City Of Pittsburgh Local Tax Rate

City Of Pittsburgh Local Tax Rate - The 2022 carnegie library real. All owners of real estate located within the city and school district. View and sort psd codes & eit rates by county, municipality, and school district. The 2022 school district real estate tax rate is 10.25 mills. The first two (2) digits of a psd code. Real estate tax is tax collected by the city. If the employer does not withhold the proper amount. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The market value of the.

If the employer does not withhold the proper amount. The 2022 carnegie library real. All owners of real estate located within the city and school district. Real estate tax is tax collected by the city. View and sort psd codes & eit rates by county, municipality, and school district. The market value of the. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The first two (2) digits of a psd code. The 2022 city real estate tax rate is 8.06 mills.

Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The 2022 carnegie library real. If the employer does not withhold the proper amount. The market value of the. All owners of real estate located within the city and school district. Real estate tax is tax collected by the city. View and sort psd codes & eit rates by county, municipality, and school district. The first two (2) digits of a psd code. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The 2022 city real estate tax rate is 8.06 mills.

Fill Free fillable forms City of Pittsburgh

The first two (2) digits of a psd code. If the employer does not withhold the proper amount. Real estate tax is tax collected by the city. The 2022 city real estate tax rate is 8.06 mills. The 2022 school district real estate tax rate is 10.25 mills.

