Deed In Lieu Of Foreclosure Tax Consequences

Deed In Lieu Of Foreclosure Tax Consequences - Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. The extra amount you owe is called.

Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. The extra amount you owe is called. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,.

The extra amount you owe is called. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven.

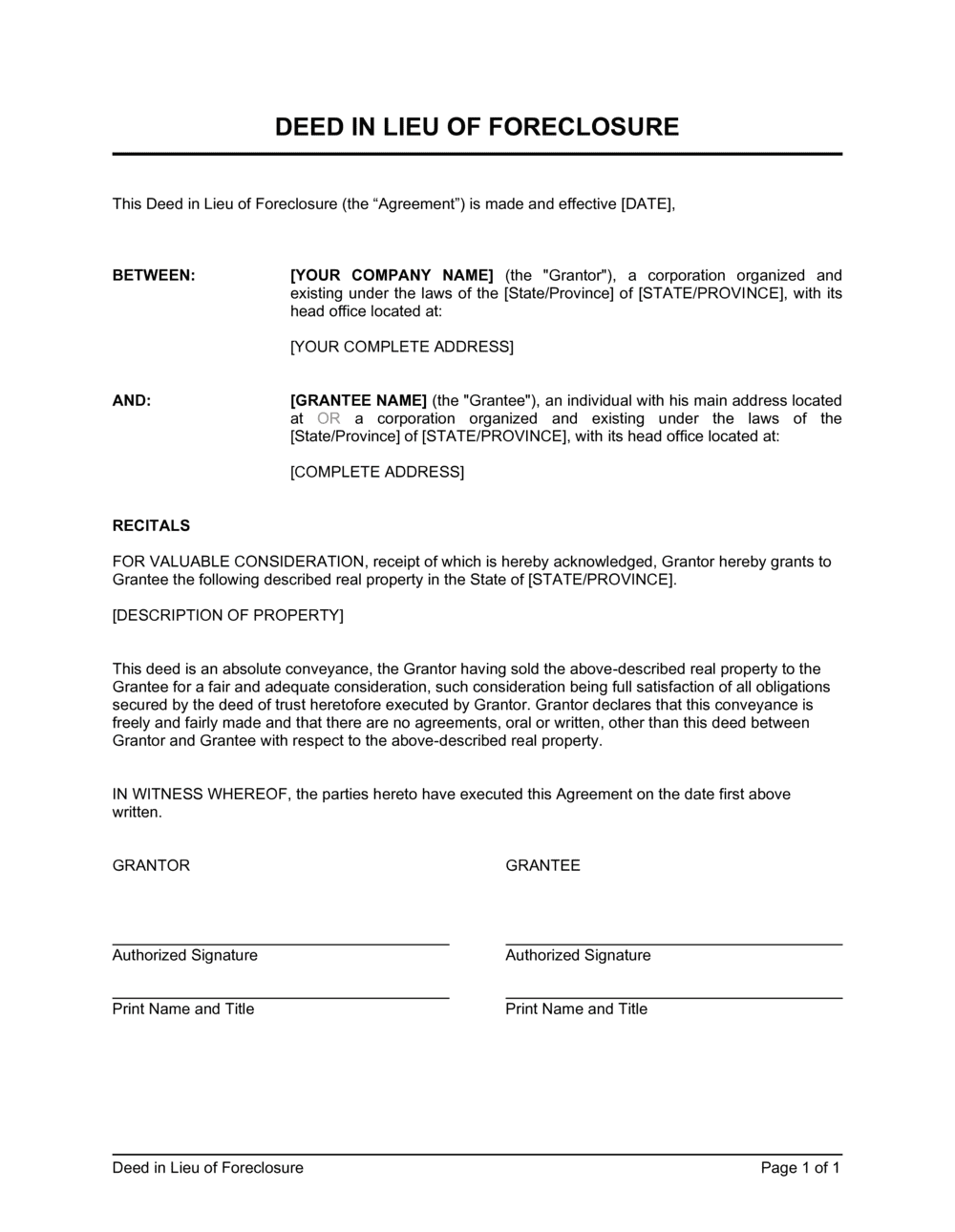

Deed In Lieu of Foreclosure Template by BusinessinaBox™

The extra amount you owe is called. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. If your lender agrees to a short sale or to accept a deed in lieu of.

Deed in Lieu of Foreclosure Example Law Firm

Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax.

Deed In Lieu Of Foreclosure Junior Rutledge

The extra amount you owe is called. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. If your lender agrees to a short sale or to accept a deed in lieu of.

