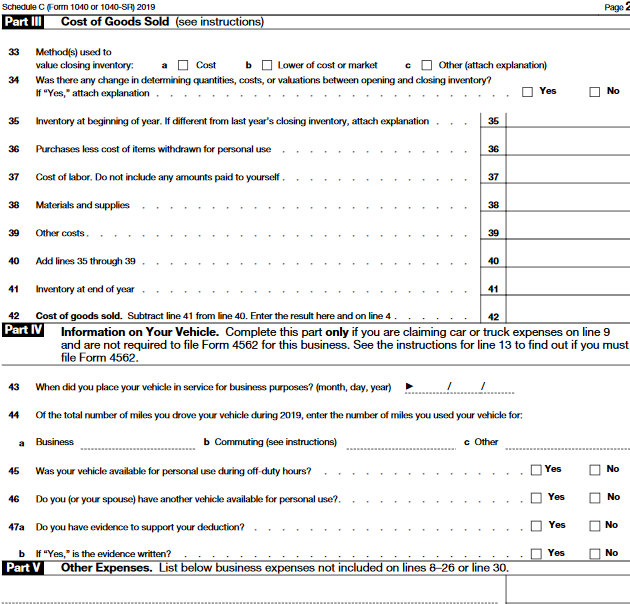

Sole Proprietor Tax Forms Everything You'll Need in 2021 The Blueprint

You are personally liable for your business debts under the following circumstances, which we cover below: If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities,.

Difference Between Llc And Sole Proprietor

You are personally liable for your business debts under the following circumstances, which we cover below: If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities,.

Microsoft Apps

You are a sole proprietor or. Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. In contrast, llcs and.

Sole Proprietor Liability How To Protect Yourself

While the federal tax lien will not encumber the property of the llc since that property is owned by the llc and not by the taxpayer who. If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any. You are a sole proprietor or..

Are You Making These 7 Common Sole Proprietor Tax Mistakes?

While the federal tax lien will not encumber the property of the llc since that property is owned by the llc and not by the taxpayer who. You are a sole proprietor or. You are personally liable for your business debts under the following circumstances, which we cover below: Because a limited liability company is a legal entity separate and.

What Every Sole Proprietor Should Know About Tax Planning

You are personally liable for your business debts under the following circumstances, which we cover below: Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with. While the.

You Are A Sole Proprietor Or.

Because a limited liability company is a legal entity separate and apart from its member (s), real property held by a limited liability. In contrast, llcs and corporations provide limited liability protection, safeguarding personal assets from business debts and liabilities, albeit with. You are personally liable for your business debts under the following circumstances, which we cover below: If the single member llc is respected as a separate legal entity apart from its member, real property held by the llc should be free of any.