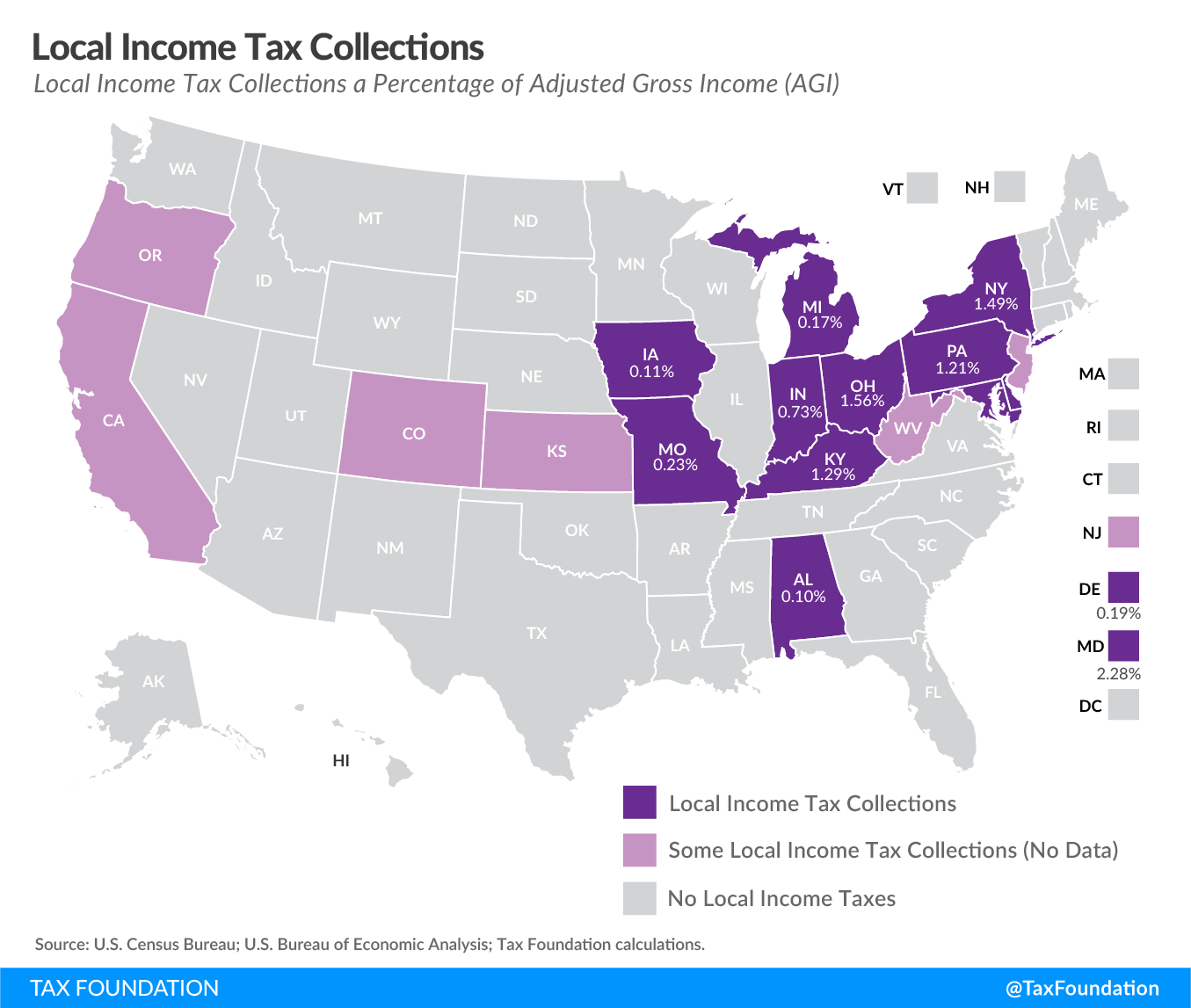

Local Taxes in 2019 Local Tax City & County Level

The market value of the. The 2022 city real estate tax rate is 8.06 mills. The 2022 carnegie library real. Real estate tax is tax collected by the city. If the employer does not withhold the proper amount.

TRENDING

Real estate tax is tax collected by the city. The 2022 school district real estate tax rate is 10.25 mills. The 2022 carnegie library real. The 2022 city real estate tax rate is 8.06 mills. If the employer does not withhold the proper amount.

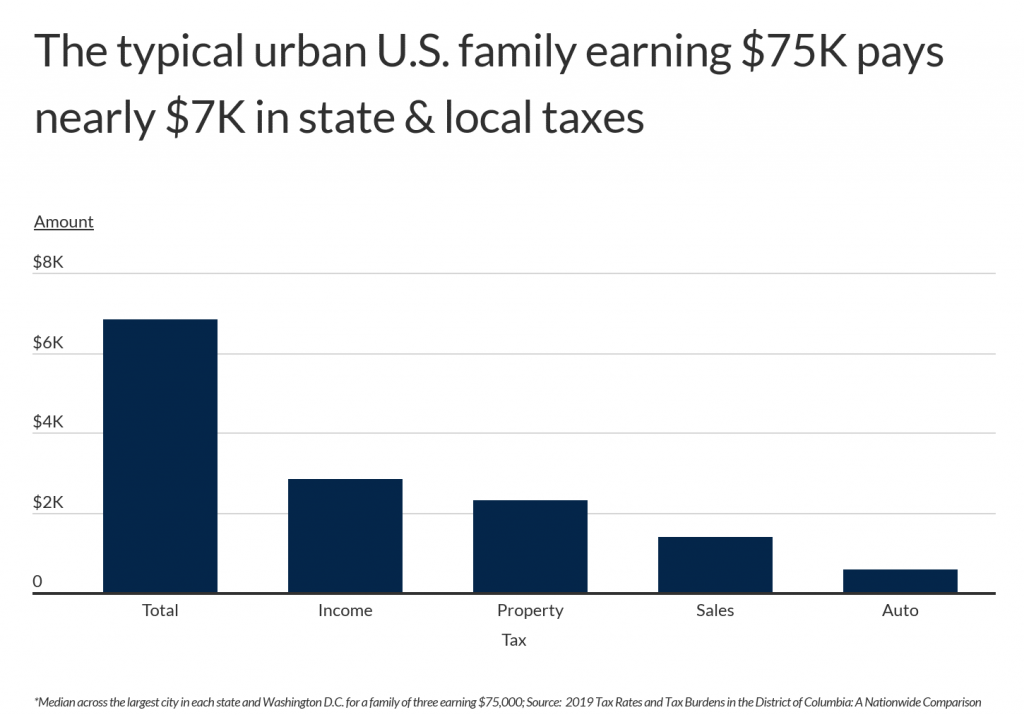

doSh Relocating to Pittsburgh Pittsburgh Taxes doSh

If the employer does not withhold the proper amount. Real estate tax is tax collected by the city. View and sort psd codes & eit rates by county, municipality, and school district. The 2022 carnegie library real. The first two (2) digits of a psd code.

