Denver Local Income Tax Withholding

Denver Local Income Tax Withholding - Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. You can click on any city or county for more details, including the. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. We have information on the local income tax rates in 3 localities in colorado. Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the.

We have information on the local income tax rates in 3 localities in colorado. Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. You can click on any city or county for more details, including the. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),.

Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the. We have information on the local income tax rates in 3 localities in colorado. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. You can click on any city or county for more details, including the.

Withholding Allowance What Is It, and How Does It Work? (2024)

We have information on the local income tax rates in 3 localities in colorado. You can click on any city or county for more details, including the. Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. Visit our information for local government or entities implementing a new.

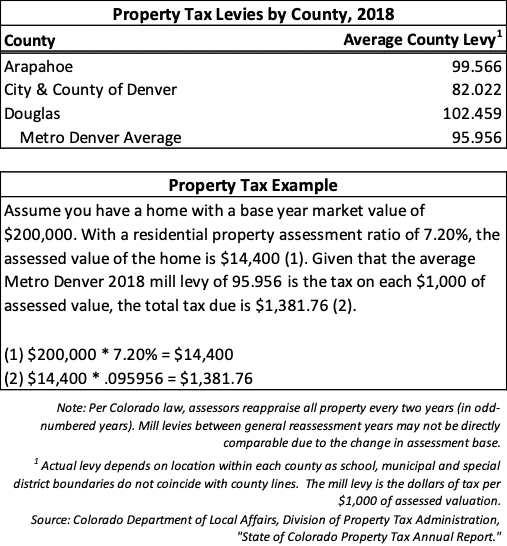

These Denver neighborhoods are getting the biggest property tax hikes

Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),. Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the.

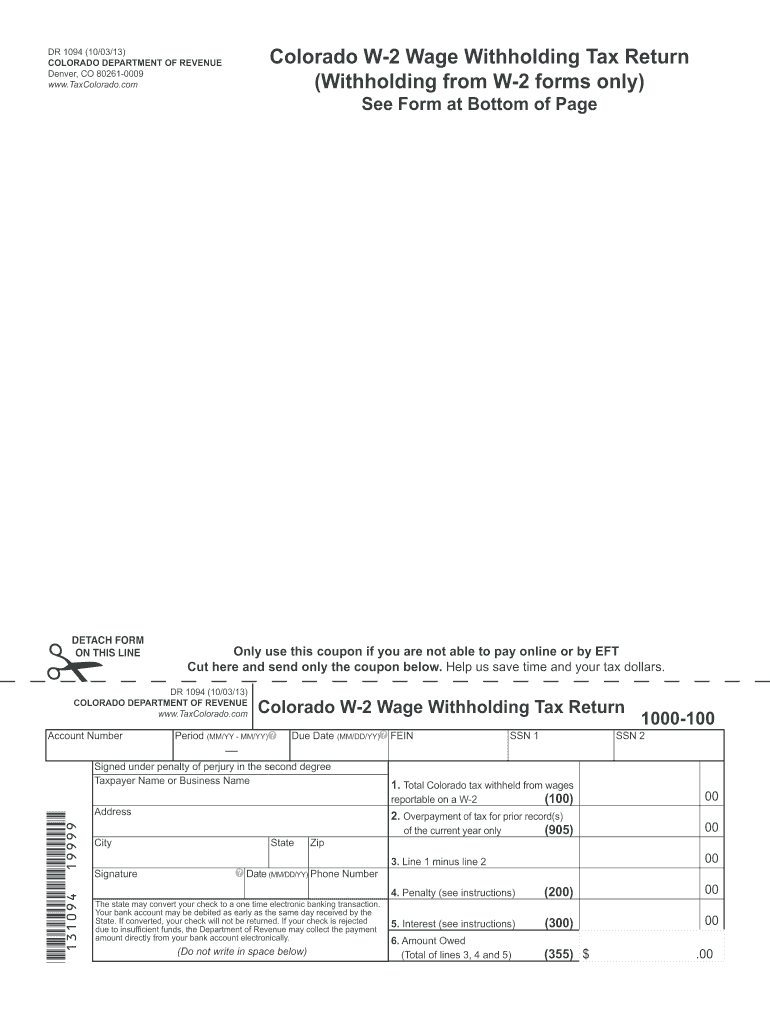

Colorado W 2 Wage Withholding Tax Return Colorado Gov Colorado Fill

Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. You can click on any city or county for more details, including the. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of..

