Discharge Of Indebtedness

Discharge Of Indebtedness - 9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Amendment by section 405(b) of pub. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026.

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. 9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. Amendment by section 405(b) of pub.

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. 9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Amendment by section 405(b) of pub.

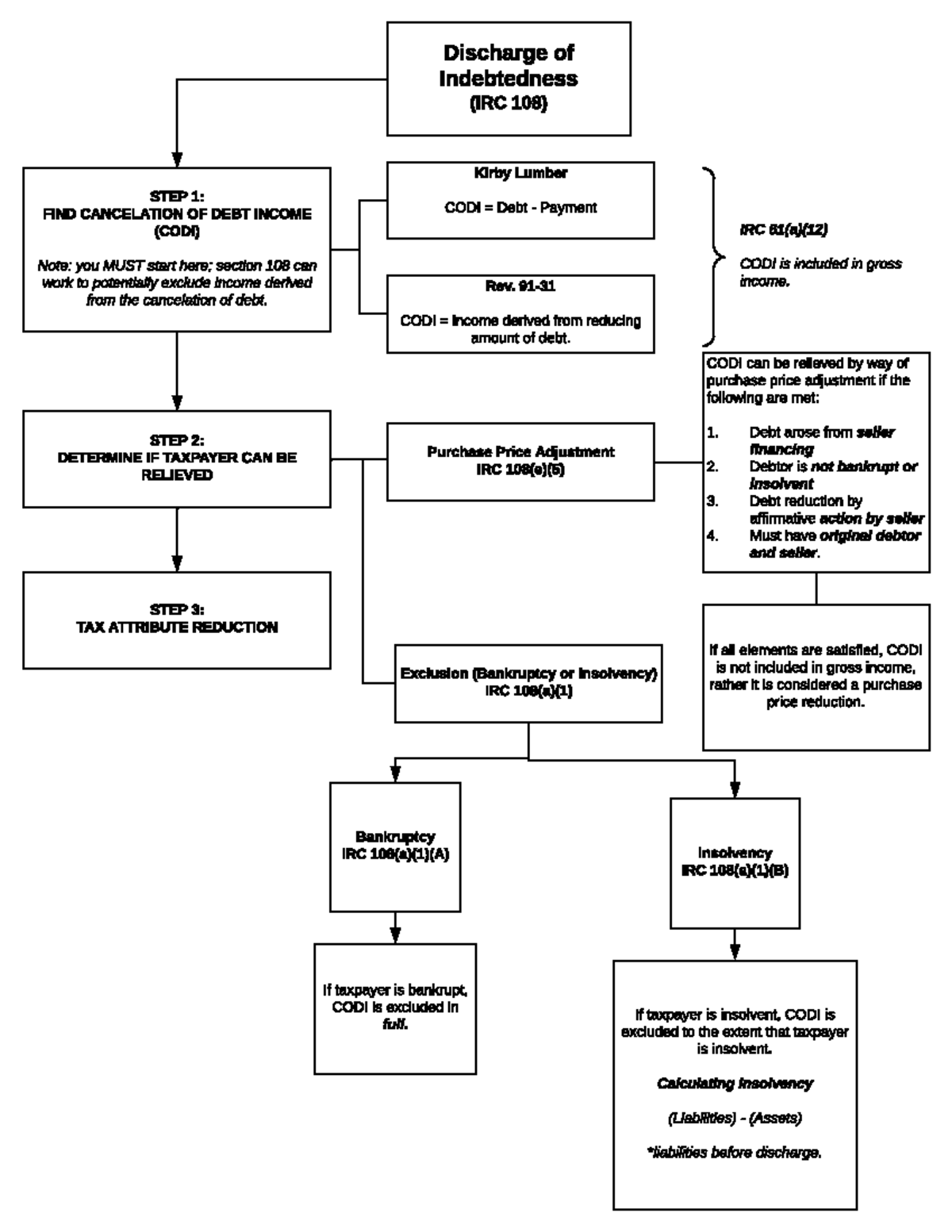

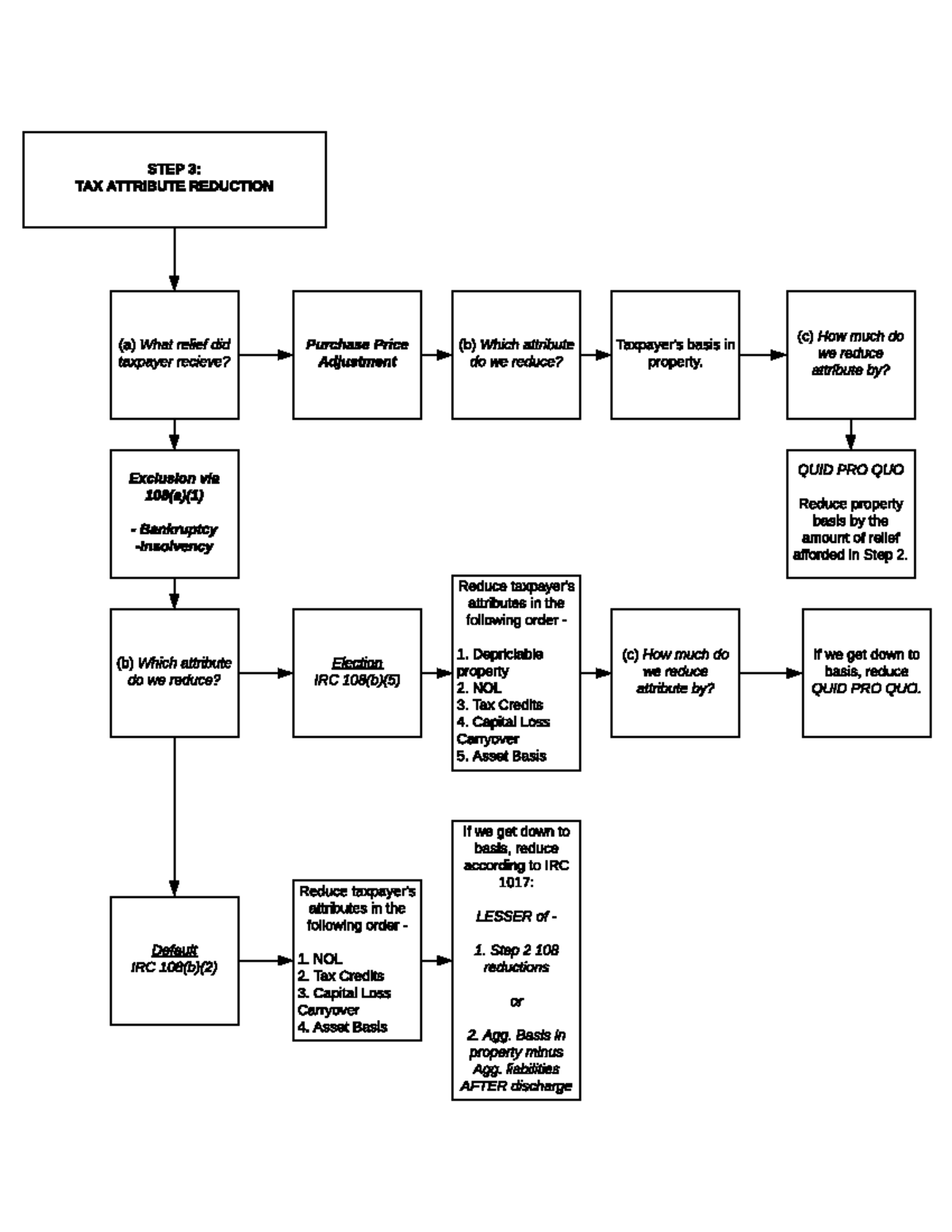

Discharge of Indebtedness Chart 1 Discharge of Indebtedness (IRC

Amendment by section 405(b) of pub. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take.

Discharge of Indebtedness on Principal Residences and Business Real

9, 1986, in taxable years. Amendment by section 405(b) of pub. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross.

