Change Name On Tax Id

Change Name On Tax Id - You need a new ein, in general, when you change your entity’s ownership or structure. Business owners and other authorized individuals can submit a name change for their business. This guide covers the steps, including a sample business name change. Follow our guide for filing requirements and the process to ensure your. Learn how to update your itin after a name change. Learn how to change your business name with the irs. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. You don’t need a new ein if you just. The specific action required may vary depending on.

This guide covers the steps, including a sample business name change. You need a new ein, in general, when you change your entity’s ownership or structure. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. Follow our guide for filing requirements and the process to ensure your. Learn how to change your business name with the irs. Business owners and other authorized individuals can submit a name change for their business. Learn how to update your itin after a name change. You don’t need a new ein if you just. The specific action required may vary depending on.

Business owners and other authorized individuals can submit a name change for their business. You don’t need a new ein if you just. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. This guide covers the steps, including a sample business name change. Learn how to update your itin after a name change. The specific action required may vary depending on. Follow our guide for filing requirements and the process to ensure your. You need a new ein, in general, when you change your entity’s ownership or structure. Learn how to change your business name with the irs.

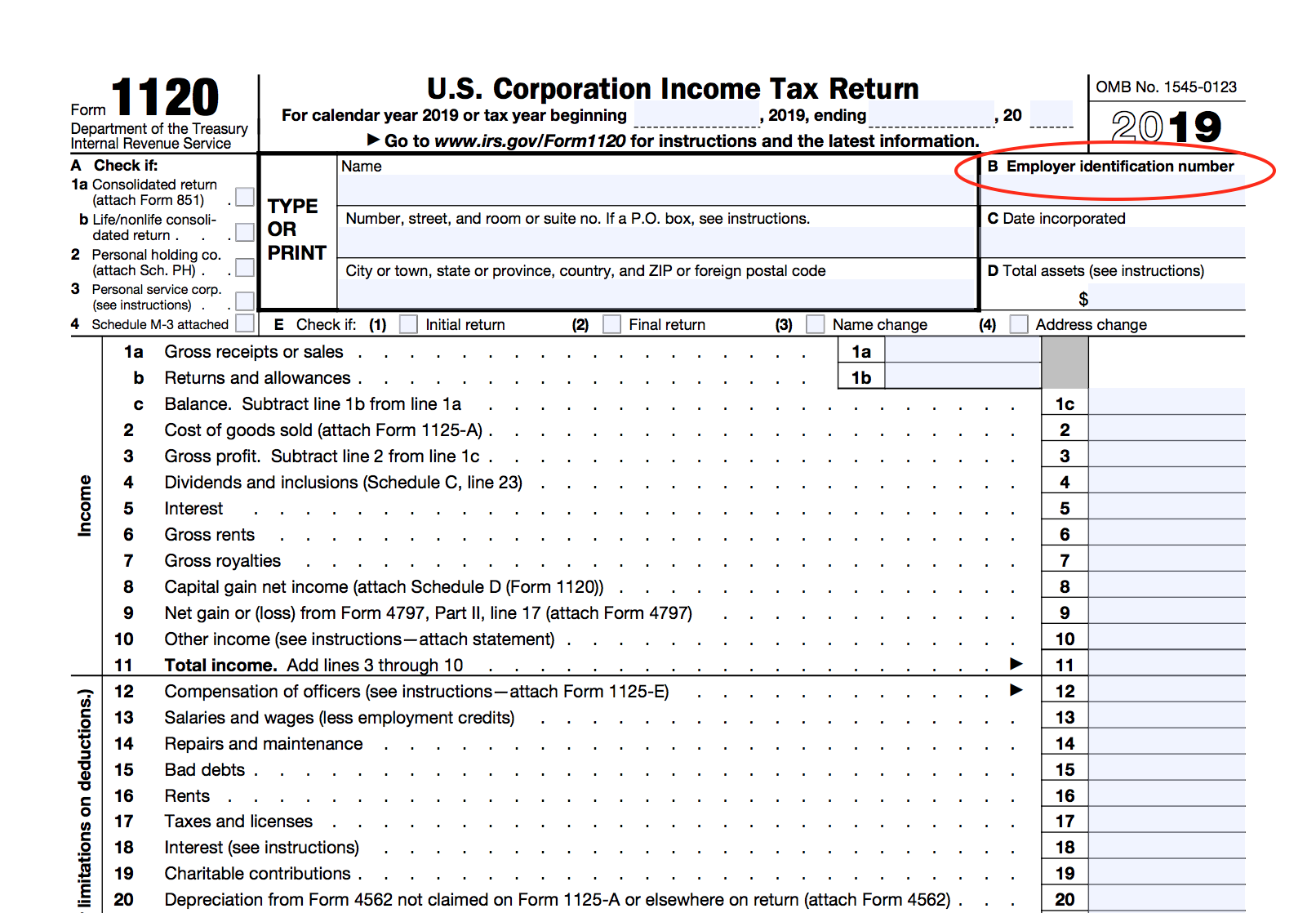

EIN Lookup How to Find Your Business Tax ID Number

Learn how to change your business name with the irs. You need a new ein, in general, when you change your entity’s ownership or structure. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. You don’t need a new ein if you just.

When is a tax ID needed?

The specific action required may vary depending on. You need a new ein, in general, when you change your entity’s ownership or structure. This guide covers the steps, including a sample business name change. Learn how to update your itin after a name change. Learn how to change your business name with the irs.

Streamline VAT compliance for your business CDQ

You don’t need a new ein if you just. Business owners and other authorized individuals can submit a name change for their business. Learn how to update your itin after a name change. You need a new ein, in general, when you change your entity’s ownership or structure. Learn how to change your business name with the irs.

Tax Id Numbers Or Fein?

Learn how to change your business name with the irs. The specific action required may vary depending on. Learn how to update your itin after a name change. This guide covers the steps, including a sample business name change. You don’t need a new ein if you just.

