Define Local Income Tax

Define Local Income Tax - What is local income tax? Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax.

What is local income tax? Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. What is local income tax? Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

State and Local Individual Tax Collections Per Capita Tax

What is local income tax? Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

Local Taxes in 2019 Local Tax City & County Level

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. What is local income tax?

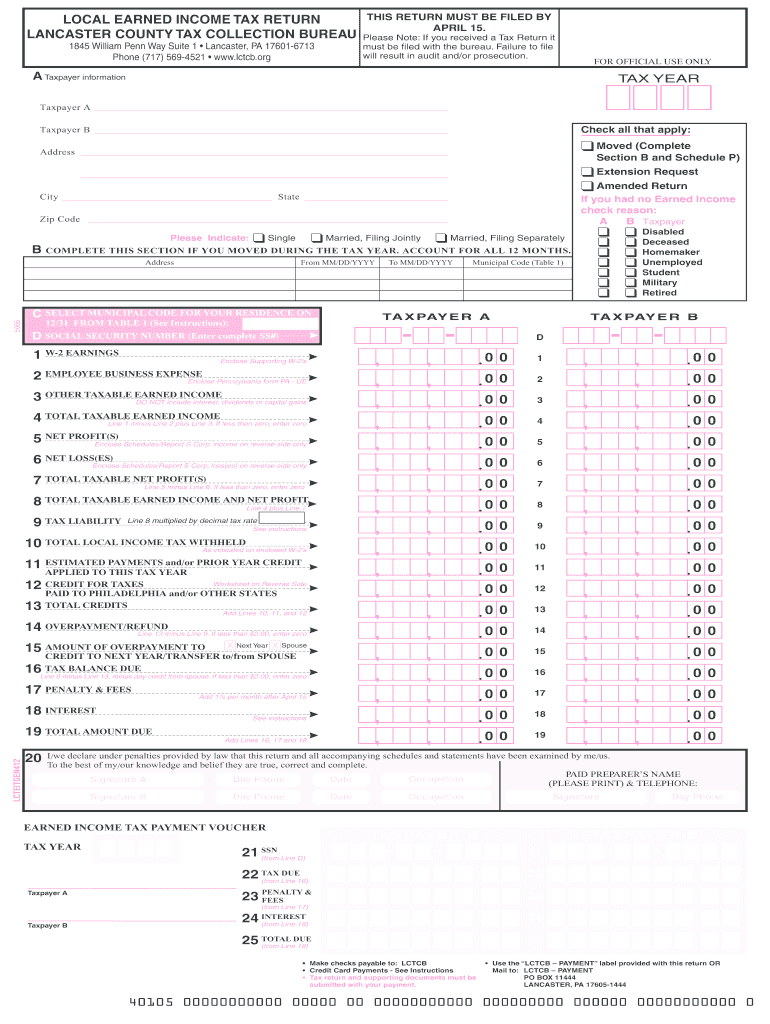

Fillable Local Earned Tax Form Pa Printable Forms Free Online

What is local income tax? Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax.

New Zealand SelfEmployed Tax Calculator

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. What is local income tax? Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax.

Free Corporate Tax Return Templates For Google Sheets And

Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. What is local income tax? Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax.

Advance Tax under Tax (With Dates) InstaFiling

Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. What is local income tax?

Local Taxes by State Local Tax Data Tax Foundation

What is local income tax? Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

Minimum salary to pay tax in Malaysia. Link below on how to file

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. What is local income tax? Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax.

