County Tax Website Tax Liens

County Tax Website Tax Liens - The list can be found by clicking on state held liens in the menu to the left. The next tax lien sale will be on february 13, 2024 online through realauction. The certificates represent liens on all unpaid. The tax lien sale provides for the payment of delinquent property taxes by a bidder. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. If we buy or sell a home. The tax on the property is auctioned in open competitive. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received.

The tax on the property is auctioned in open competitive. The list can be found by clicking on state held liens in the menu to the left. If we buy or sell a home. We will issue a tax lien release once your unsecured property tax bill is paid in full. The tax lien sale provides for the payment of delinquent property taxes by a bidder. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The certificates represent liens on all unpaid. If you have paid your bill in full and have not received. The next tax lien sale will be on february 13, 2024 online through realauction.

The next tax lien sale will be on february 13, 2024 online through realauction. We will issue a tax lien release once your unsecured property tax bill is paid in full. The certificates represent liens on all unpaid. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The list can be found by clicking on state held liens in the menu to the left. The tax lien sale provides for the payment of delinquent property taxes by a bidder. The tax on the property is auctioned in open competitive. If we buy or sell a home. If you have paid your bill in full and have not received. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

Mohave County Tax Lien Sale 2024 Dore Nancey

The certificates represent liens on all unpaid. We will issue a tax lien release once your unsecured property tax bill is paid in full. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax on the property is auctioned in open competitive. The.

Tax Liens Grand County, CO Official Website

The tax lien sale provides for the payment of delinquent property taxes by a bidder. We will issue a tax lien release once your unsecured property tax bill is paid in full. If we buy or sell a home. The certificates represent liens on all unpaid. The next tax lien sale will be on february 13, 2024 online through realauction.