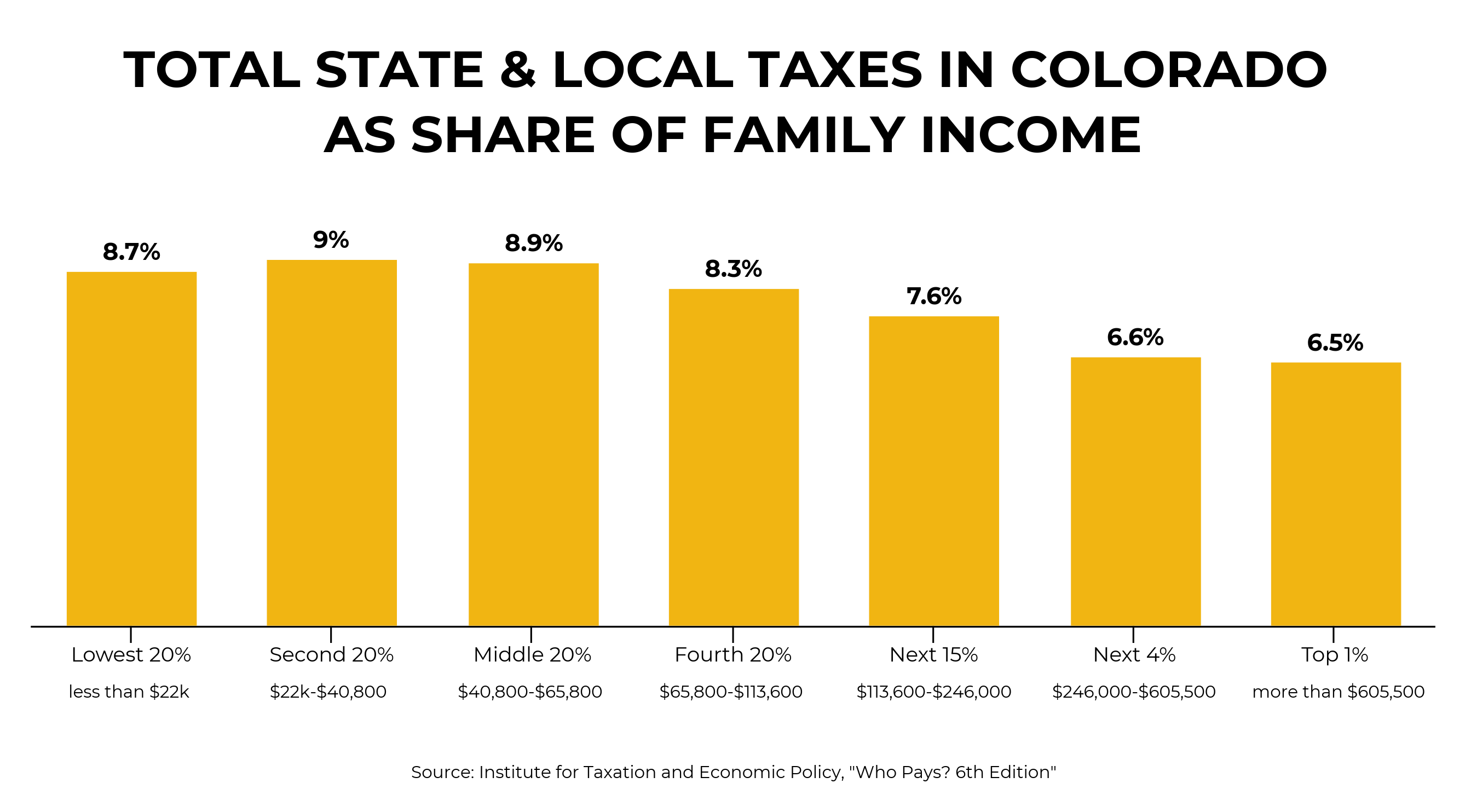

State & Local Taxes Denver South

We have information on the local income tax rates in 3 localities in colorado. Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most.