Taxes Per Capita, By State, 2021 Tax Foundation

All owners of real estate located within the city and school district. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The first two (2) digits of a psd code. The 2022 city real estate tax rate is 8.06 mills. Real estate tax is tax collected by the city.

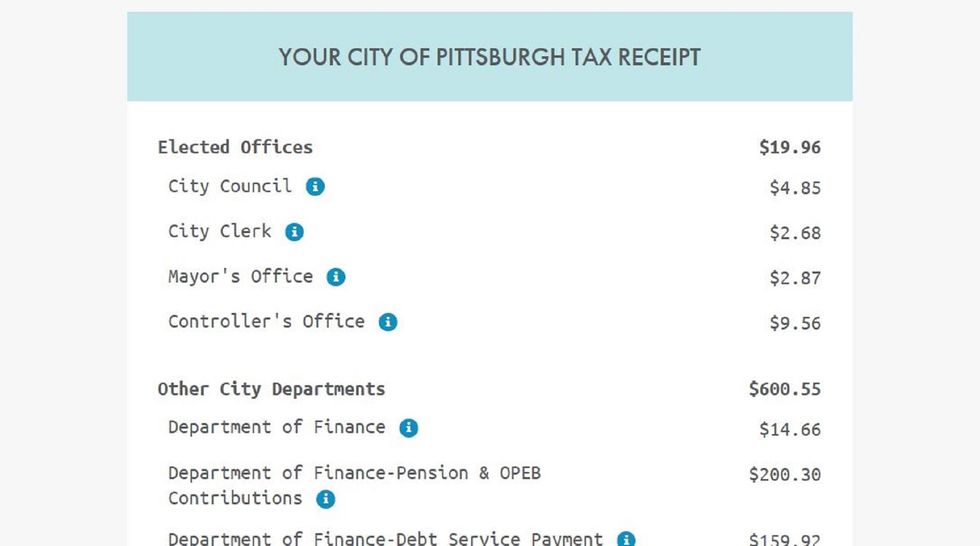

City of Pittsburgh launches interactive tool to show residents where

The first two (2) digits of a psd code. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The 2022 school district real estate tax rate is 10.25 mills. The local services tax of $52 is to be deducted.

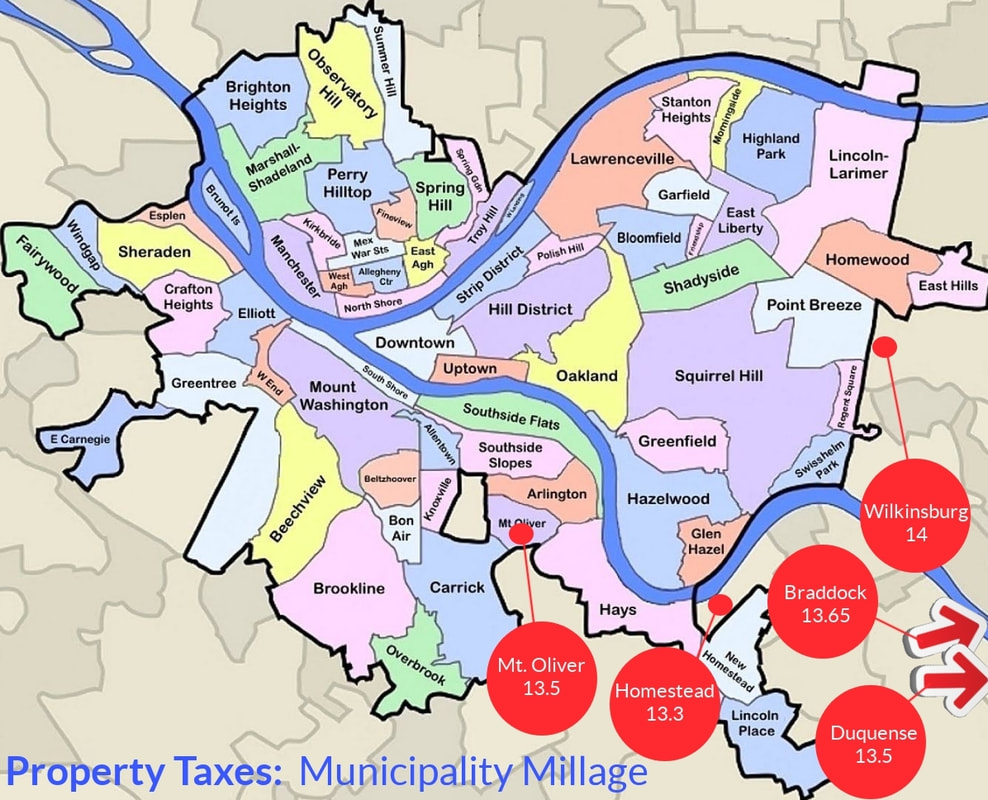

Where are the highest property tax rates in central Pa.?

If the employer does not withhold the proper amount. The 2022 carnegie library real. Real estate tax is tax collected by the city. View and sort psd codes & eit rates by county, municipality, and school district. The 2022 school district real estate tax rate is 10.25 mills.

Pitt Study Pa. municipalities in line to lose 3.4B in tax revenue in

The 2022 city real estate tax rate is 8.06 mills. The market value of the. Real estate tax is tax collected by the city. The 2022 school district real estate tax rate is 10.25 mills. The 2022 carnegie library real.

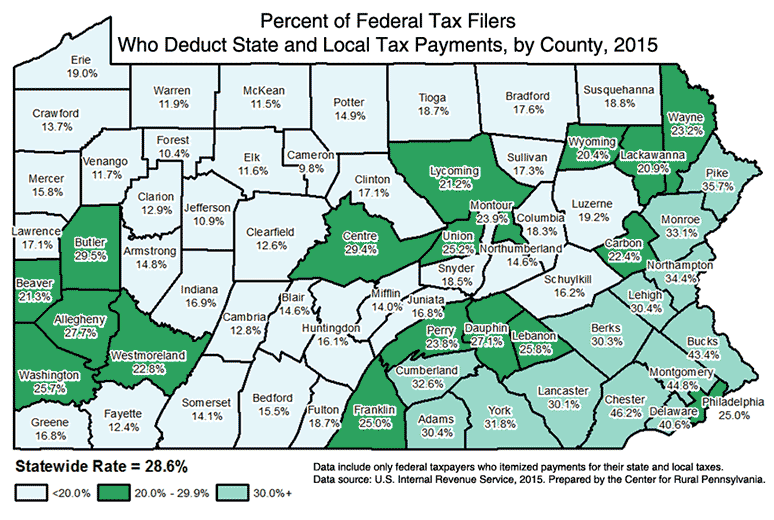

DataGrams Center for Rural PA

The 2022 school district real estate tax rate is 10.25 mills. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The first two (2) digits of a psd code. The market value of the. All owners of real estate located within the city and school district.

Policy Property Tax Assessments — ProHousing Pittsburgh

View and sort psd codes & eit rates by county, municipality, and school district. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. All owners of real estate located within the city and school district. The market value of the. The 2022 school district real estate tax rate is 10.25 mills.

All Owners Of Real Estate Located Within The City And School District.

The 2022 carnegie library real. The first two (2) digits of a psd code. The 2022 city real estate tax rate is 8.06 mills. If the employer does not withhold the proper amount.

Pittsburgh Pa 15219 Tax Rate By Tax Type For Tax Year 20 20 Tax Type City Rate School Rate City P & I Total School P & I Total At.

The 2022 school district real estate tax rate is 10.25 mills. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The market value of the. Real estate tax is tax collected by the city.