Buying Tax Liens In Nj

Buying Tax Liens In Nj - If you do not pay your property. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! This helps raise money for. In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. Access hundreds of tax lien auctions and thousands of properties. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales.

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. Access hundreds of tax lien auctions and thousands of properties. In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! This helps raise money for. If you do not pay your property.

If you do not pay your property. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. Access hundreds of tax lien auctions and thousands of properties. In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. This helps raise money for.

5 Steps to Buying Tax Liens Online Plan Trustler The blogger evolution

Access hundreds of tax lien auctions and thousands of properties. If you do not pay your property. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. New jersey.

Exploring Tax Liens How Does Buying Tax Liens Work

This helps raise money for. In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. The tax collector is required by state law to.

Tax Preparation Business Startup

Access hundreds of tax lien auctions and thousands of properties. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. Parcel fair is excited to unlock the.

Is your statement ‘tax ready’? Taxpro

Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! This helps raise money for. In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. New jersey law requires all municipalities to offer the tax liens on tax delinquent.

Read This before Buying Tax Liens Michael Schuett

Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. Access hundreds of tax lien auctions and thousands of properties. New jersey law requires all municipalities to offer the tax liens on.

TAX Consultancy Firm Gurugram

This helps raise money for. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! If you do not pay your property. The tax collector is required by state law to hold a.

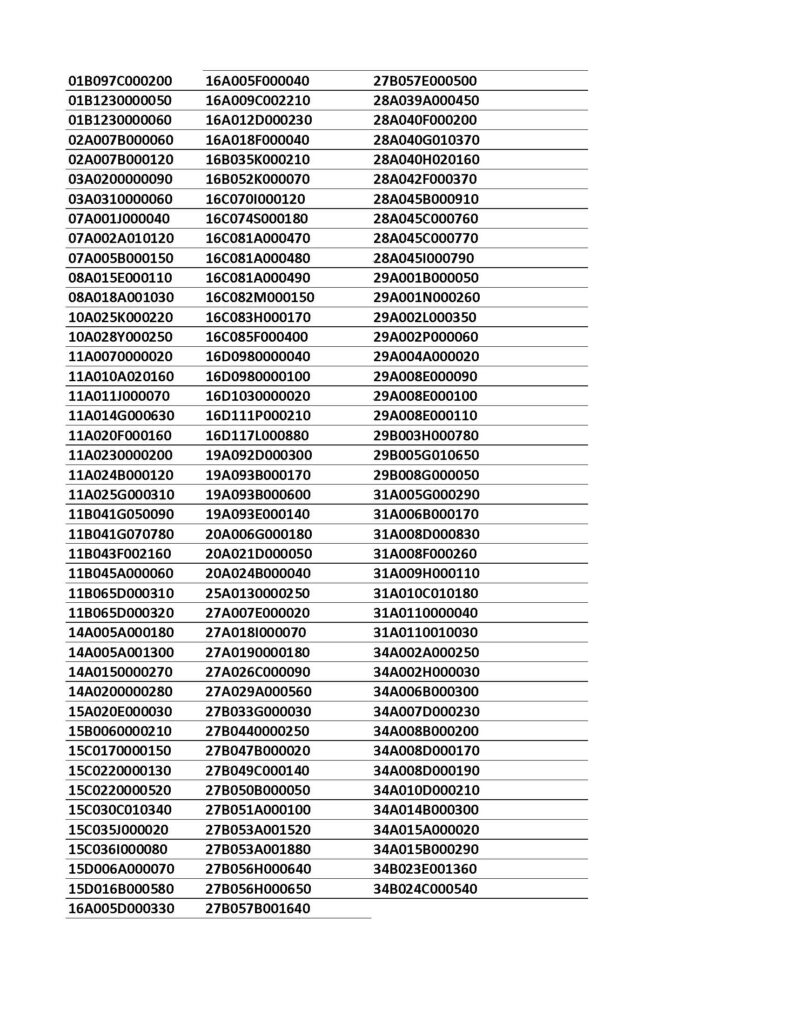

TAX LIENS PENDING CERTIFICATE FILING Treasurer

Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! This helps raise money for. New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. The tax collector is required by state law to hold a tax sale each year for the prior.

Tax Liens Cash for Properties

Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! This helps raise money for. The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. In most cases the municipality may contract with a vendor to conduct a sale on behalf of.

Things to Know about Buying a House with Tax Liens Tax Lien Code

This helps raise money for. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges. In most cases the municipality may contract with a vendor to conduct a sale on behalf of.

Buying Tax Liens Online LOADCOURSE Best Discount Trading

New jersey law requires all municipalities to offer the tax liens on tax delinquent properties to buyers at regular tax sales. Access hundreds of tax lien auctions and thousands of properties. If you do not pay your property. The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges..

This Helps Raise Money For.

In most cases the municipality may contract with a vendor to conduct a sale on behalf of the tax collector without quotations or public bids. If you do not pay your property. Parcel fair is excited to unlock the new jersey 2025 tax lien auction season for you! Access hundreds of tax lien auctions and thousands of properties.

New Jersey Law Requires All Municipalities To Offer The Tax Liens On Tax Delinquent Properties To Buyers At Regular Tax Sales.

The tax collector is required by state law to hold a tax sale each year for the prior year's unpaid municipal charges.