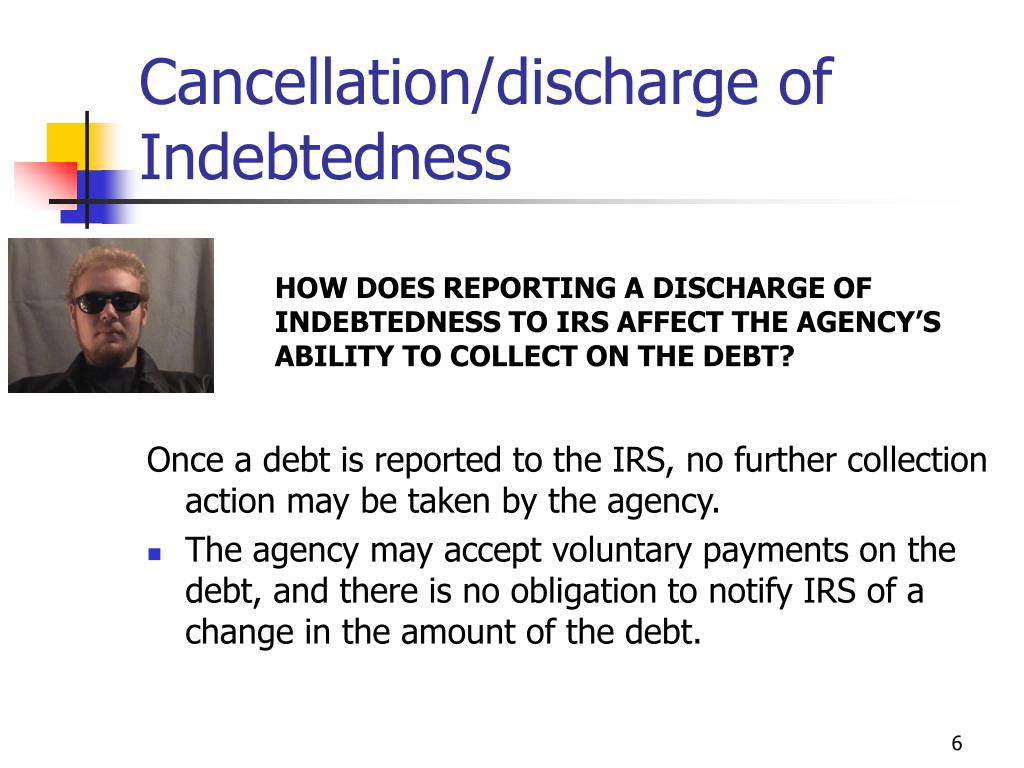

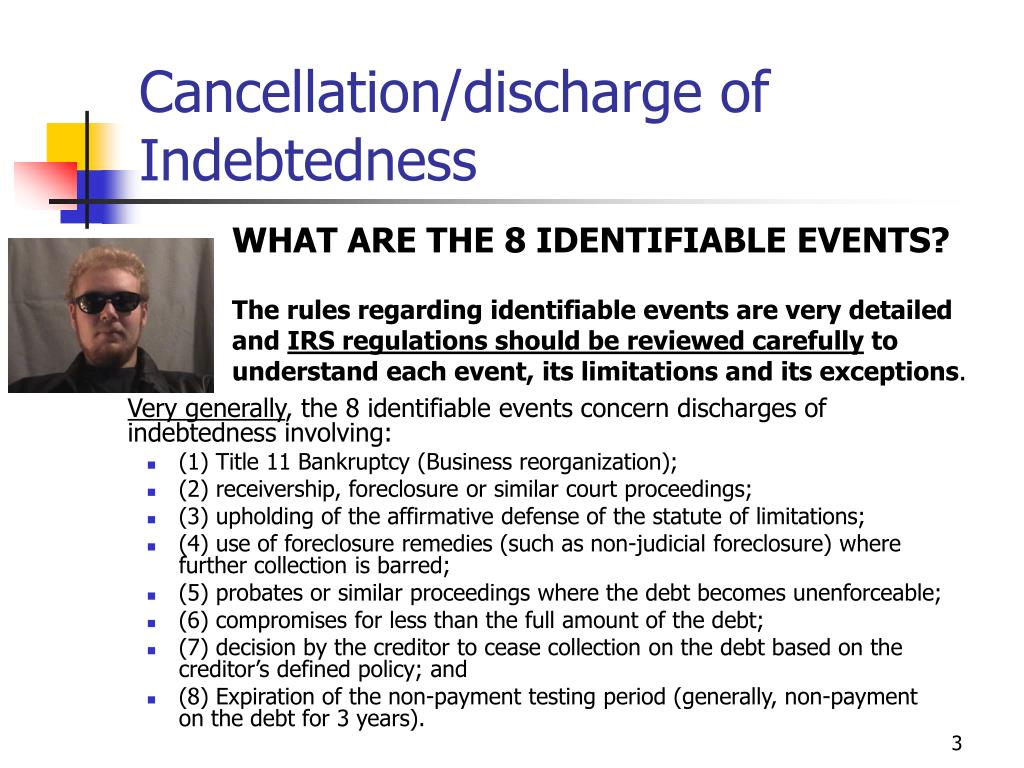

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. 9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for.

