Can I Accept Credit Card Payments With A Tax Lien

Can I Accept Credit Card Payments With A Tax Lien - All major credit cards are accepted. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Does the commissioner of finance accept the. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. Can a tax lien affect my ability to get a loan or credit card? The irs releases your lien within 30 days after you have paid your tax debt. For more details see, pay real estate. Can i pay my taxes by credit card, and which cards are accepted?

Can a tax lien affect my ability to get a loan or credit card? All major credit cards are accepted. For more details see, pay real estate. Does the commissioner of finance accept the. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. Can i pay my taxes by credit card, and which cards are accepted? The irs releases your lien within 30 days after you have paid your tax debt.

Does the commissioner of finance accept the. Can a tax lien affect my ability to get a loan or credit card? Can i pay my taxes by credit card, and which cards are accepted? All major credit cards are accepted. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. The irs releases your lien within 30 days after you have paid your tax debt. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. For more details see, pay real estate.

How to Accept Credit Card Payments for Your Small Business

The irs releases your lien within 30 days after you have paid your tax debt. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Does the commissioner of finance accept the. Can i pay my taxes by credit card, and which cards are accepted? Credit card payments will be accepted.

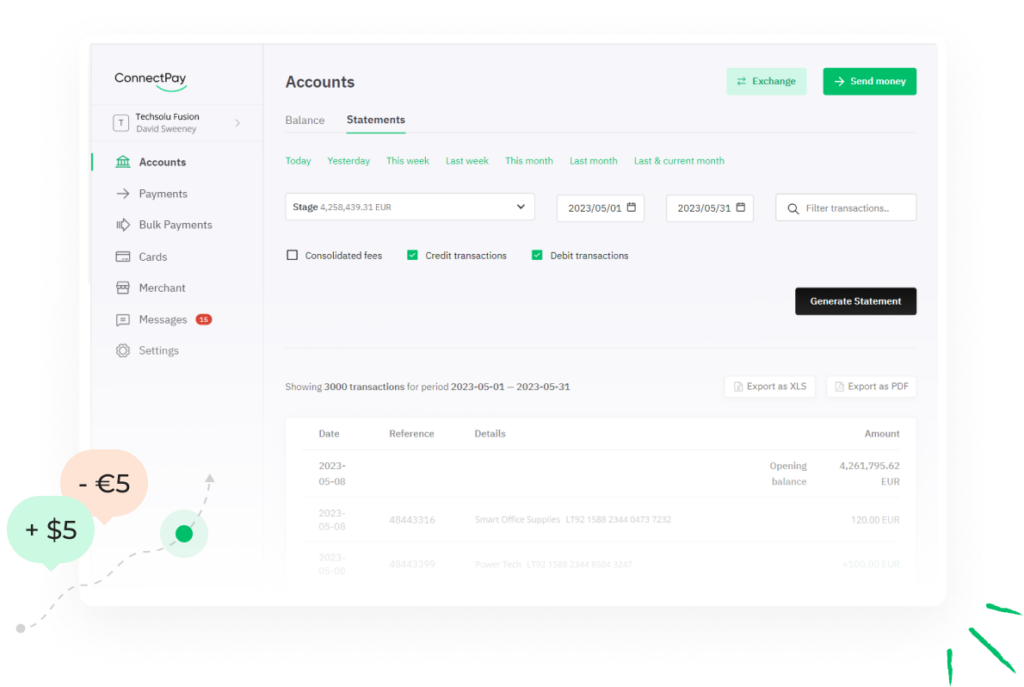

Accept Credit Card & Debit Card Payments Checkout Service

Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Can i pay my taxes by credit card, and which cards are accepted? The irs releases your lien within 30 days after you have paid your tax debt. All major credit cards are accepted. Can a tax lien affect my ability.

How to Accept Credit Card Payments

Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. All major credit cards are accepted. The irs releases your lien within 30 days after you have paid your tax debt. Does the commissioner of finance accept the. Credit card payments will be accepted in person in the finance office for.

Accept Credit Card & Debit Card Payments Checkout Service

Can a tax lien affect my ability to get a loan or credit card? For more details see, pay real estate. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Does the commissioner of finance accept the. Can i pay my taxes by credit card, and which cards are accepted?

How to Accept Credit Card Payments as a Contractor (+ 6 Benefits)

For more details see, pay real estate. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. All major credit cards are accepted. Does the commissioner of finance accept the.

muhakat We Accept Credit Card Payments

Does the commissioner of finance accept the. All major credit cards are accepted. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. The irs releases your lien within 30 days after you have paid your tax debt. Can i pay my taxes by credit card, and which cards are accepted?

Credit Card Payments WIZniche

Credit card payments will be accepted in person in the finance office for delinquent real property taxes. For more details see, pay real estate. Can i pay my taxes by credit card, and which cards are accepted? The irs releases your lien within 30 days after you have paid your tax debt. All major credit cards are accepted.

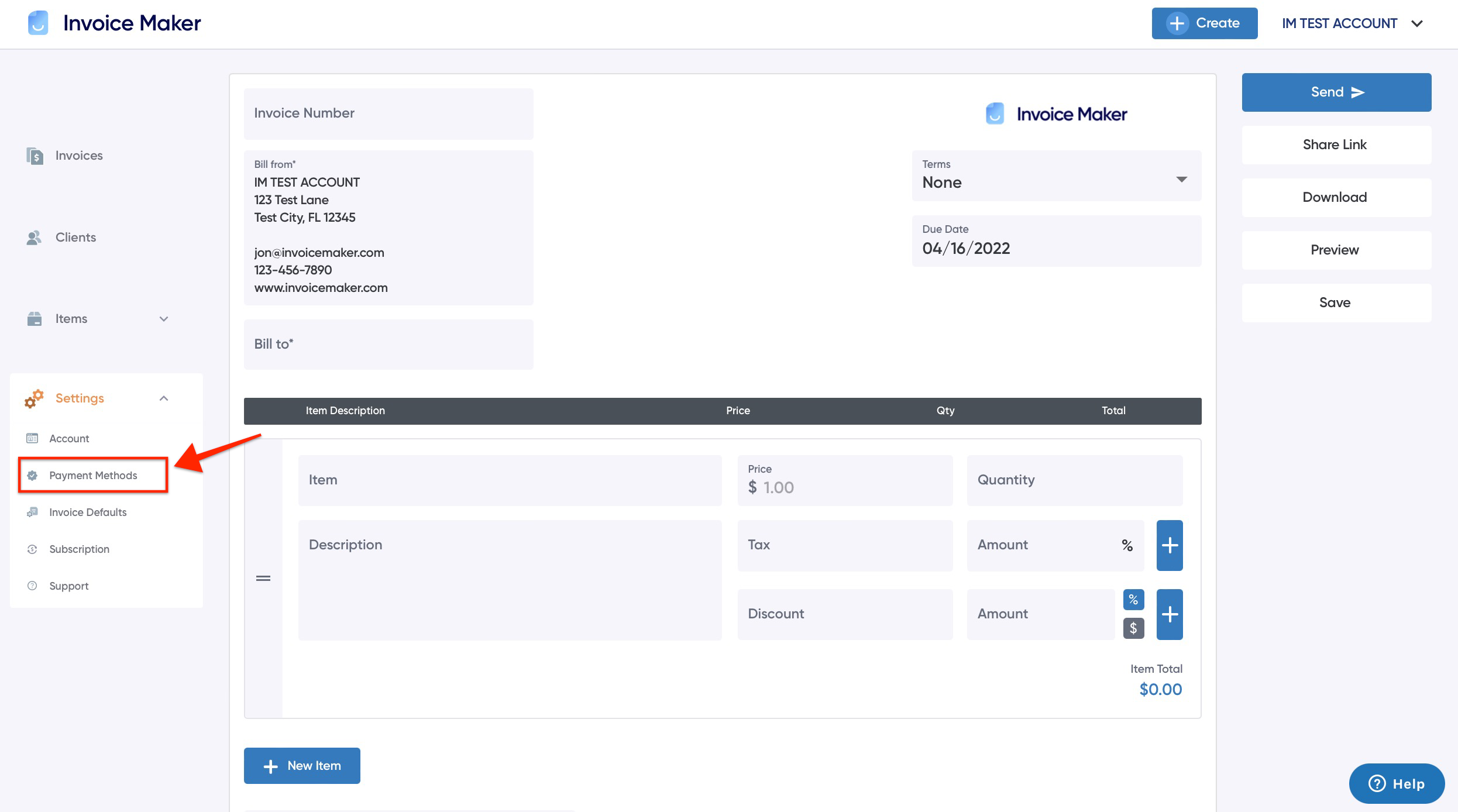

How to Accept Credit Card Payments Invoice Maker

Does the commissioner of finance accept the. The irs releases your lien within 30 days after you have paid your tax debt. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Can i pay my taxes by credit card, and which cards are accepted? Can a tax lien affect my.

