Discharge Tax Debt In Bankruptcy

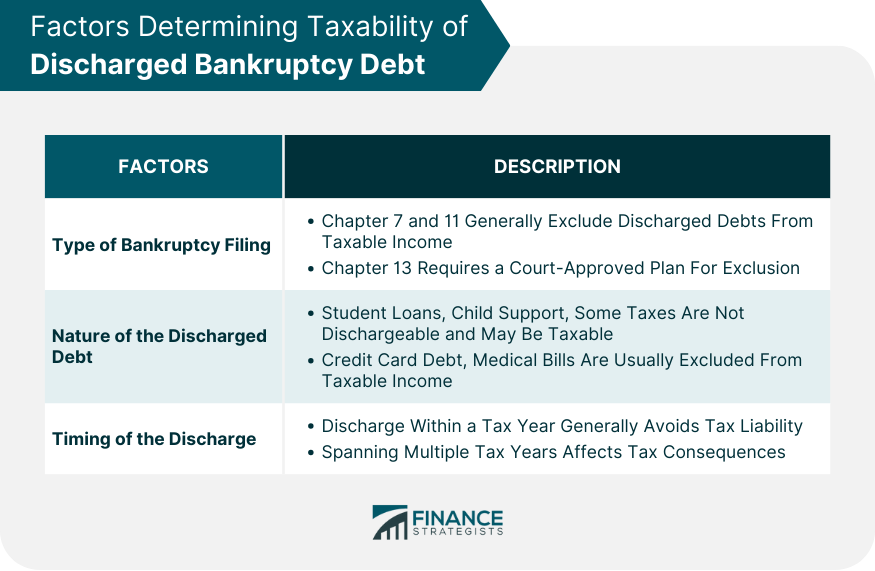

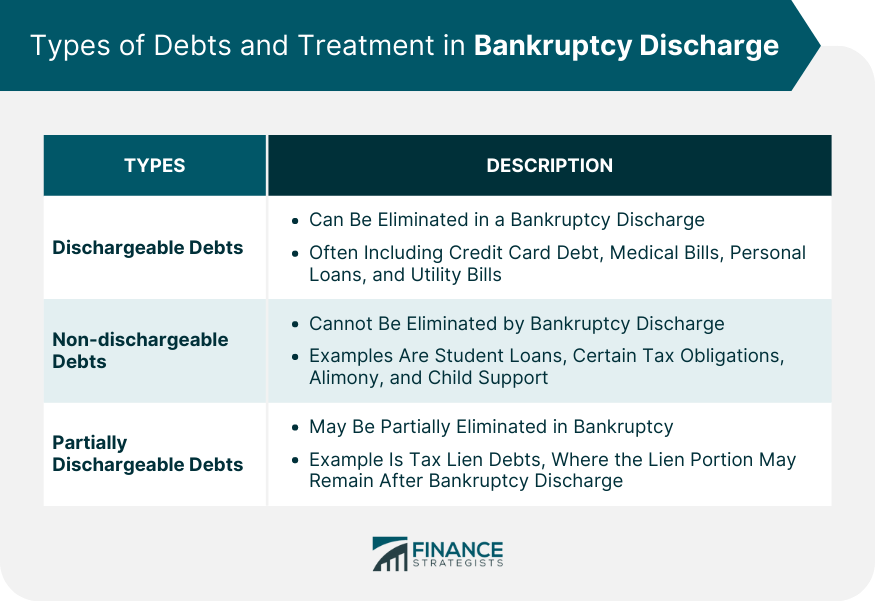

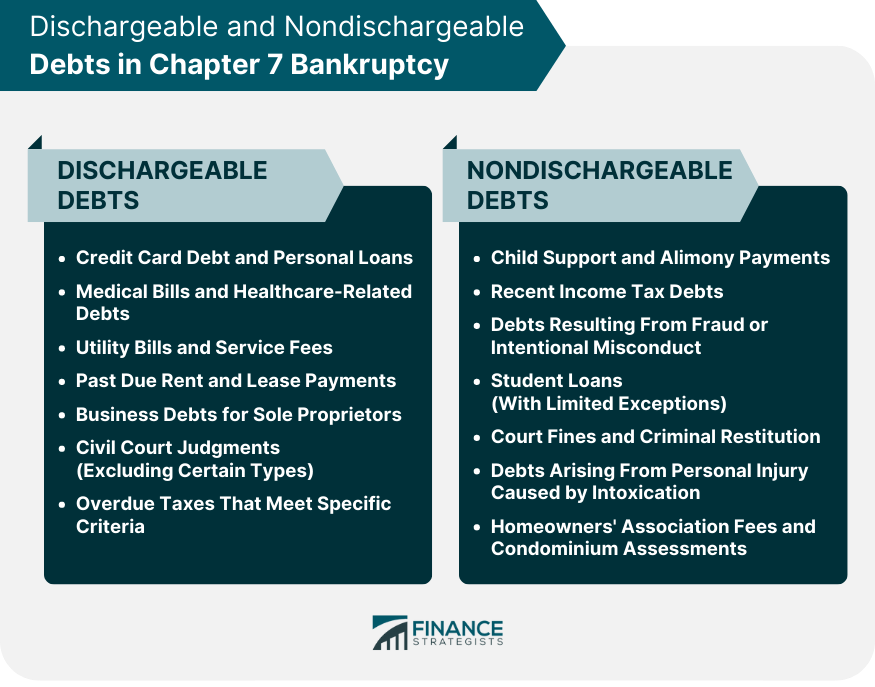

Discharge Tax Debt In Bankruptcy - While in an open bankruptcy. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. Learn how bankruptcy affects your federal tax obligations and options. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Find out what types of bankruptcy are available, how to notify. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Find out which types of tax. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors.

Find out what types of bankruptcy are available, how to notify. Find out which types of tax. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Learn how bankruptcy affects your federal tax obligations and options. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. While in an open bankruptcy.

You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Find out which types of tax. Learn how bankruptcy affects your federal tax obligations and options. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. While in an open bankruptcy. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Find out what types of bankruptcy are available, how to notify.

Identifying Bankruptcy Discharge Tax Debt IRS Solutions

While in an open bankruptcy. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Find out what types of bankruptcy are available, how to notify. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. Learn how bankruptcy affects your federal.

Does Bankruptcy Discharge My Tax Debt?

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. While in an open bankruptcy. Find out which types of tax.

Do You Have to Pay Taxes on Discharged Bankruptcy Debt?

Find out which types of tax. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. While in.

How Bankruptcy Gets Discharged Overview, Impact, Prevention

Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Find out what types of bankruptcy are available,.

Discharge Taxes in Bankruptcy Dischargeability Analysis

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Find out what types of bankruptcy are available, how to notify. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types.

