Company Buying Its Own Product

Company Buying Its Own Product - When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. If a company is to invest the money in. Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. For one, stock buybacks allow companies an easy path to increase shareholder value.

Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. For one, stock buybacks allow companies an easy path to increase shareholder value. If a company is to invest the money in. A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance.

If a company is to invest the money in. For one, stock buybacks allow companies an easy path to increase shareholder value. Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance.

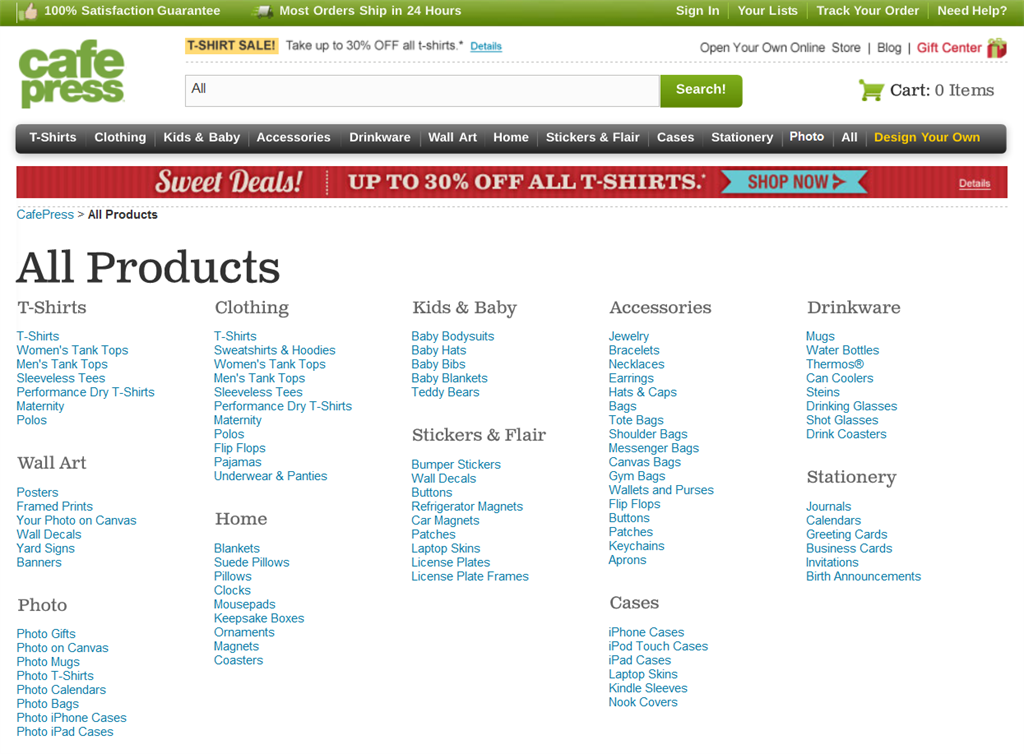

Selling Your Own Product Vs. An Affiliate Product JVZoo Blog

Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. If a company is to invest the money in. When listed companies acquire their own company shares through the tse market, they have.

Create Your Own Product In 5 Easy Steps

If a company is to invest the money in. For one, stock buybacks allow companies an easy path to increase shareholder value. A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. When listed companies.

Should you use your own product? Canny Blog

If a company is to invest the money in. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. For one, stock buybacks allow companies an easy path.

Philip Kotler Quote “Every company should work hard to obsolete its

A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. If a company is to invest the money in. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. Companies announcing buybacks repurchase shares from their shareholders and effectively remove.

CREATE YOUR OWN PRODUCT Markting Create WebQuest

Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. For one, stock buybacks allow companies an easy path to increase shareholder value. In summary, a company can buy its own shares, and this can.

Creating Your Own Product

Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. When listed companies.

How to a Better Copywriter by Selling Your Own Product Copyblogger

In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. For one, stock buybacks allow companies an easy path to increase shareholder value. If a company is to.

Philip Kotler Quote “Every company should work hard to obsolete its

A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. If a company is to invest the money in. For one, stock buybacks allow companies an easy path to increase.

Buying

If a company is to invest the money in. Companies announcing buybacks repurchase shares from their shareholders and effectively remove them from the stock. For one, stock buybacks allow companies an easy path to increase shareholder value. In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. A.

Why Would a Company Buy Back Its Own Shares?

In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. If a company is to invest the money in. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. Companies announcing buybacks repurchase shares from their shareholders and.

Companies Announcing Buybacks Repurchase Shares From Their Shareholders And Effectively Remove Them From The Stock.

In summary, a company can buy its own shares, and this can be beneficial to its remaining shareholders and the company at. For one, stock buybacks allow companies an easy path to increase shareholder value. When listed companies acquire their own company shares through the tse market, they have to comply with cabinet office ordinance. If a company is to invest the money in.

:max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)