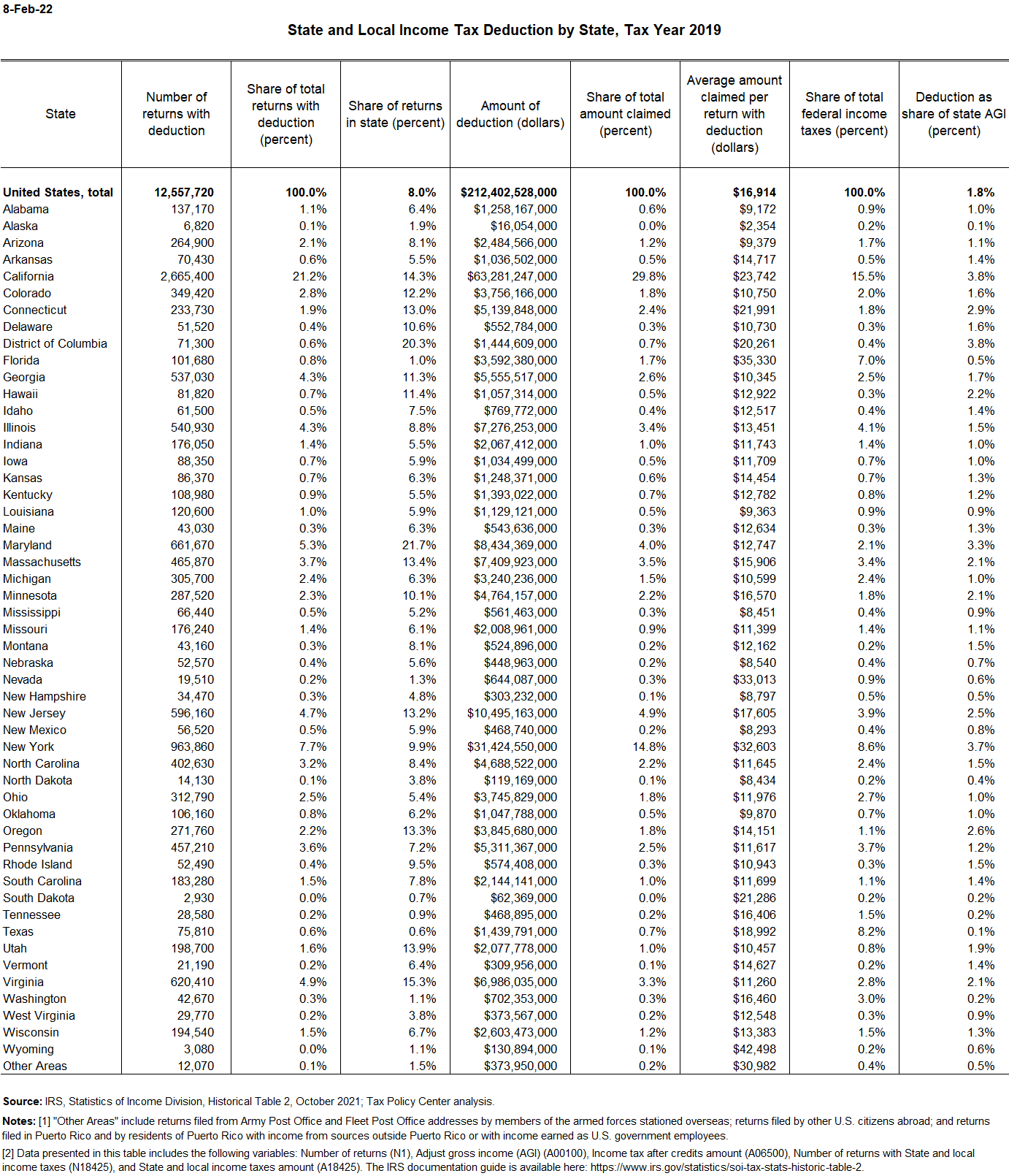

State and Local Tax Deduction by State Tax Policy Center

Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. What is local income tax? Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

What Is Local Tax? Flat Tax Rate, Progressive

Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local. What is local income tax?

Local Tax Refers To Taxes Imposed By Local Government Entities Such As Counties, Cities, And Municipalities.

Prefectural inhabitant tax and municipal inhabitant tax are generically called local income tax. What is local income tax? Local income tax refers to a tax levied on the income of individuals, businesses, or entities by local.