Columbus Local Tax

Columbus Local Tax - Taxpayers may also have an. How are local taxes determined? Municipal tax is paid first to the city where work is performed or income earned. Lookup your taxing jurisdiction on crisp.columbus.gov. For individual filers, city income. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. You are responsible for paying additional tax if the tax rate where you. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated.

For individual filers, city income. Lookup your taxing jurisdiction on crisp.columbus.gov. Municipal tax is paid first to the city where work is performed or income earned. It is quick, secure and convenient! How are local taxes determined? Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Taxpayers may also have an. The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov).

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). How are local taxes determined? Lookup your taxing jurisdiction on crisp.columbus.gov. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. It is quick, secure and convenient! You are responsible for paying additional tax if the tax rate where you. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. For individual filers, city income. The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. Municipal tax is paid first to the city where work is performed or income earned.

After sweeping municipal tax rate increases across Ohio, where

Lookup your taxing jurisdiction on crisp.columbus.gov. How are local taxes determined? It is quick, secure and convenient! You are responsible for paying additional tax if the tax rate where you. Municipal tax is paid first to the city where work is performed or income earned.

Columbus Council seeks citywide tax abatements for housing

You are responsible for paying additional tax if the tax rate where you. Lookup your taxing jurisdiction on crisp.columbus.gov. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). It is quick, secure and convenient! Taxpayers may also have an.

PPT Your premier tax service in Columbus, Ohio PowerPoint

It is quick, secure and convenient! Lookup your taxing jurisdiction on crisp.columbus.gov. Municipal tax is paid first to the city where work is performed or income earned. You are responsible for paying additional tax if the tax rate where you. Taxpayers may also have an.

How do I determine my Ohio local tax district? — Charitax

How are local taxes determined? The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. We strongly recommend you file and pay with our new online tax.

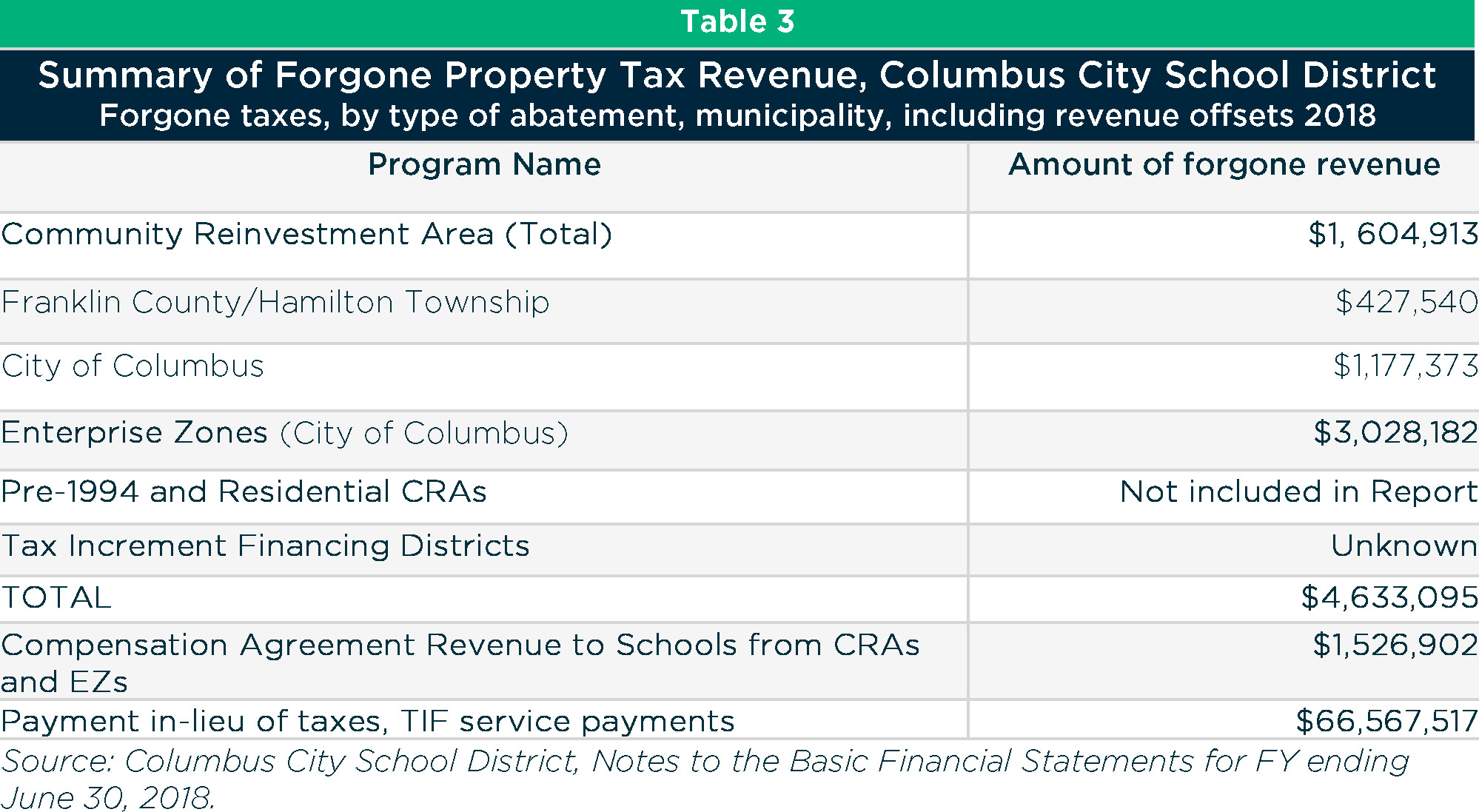

Columbus property tax abatements transparency and accountability to

Municipal tax is paid first to the city where work is performed or income earned. Taxpayers may also have an. You are responsible for paying additional tax if the tax rate where you. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. The city of columbus collects a 2.5%.

Columbus City Council approves warehouse tax break in busy session

The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. Municipal tax is paid first to the city where work is performed or income earned. You are responsible for paying additional tax if the tax rate where you. Residents of columbus pay a flat city income tax of 2.50% on earned income, in.

COLUMBUS OHIO TAX REFUND YouTube

Municipal tax is paid first to the city where work is performed or income earned. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. It is quick, secure and convenient! Residents of columbus pay.

Local Projects Land Tax Credits Bank Renovation Moving Forward but

Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Municipal tax is paid first to the city where work is performed or income earned. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You are responsible for.

Tax Preparer Columbus Tax and Law Research Inc

Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. The city of columbus collects a 2.5% tax on the income of columbus residents,.

Find the Best Tax Preparation Services in Columbus, IN

Lookup your taxing jurisdiction on crisp.columbus.gov. Taxpayers may also have an. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. You are responsible for paying additional tax if the tax rate where you. It is quick, secure and convenient!

For Individual Filers, City Income.

It is quick, secure and convenient! The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Taxpayers may also have an.

Residents Of Columbus Pay A Flat City Income Tax Of 2.50% On Earned Income, In Addition To The Ohio Income Tax And The Federal Income Tax.

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Municipal tax is paid first to the city where work is performed or income earned. You are responsible for paying additional tax if the tax rate where you. How are local taxes determined?