What Debts Are Discharged in Chapter 7 Bankruptcy?

Find out what types of bankruptcy are available, how to notify. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Find out which types of tax. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. When determining whether they can discharge tax debt, bankruptcy filers must consider many.

How Does a Bankruptcy Discharge Work? Lexington Law

Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. Learn how to discharge income tax debt in chapter 7 bankruptcy and the conditions you must meet. Some filers can discharge or wipe out.

Form 982 IRS How to Reduce Your Tax Liability Through Debt Discharge?

Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. While in an open bankruptcy. Learn how bankruptcy affects your federal tax obligations and options. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain.

What Debts Are Discharged in Chapter 7 Bankruptcy?

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. While in an open bankruptcy. Learn how bankruptcy affects your federal tax obligations and options. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Federal income tax debt can be discharged by.

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

You can discharge federal income tax debt in chapter 7 bankruptcy if you meet certain requirements, but most other types of. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Find out what types of bankruptcy are available, how to.

Learn How To Discharge Income Tax Debt In Chapter 7 Bankruptcy And The Conditions You Must Meet.

Find out what types of bankruptcy are available, how to notify. Federal income tax debt can be discharged by bankruptcy, but only under very specific conditions. Learn how bankruptcy affects your federal tax obligations and options. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors.

You Can Discharge Federal Income Tax Debt In Chapter 7 Bankruptcy If You Meet Certain Requirements, But Most Other Types Of.

A bankruptcy discharge may provide relief to a taxpayer by reducing or eliminating certain debts. Find out which types of tax. While in an open bankruptcy. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan.