Dc Amended Tax Return Form

Dc Amended Tax Return Form - Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. If you are required to file a d.c. Mail return and payment to: Government, office of tax and revenue, ben franklin station, p.o. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes.

Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. Mail return and payment to: Government, office of tax and revenue, ben franklin station, p.o. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. If you are required to file a d.c.

Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. If you are required to file a d.c. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Government, office of tax and revenue, ben franklin station, p.o. Mail return and payment to:

Where’s My Amended Return? (Easy Ways to File Form 1040X) The Handy

If you are required to file a d.c. Government, office of tax and revenue, ben franklin station, p.o. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Individual.

Dc Non Resident Tax Form 2023 Printable Forms Free Online

If you are required to file a d.c. Government, office of tax and revenue, ben franklin station, p.o. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc.

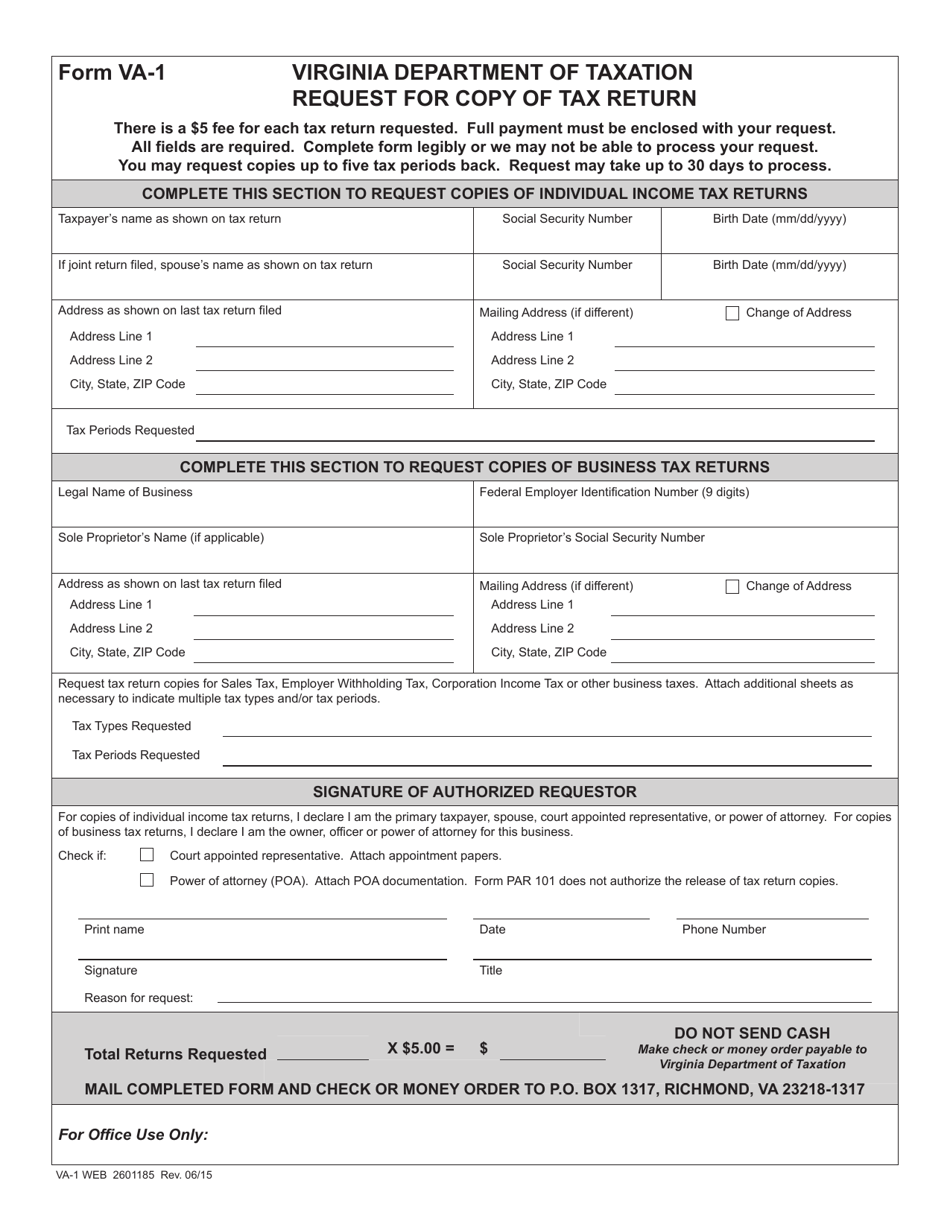

Virginia Fillable Tax Forms Printable Forms Free Online

Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. Government, office of tax and revenue, ben franklin station, p.o. If you are required to file a d.c. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Mail.

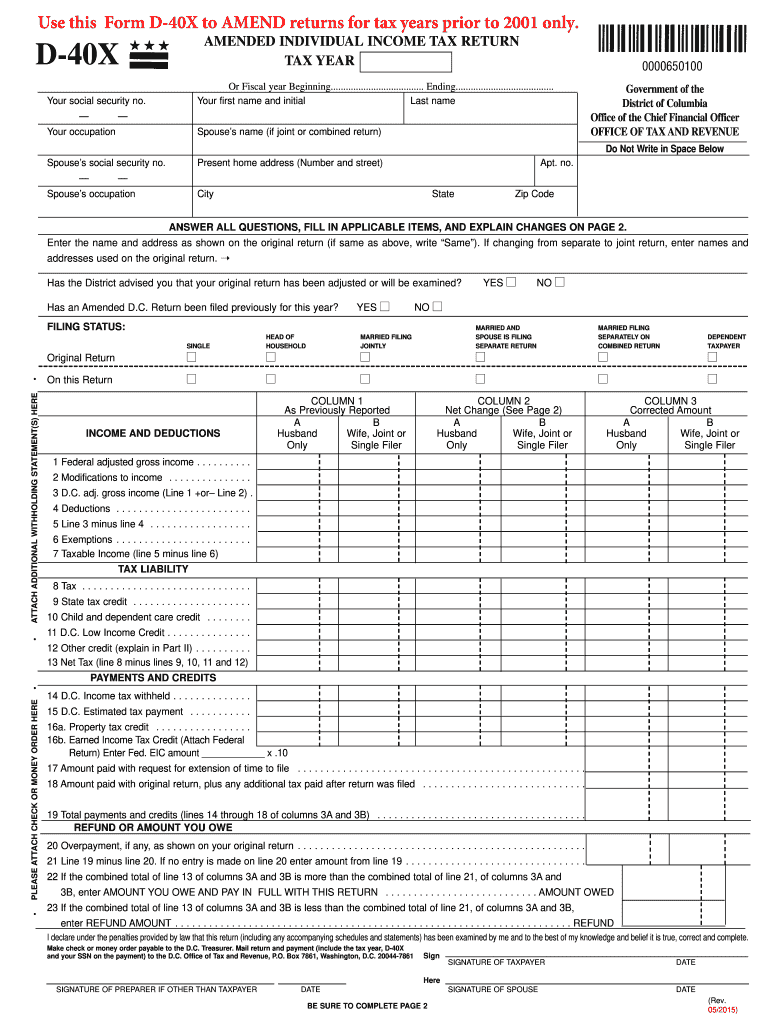

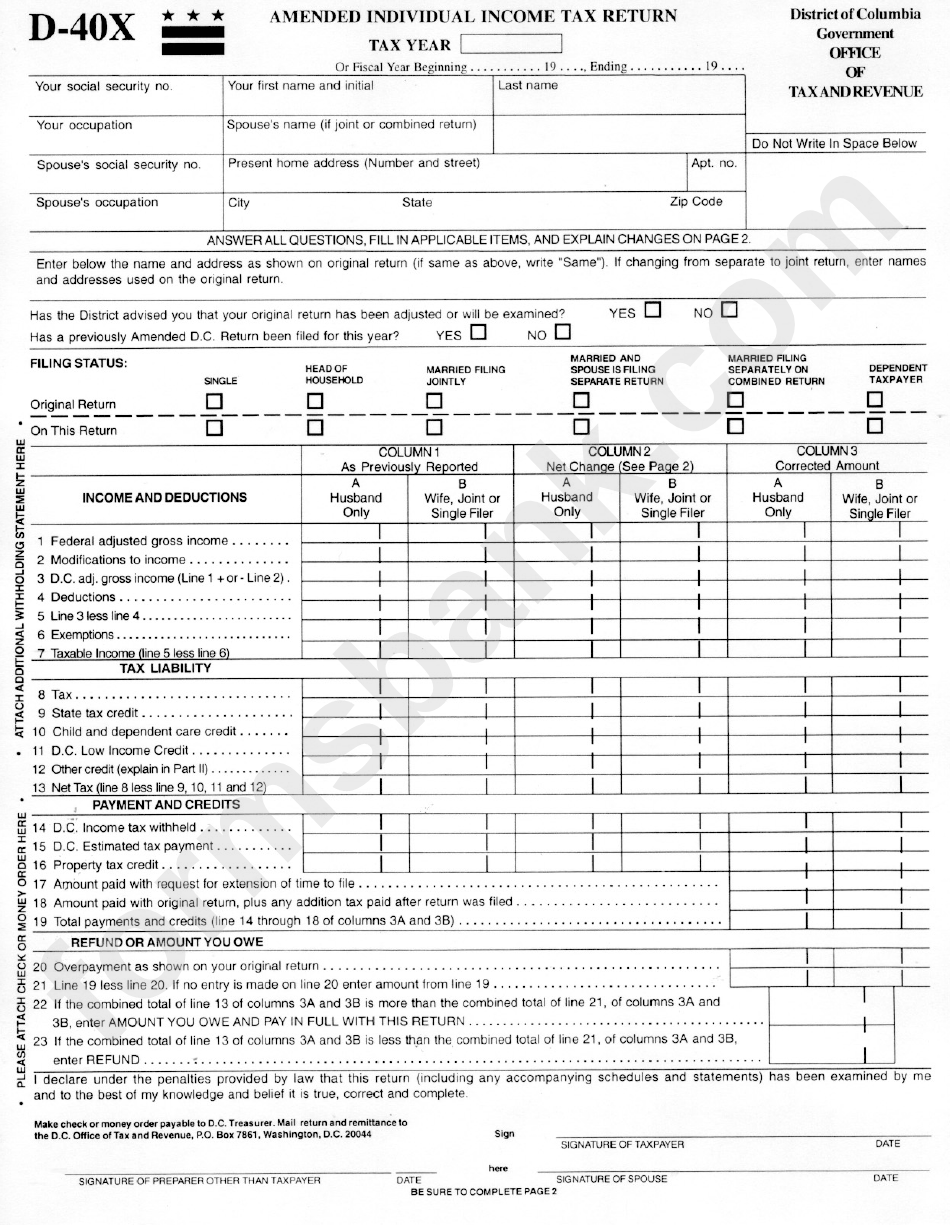

Dc Amended Tax Return 20152024 Form Fill Out and Sign Printable PDF

If you are required to file a d.c. Mail return and payment to: Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. Government, office of tax and revenue,.

I Amended My Tax Return Now What? Optima Tax Relief

If you are required to file a d.c. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Mail return and payment to: Individual income tax forms and instructions.

Should You File an Amended Tax Return? Credo CFOs & CPAs

Government, office of tax and revenue, ben franklin station, p.o. If you are required to file a d.c. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. Mail return and payment to: If the us internal revenue service adjusts your individual income tax return, you.

Fillable Form D40x Amended Individual Tax Return printable

If you are required to file a d.c. Government, office of tax and revenue, ben franklin station, p.o. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. If.

How to file an amended tax return WTOP News

If you are required to file a d.c. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. If the us internal revenue service adjusts your individual income tax.

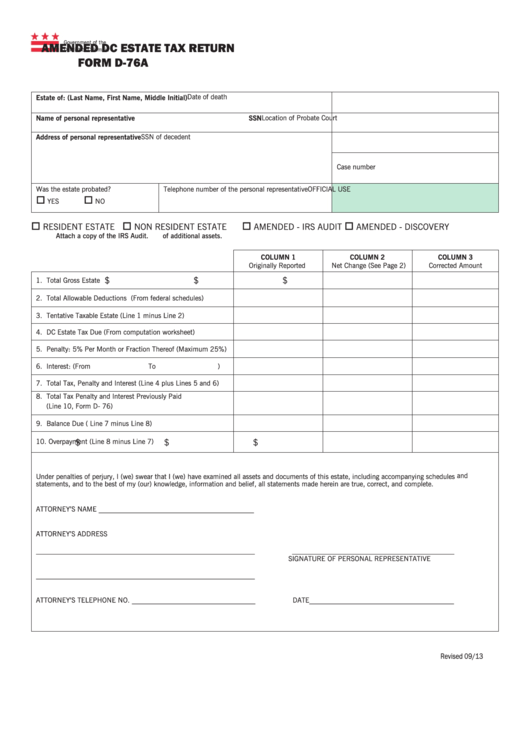

Form D76a Amended Dc Estate Tax Return printable pdf download

Mail return and payment to: If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. If you are required to file a d.c. Individual income tax forms and instructions.

How can you correct your taxes with an amended tax return? NSKT Global

If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Government, office of tax and revenue, ben franklin station, p.o. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. If you.

If You Are Required To File A D.c.

Important changes to dc tax laws are happening october 1, learn more about the upcoming tax changes. If the us internal revenue service adjusts your individual income tax return, you must file an amended dc return within 90 days of receiving. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before april 15, 2024. Mail return and payment to: