California State Tax Lien Search

California State Tax Lien Search - Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Learn about accessing california public records, utilizing. Search for california lien records. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Find out how to avoid or resolve liens, levies, and offsets from. Explore the types of liens, such as tax liens and judgment liens.

Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Search for california lien records. Explore the types of liens, such as tax liens and judgment liens. Find out how to avoid or resolve liens, levies, and offsets from. Learn about accessing california public records, utilizing. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien.

Find out how to avoid or resolve liens, levies, and offsets from. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Explore the types of liens, such as tax liens and judgment liens. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Learn about accessing california public records, utilizing. Search for california lien records.

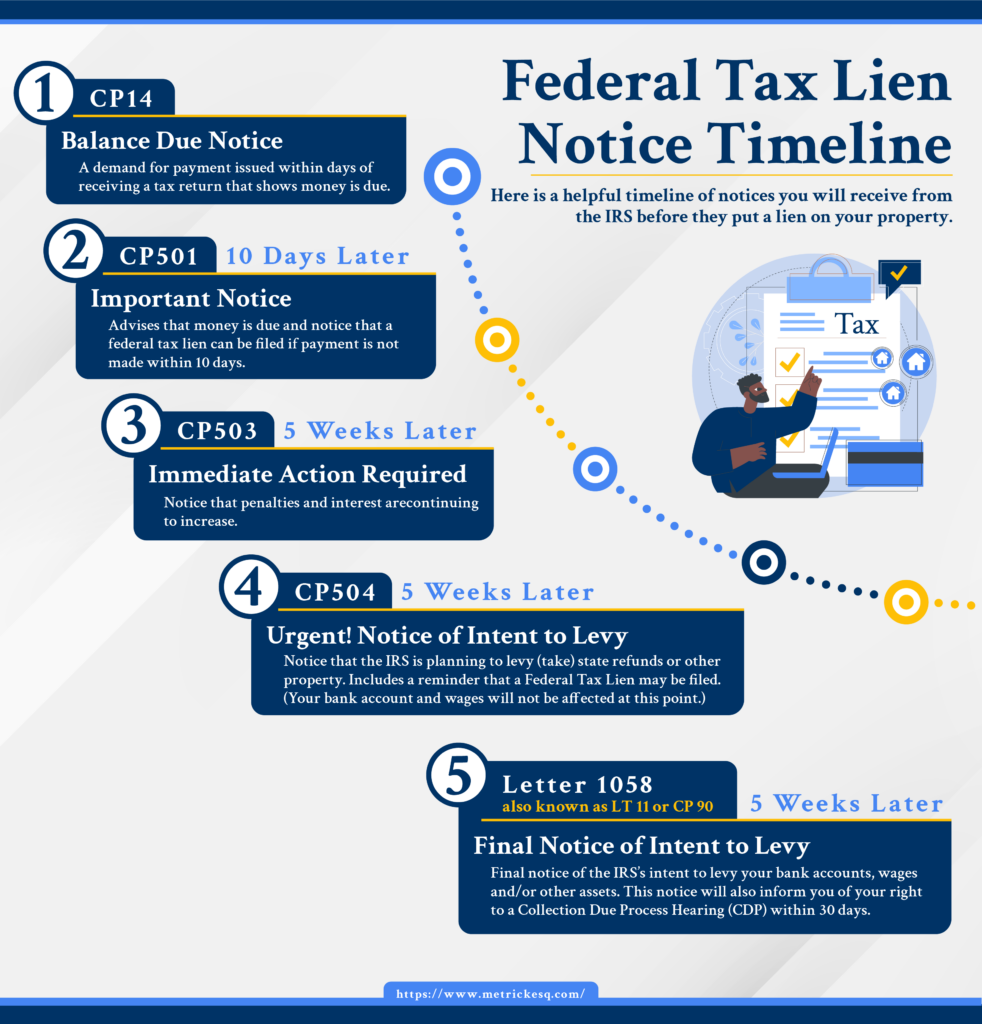

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Learn about accessing california public records, utilizing. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Find out how to avoid or resolve liens, levies, and offsets from. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). This.

3 Ways to Remove a Tax Lien from your Credit Report

This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Learn about accessing california public records, utilizing. Under california law, priority between state and federal tax liens is determined when each.

Tax Lien California State Tax Lien

Find out how to avoid or resolve liens, levies, and offsets from. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Learn about accessing california public records, utilizing. Search for california lien records. Under california law, priority between state and federal tax liens is determined when each liability was first created.

Tips On Dealing With A State Tax Lien Legal News Letter

Learn about accessing california public records, utilizing. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Explore the types of liens, such as tax liens and judgment liens. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Search for.

Tax Lien Certificate Sales

Explore the types of liens, such as tax liens and judgment liens. Search for california lien records. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date)..

Tax Lien State Tax Lien California

Learn about accessing california public records, utilizing. Search for california lien records. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. Under california law, priority between state and federal tax.

Tax Lien Texas State Tax Lien

Find out how to avoid or resolve liens, levies, and offsets from. Learn how to deal with tax or fee liabilities that are due and payable by the date shown. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Under california law, priority between state and federal tax.

Property Tax Lien Search Nationwide Title Insurance

Find out how to avoid or resolve liens, levies, and offsets from. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Learn about accessing california public.

How to Do a UCC and Federal or State Tax Lien Search

This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Explore the types of liens, such as tax liens and judgment liens. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Search for california lien records..

Tax Lien State Tax Lien California

Search for california lien records. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Find out how to avoid or resolve liens, levies, and offsets from. Explore the types of liens, such as tax liens and judgment liens. Under california law, priority between state and federal tax liens.

Learn About Accessing California Public Records, Utilizing.

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Find out how to avoid or resolve liens, levies, and offsets from. This tool allows you to search the california secretary of state's uniform commercial code database for abstracts of information for lien. Search for california lien records.

Explore The Types Of Liens, Such As Tax Liens And Judgment Liens.

Learn how to deal with tax or fee liabilities that are due and payable by the date shown.