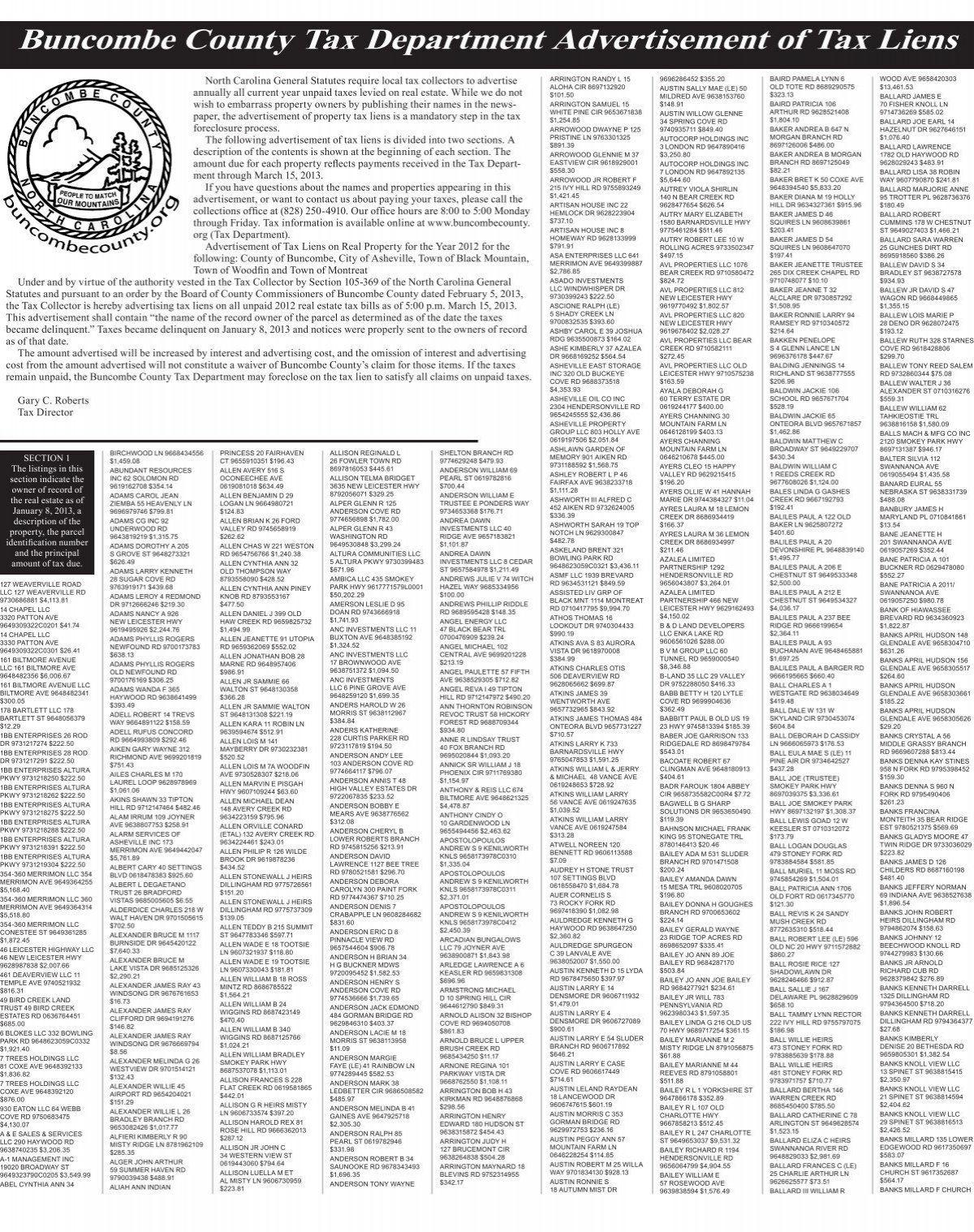

County Tax Department Advertisement of Tax Liens

Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. If we buy or sell a home. The list can be found by clicking on state held liens in the menu to the left. Properties become subject to the county tax collector’s power to sell because of a default in the.

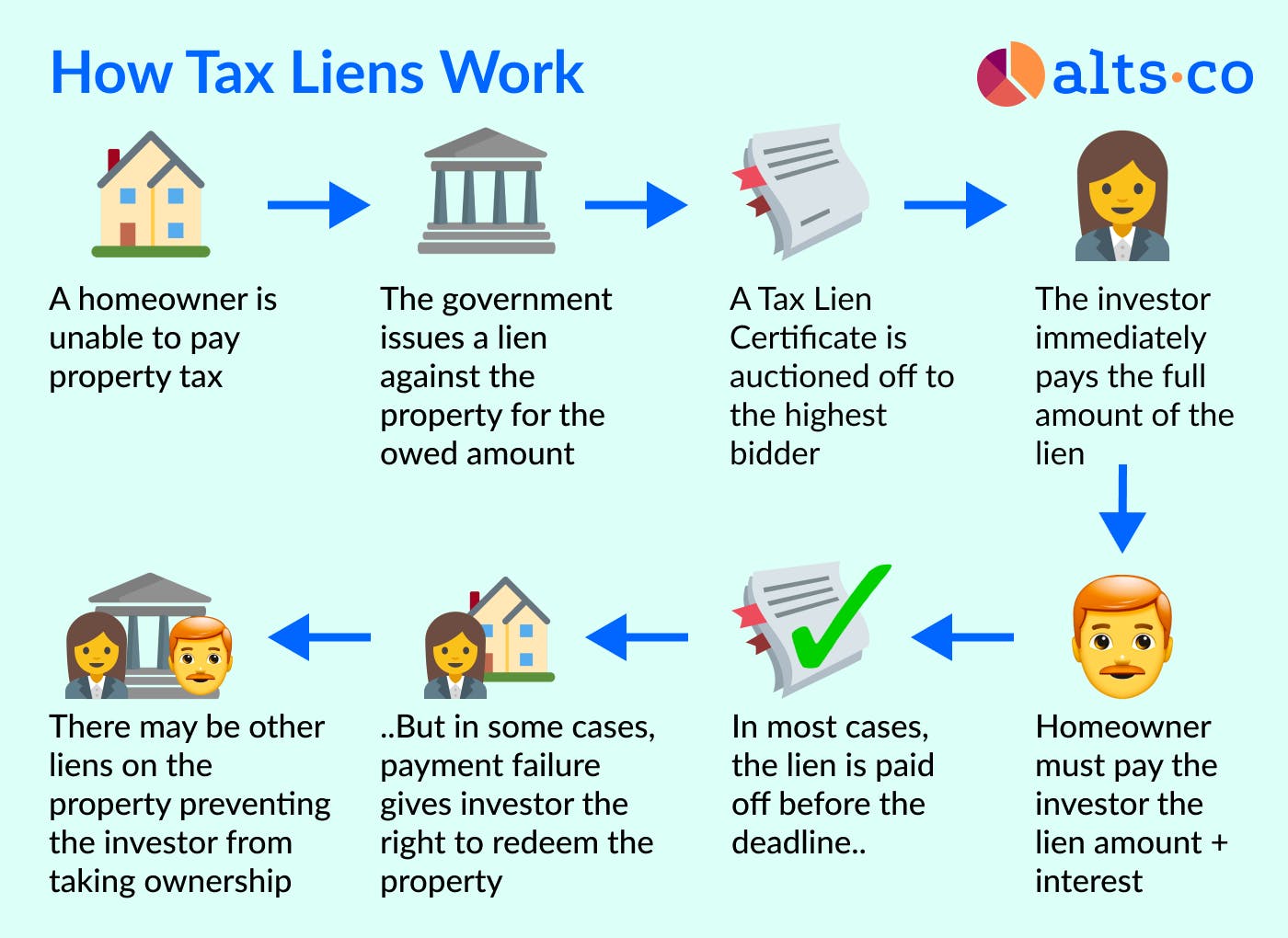

Investing In Tax Liens Alts.co

The list can be found by clicking on state held liens in the menu to the left. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. If you have paid your bill in full and have not received. If we buy or sell a home. The next tax lien sale.