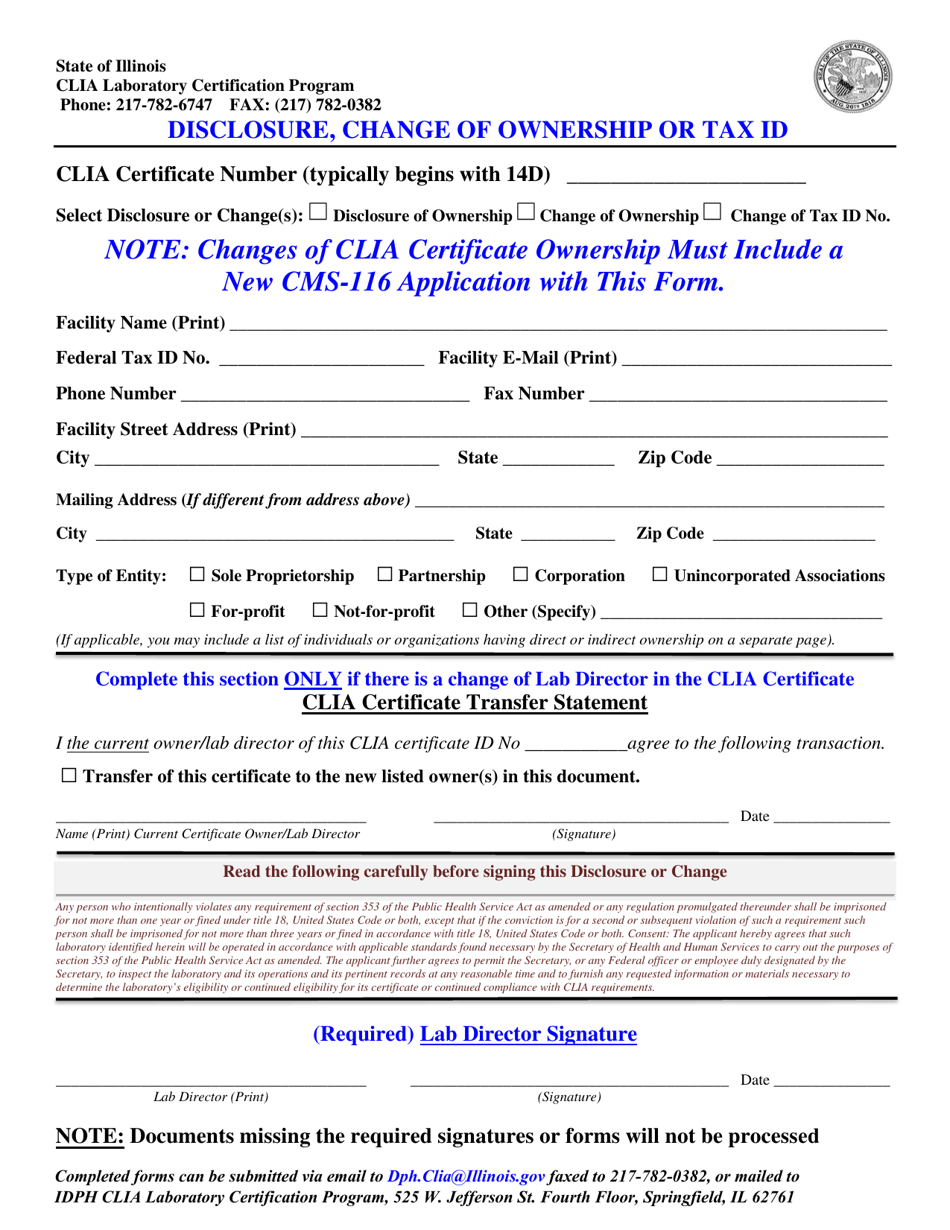

Illinois Disclosure, Change of Ownership or Tax Id Fill Out, Sign

Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. Learn how to change your business name with the irs. Learn how to update your itin after a name change. You need a new ein, in general, when you change your entity’s ownership or structure.

Federal Tax Id Number Lookup Company Free Tax Walls

Business owners and other authorized individuals can submit a name change for their business. You don’t need a new ein if you just. You need a new ein, in general, when you change your entity’s ownership or structure. This guide covers the steps, including a sample business name change. Learn how to change your business name with the irs.

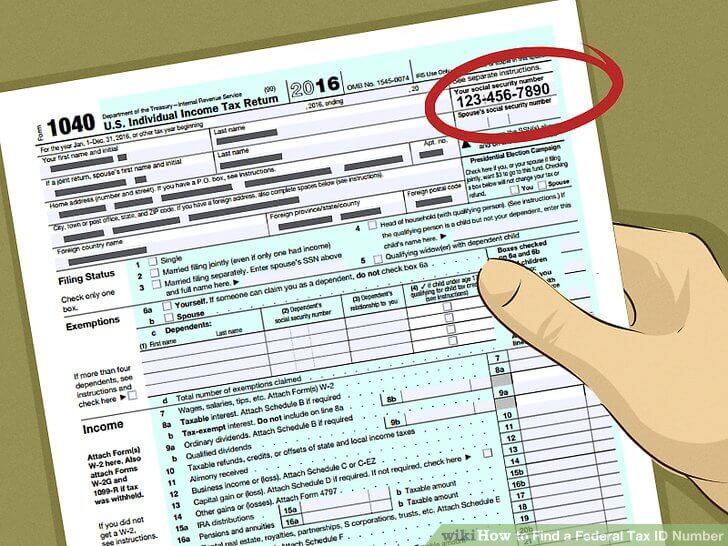

Differences Among a Tax ID, Employer ID, and ITIN

You don’t need a new ein if you just. Business owners and other authorized individuals can submit a name change for their business. Learn how to change your business name with the irs. Follow our guide for filing requirements and the process to ensure your. The specific action required may vary depending on.