6 Things to Know When Talking About Colorado Taxes

Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),. Employers.

Denver Tax Preparation The Denver Tax Group

You can click on any city or county for more details, including the. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual..

Denver Property Tax Rates Momentum 360 Tax Rates 2023

Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit our information for local government or entities implementing a new tax.

Best Tax Preparation Denver The Denver Tax Group

We have information on the local income tax rates in 3 localities in colorado. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),. Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. You can click on any city or county.

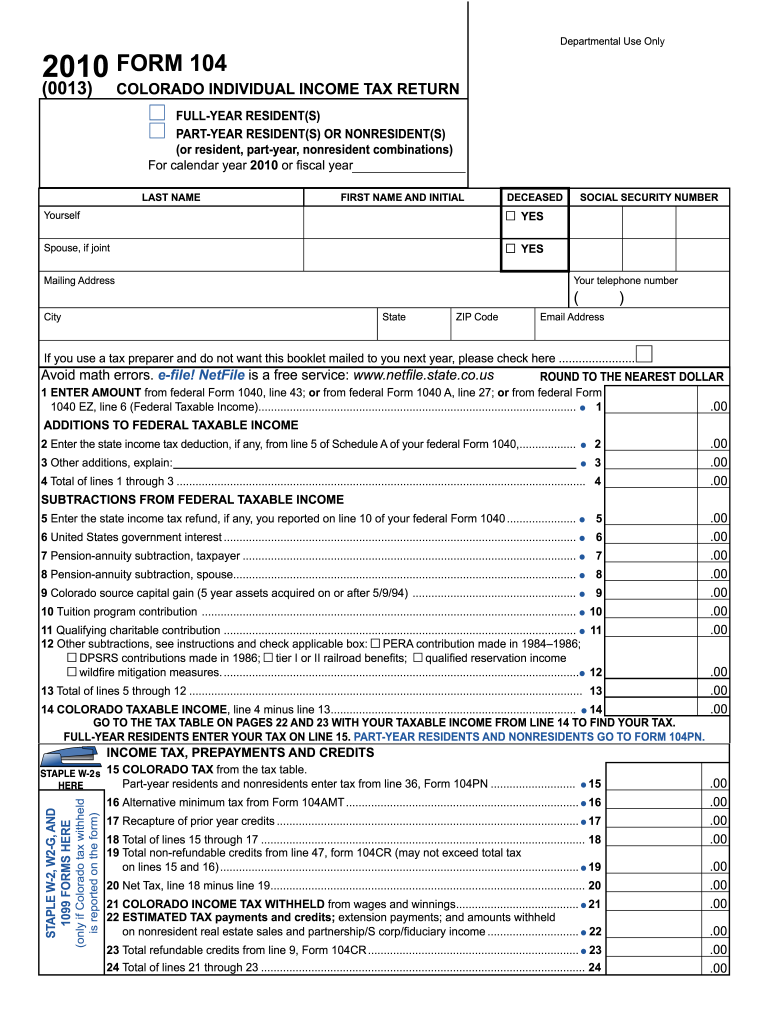

Form 104 colorado Fill out & sign online DocHub

Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual. It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),. We have information on the local income tax rates in 3 localities in colorado. You can click on any city or county.

Downloads The Denver Tax Group

We have information on the local income tax rates in 3 localities in colorado. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references.

Visit Our Information For Local Government Or Entities Implementing A New Tax Or Changed Tax Rate Page For More Information.

We have information on the local income tax rates in 3 localities in colorado. Each guide includes a brief description of the applicable law, one or more examples of taxable or exempt transactions, and references to the. You can click on any city or county for more details, including the. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of.

Employers Are Required To File Returns And Remit Tax On A Quarterly, Monthly, Or Weekly Basis, Depending On The Employer’s Total Annual.

It provides information for collecting and filing sales, use, lodger’s, occupational privilege (opt), facilities development (fda),.

:max_bytes(150000):strip_icc()/WitholdingAllowance_INV-93a2e67b5dd84226a71523911b15bd2f.jpg)