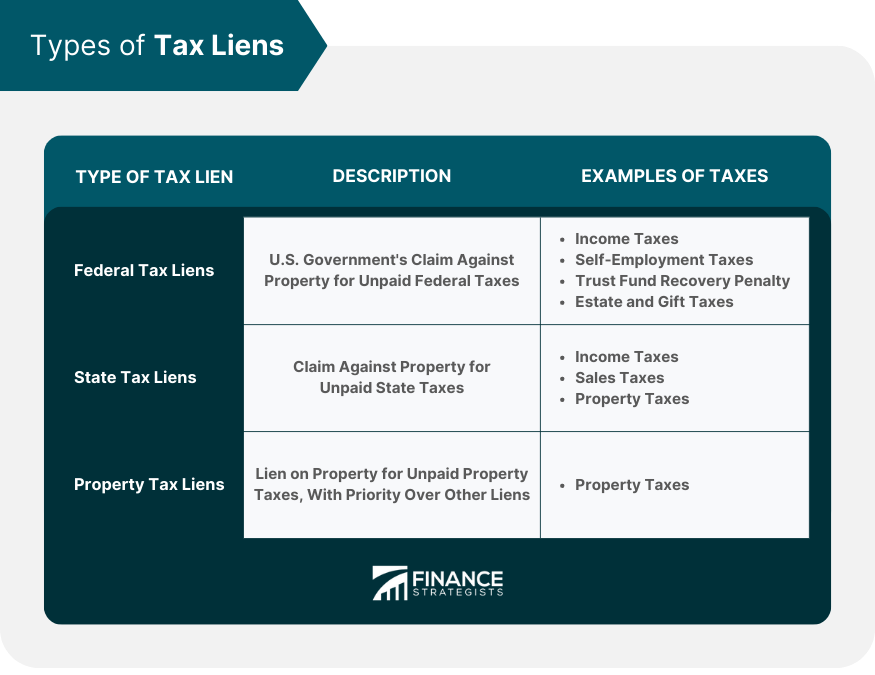

Tax Lien Definition, Process, Consequences, How to Handle

If we buy or sell a home. If you have paid your bill in full and have not received. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax on the property is auctioned in open competitive. The certificates represent liens on all.

Mohave County Tax Lien Sale 2024 Dore Nancey

The certificates represent liens on all unpaid. The list can be found by clicking on state held liens in the menu to the left. The tax lien sale provides for the payment of delinquent property taxes by a bidder. We will issue a tax lien release once your unsecured property tax bill is paid in full. Beginning on or before.

Over the Counter Tax Liens Explained Tax Sale Resources

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax on the property is auctioned in open competitive. If you have paid your bill in full and have not received. Beginning on or before june 1st, the tax collector is required by law.

How To Download Palm Beach County, FL Federal Tax Liens YouTube

The tax lien sale provides for the payment of delinquent property taxes by a bidder. If you have paid your bill in full and have not received. We will issue a tax lien release once your unsecured property tax bill is paid in full. Properties become subject to the county tax collector’s power to sell because of a default in.

Tax Liens Grand County, CO Official Website

The next tax lien sale will be on february 13, 2024 online through realauction. If you have paid your bill in full and have not received. The certificates represent liens on all unpaid. If we buy or sell a home. The tax lien sale provides for the payment of delinquent property taxes by a bidder.

El Paso County Treasurer’s Office to Hold FirstEver Online Tax Lien

The list can be found by clicking on state held liens in the menu to the left. We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received. The next tax lien sale will be on february 13, 2024 online through realauction..

We Will Issue A Tax Lien Release Once Your Unsecured Property Tax Bill Is Paid In Full.

The next tax lien sale will be on february 13, 2024 online through realauction. If we buy or sell a home. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The list can be found by clicking on state held liens in the menu to the left.

Beginning On Or Before June 1St, The Tax Collector Is Required By Law To Hold A Tax Certificate Sale.

The tax on the property is auctioned in open competitive. The tax lien sale provides for the payment of delinquent property taxes by a bidder. If you have paid your bill in full and have not received. The certificates represent liens on all unpaid.