Tax ID Verification for improved tax compliance CDQ

You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein if you just. Follow our guide for filing requirements and the process to ensure your. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business.

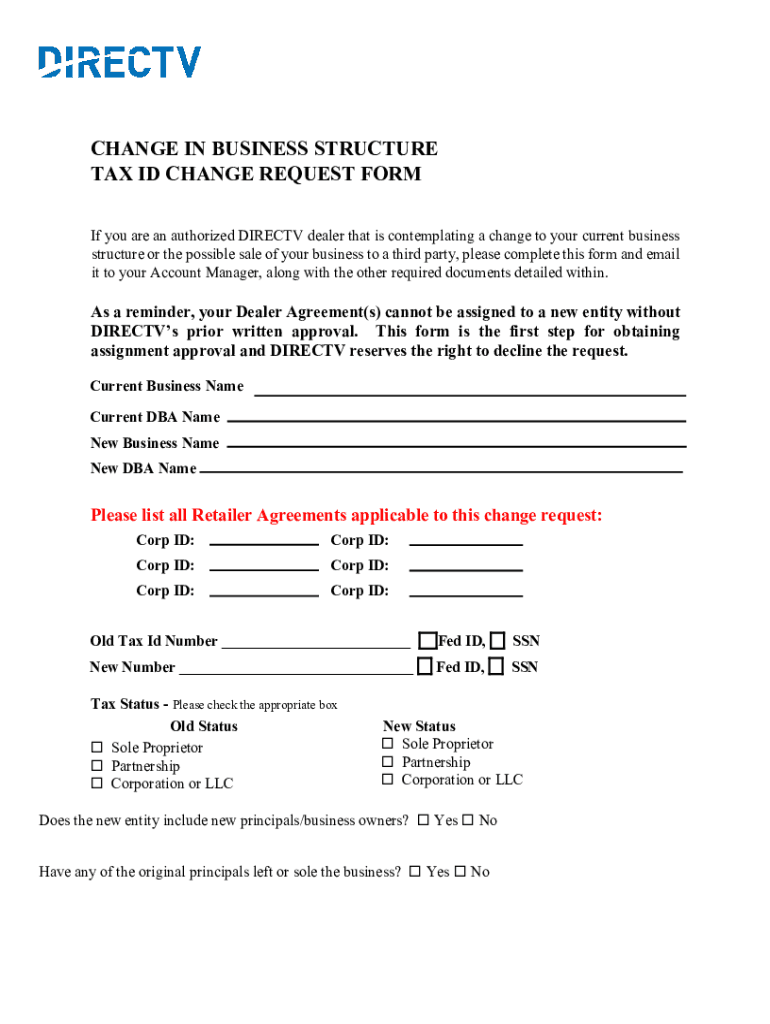

Fillable Online TAX ID CHANGE REQUEST FORM Fax Email Print pdfFiller

You don’t need a new ein if you just. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. Learn how to change your business name with the irs. Learn how to update your itin after a name change. Business owners and other authorized individuals can.

Tax ID Number Lookup TIN Number

You don’t need a new ein if you just. This guide covers the steps, including a sample business name change. The specific action required may vary depending on. You need a new ein, in general, when you change your entity’s ownership or structure. Changing the name and address associated with your tax id involves a little paperwork and a certified.

The Specific Action Required May Vary Depending On.

Business owners and other authorized individuals can submit a name change for their business. Changing the name and address associated with your tax id involves a little paperwork and a certified copy of your marriage license or other. Learn how to change your business name with the irs. Learn how to update your itin after a name change.

You Don’t Need A New Ein If You Just.

You need a new ein, in general, when you change your entity’s ownership or structure. Follow our guide for filing requirements and the process to ensure your. This guide covers the steps, including a sample business name change.

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)