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all.

IRS Form 982 Instructions Discharge of Indebtedness

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. 9, 1986, in taxable years. Amendment by section 405(b) of pub. (a) before discharging a delinquent debt (also referred to as a close out of.

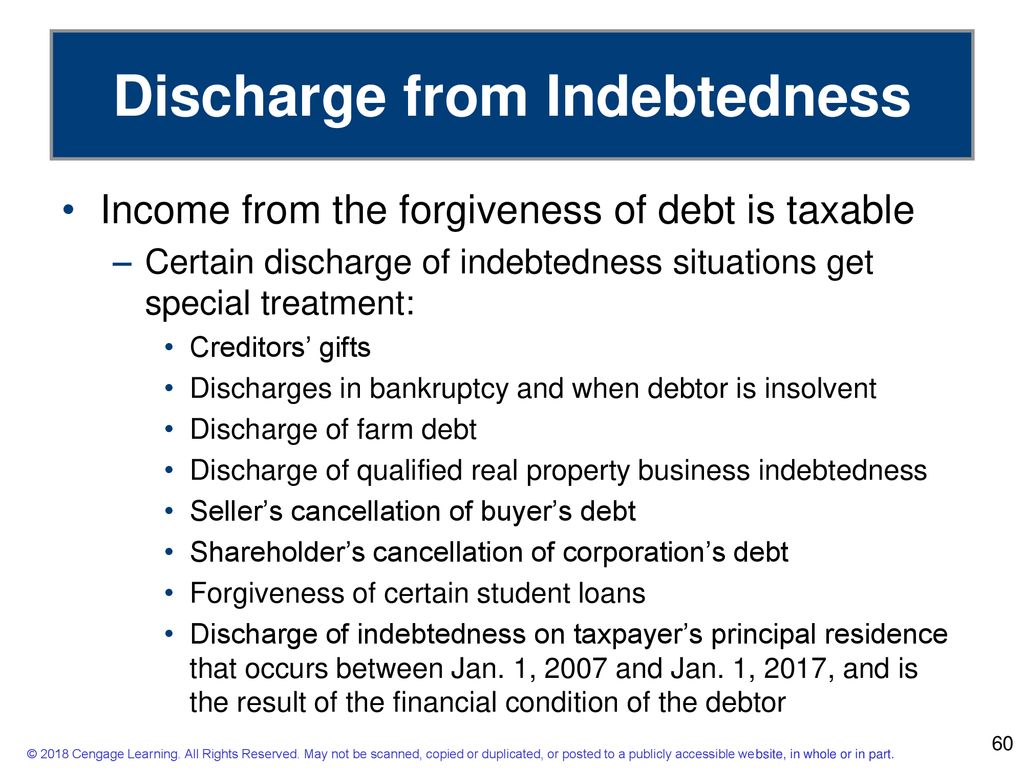

PPT Chapter 9 PowerPoint Presentation, free download ID3597638

(a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. 9, 1986, in taxable years. Amendment by section 405(b) of pub. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. This section explains how to exclude or reduce gross.

Gross Exclusions ppt download

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. 9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all.

Discharge of Indebtedness Chart 2 STEP 3 TAX ATTRIBUTE REDUCTION

9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. Amendment by section 405(b) of pub. This section explains how to exclude or reduce gross.

IRS Form 982 Instructions Discharge Of Indebtedness, 55 OFF

9, 1986, in taxable years. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. Amendment by section 405(b) of pub. Qualified principal residence indebtedness.

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. 9, 1986, in taxable years. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Amendment by section 405(b) of pub. (a) before discharging a delinquent debt (also referred to as a close out of.

9, 1986, In Taxable Years.

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Amendment by section 405(b) of pub.