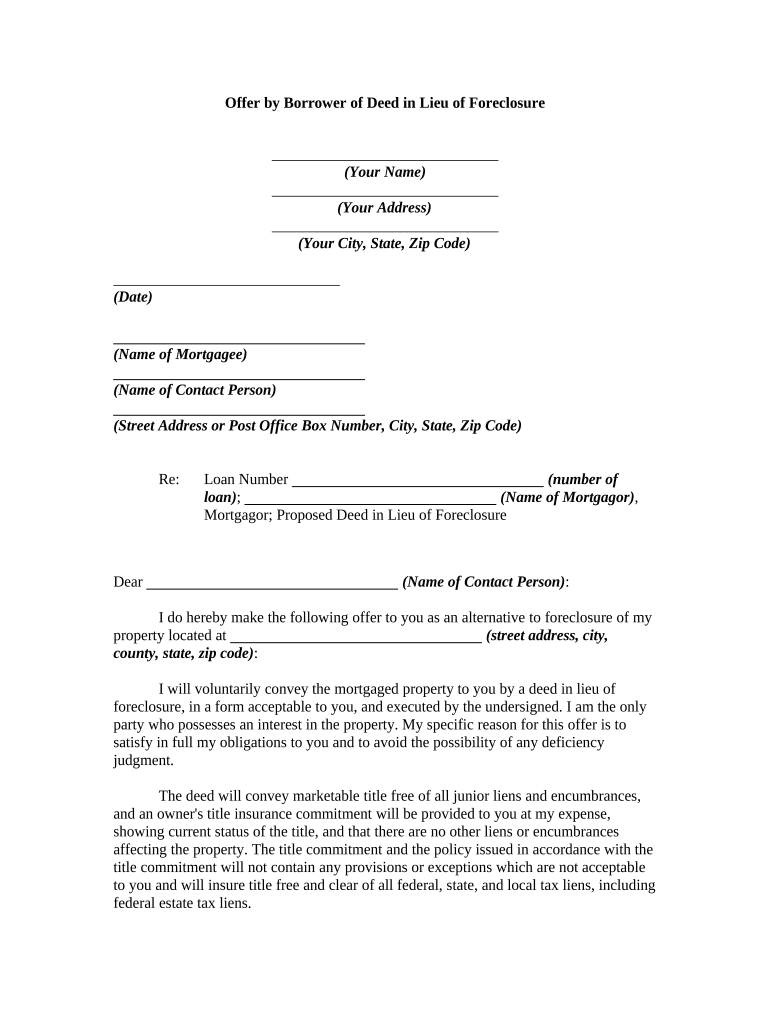

Deed lieu foreclosure Fill out & sign online DocHub

The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Tax liability can happen if the foreclosure sale price is less than the amount you owed.

Blog Post Press Release Understanding Deed in Lieu of Foreclosure

The extra amount you owe is called. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. Tax liability can happen if the foreclosure sale price.

DeedinLieu of Foreclosure Think Realty

Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. The extra amount you owe is called. If your lender agrees to a short sale or to accept a deed in lieu of.

Deed In Lieu Process Broward 954.237.7740 Florida Foreclosure

The extra amount you owe is called. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Tax liability can happen if the foreclosure sale price.

Long Island Foreclosure Help Should You Consider a Deed In Lieu of

The extra amount you owe is called. Tax liability can happen if the foreclosure sale price is less than the amount you owed on your mortgage. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The mortgage forgiveness debt relief act provided tax.

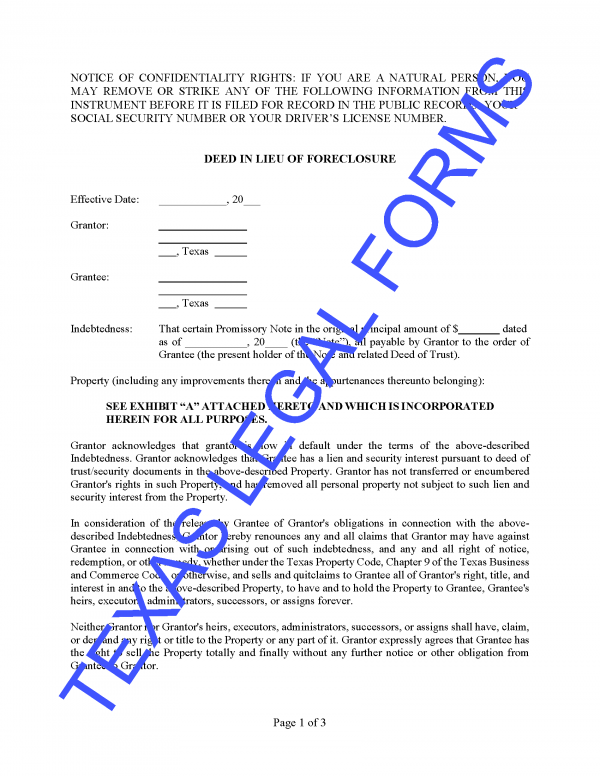

Texas Deed In Lieu Of Foreclosure Form Buy Real Estate Legal Forms

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. Tax liability can happen if the foreclosure sale price is less than the amount you owed.

Free Deed in Lieu of Foreclosure Form [PDF Template]

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. Tax liability can happen if the foreclosure sale price is less than the amount you owed.

Tax Liability Can Happen If The Foreclosure Sale Price Is Less Than The Amount You Owed On Your Mortgage.

The mortgage forgiveness debt relief act provided tax relief to homeowners who had mortgage debt forgiven through foreclosure,. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. The extra amount you owe is called.

![Free Deed in Lieu of Foreclosure Form [PDF Template]](https://formspal.com/wp-content/uploads/2021/05/deed-in-lieu-of-foreclosure.webp)