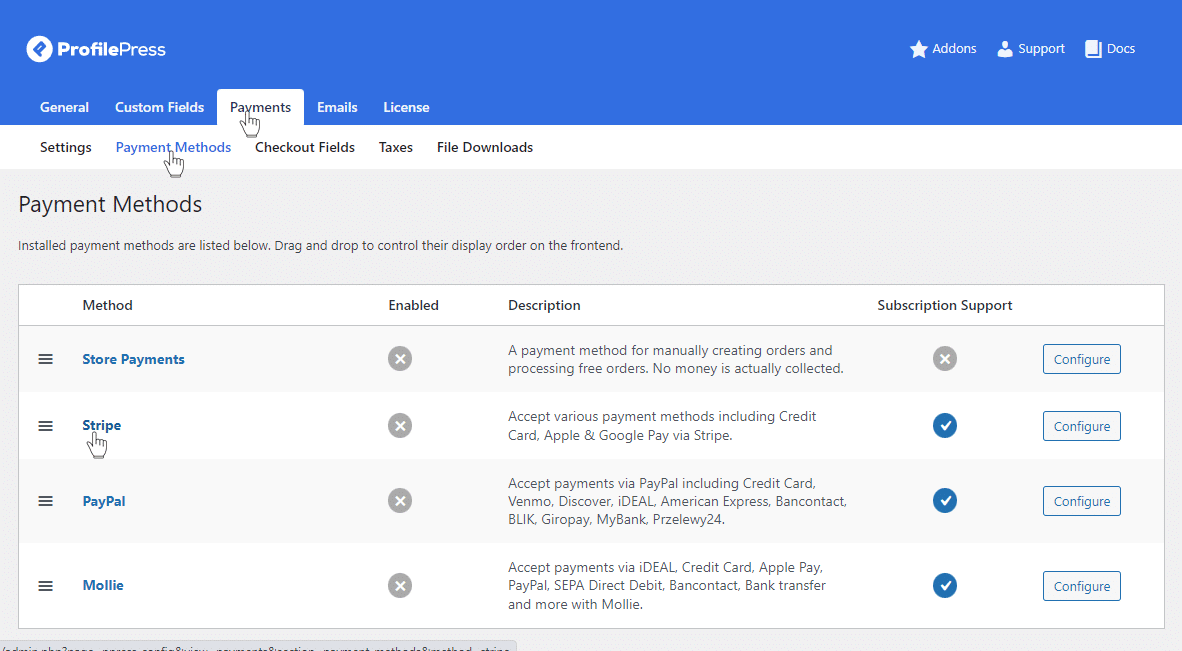

How to Accept Credit Card Payments in WordPress

Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. For more details see, pay real estate. All major credit cards are accepted. Can a tax lien affect my ability to get a loan or credit card? Can i pay my taxes by credit card, and which cards are accepted?

How to Easily Accept Credit Card Payments Online in WordPress

Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Can a tax lien affect my ability to get a loan or credit card? For more details see, pay real estate. Can i pay my taxes by credit card, and which cards are accepted? The irs releases your lien within 30.

Can A Tax Lien Affect My Ability To Get A Loan Or Credit Card?

Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. All major credit cards are accepted. Can i pay my taxes by credit card, and which cards are accepted? Does the commissioner of finance accept the.

The Irs Releases Your Lien Within 30 Days After You Have Paid Your Tax Debt.

Credit card payments will be accepted in person in the finance office for delinquent real property taxes. For more details see, pay real estate.

/GettyImages-500500849-56a066c43df78cafdaa16b4d.jpg)