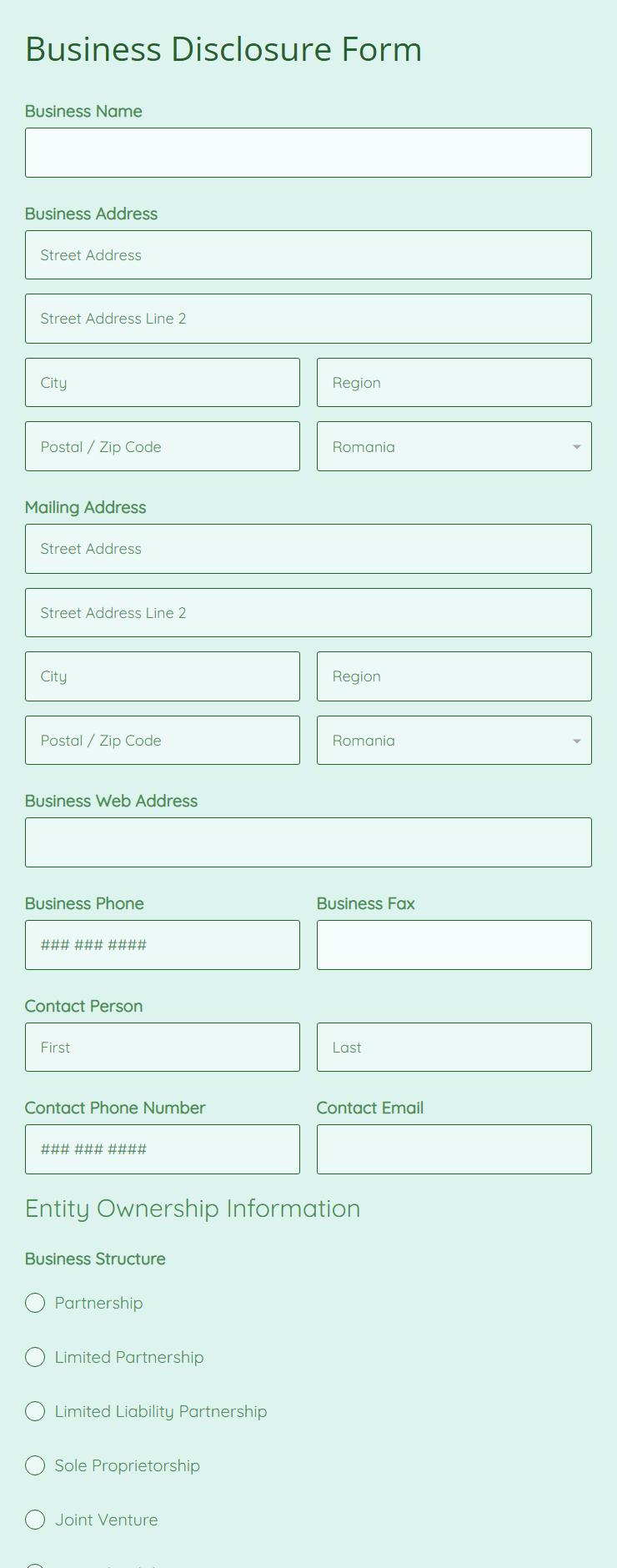

Business Disclosure Form

Business Disclosure Form - 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. To avoid penalties, entities that existed before. General instructions to form 4: The corporate transparency act requires most llcs and business entities to file a boi report. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Need to file another type of bsa report? When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Go to the help section in the blue. Annual statement of beneficial ownership of securities general instructions to form 5: Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate.

Need to file another type of bsa report? General instructions to form 4: Need to file a boir? Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. The corporate transparency act requires most llcs and business entities to file a boi report. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Go to the help section in the blue. When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Companies that are required to comply (“reporting companies”) must file their initial. To avoid penalties, entities that existed before.

Need to file another type of bsa report? Need to file a boir? Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate. The corporate transparency act requires most llcs and business entities to file a boi report. To avoid penalties, entities that existed before. Annual statement of beneficial ownership of securities general instructions to form 5: General instructions to form 4: Many companies are required to report information to fincen about the individuals who ultimately own or control them. When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Go to the help section in the blue.

Where is Affiliated Business Arrangement Disclosure for eXp Realty in

Annual statement of beneficial ownership of securities general instructions to form 5: Need to file a boir? Many companies are required to report information to fincen about the individuals who ultimately own or control them. Need to file another type of bsa report? General instructions to form 4:

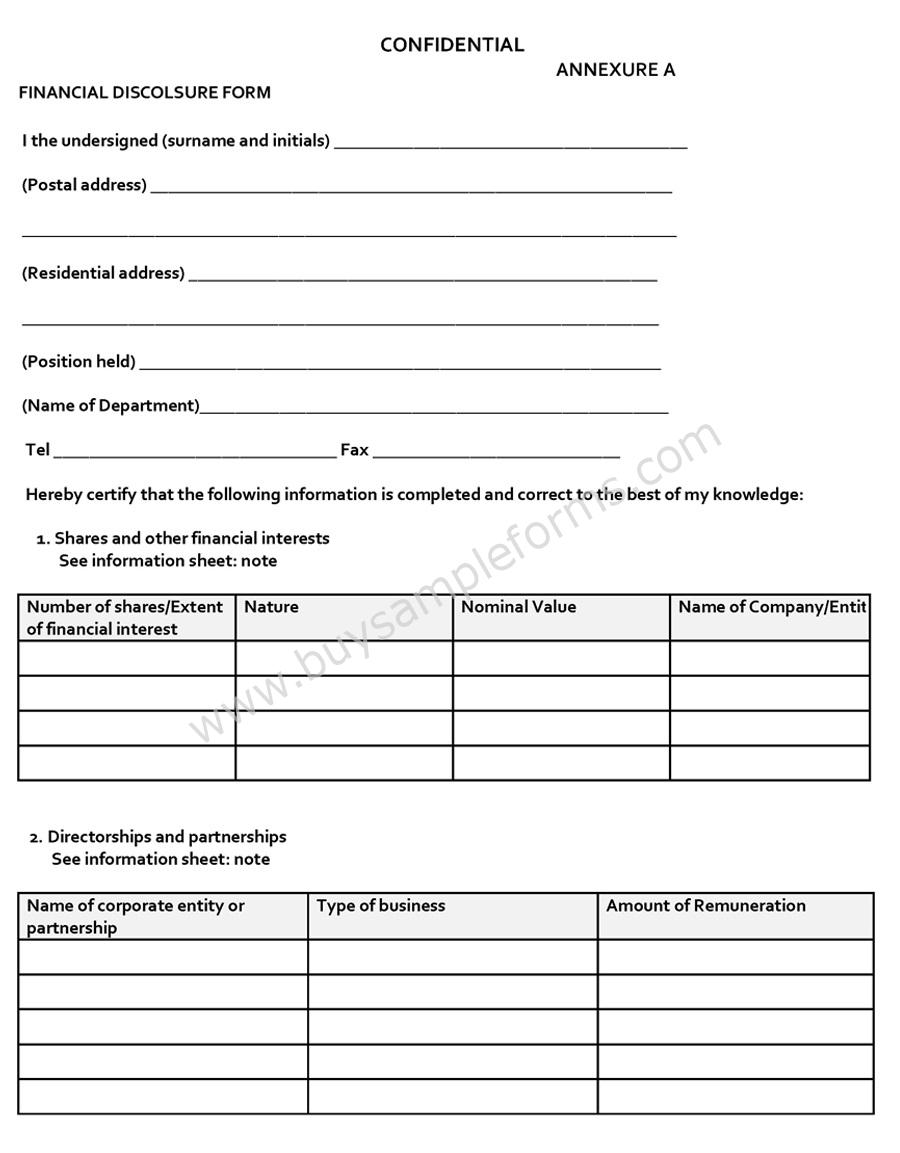

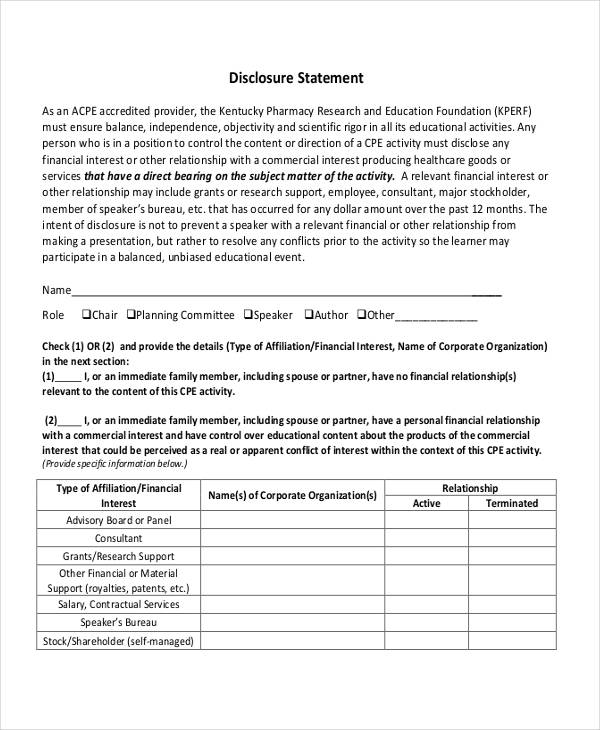

Financial Disclosure Form Sample Forms

Companies that are required to comply (“reporting companies”) must file their initial. Many companies are required to report information to fincen about the individuals who ultimately own or control them. The corporate transparency act requires most llcs and business entities to file a boi report. Need to file a boir? To avoid penalties, entities that existed before.

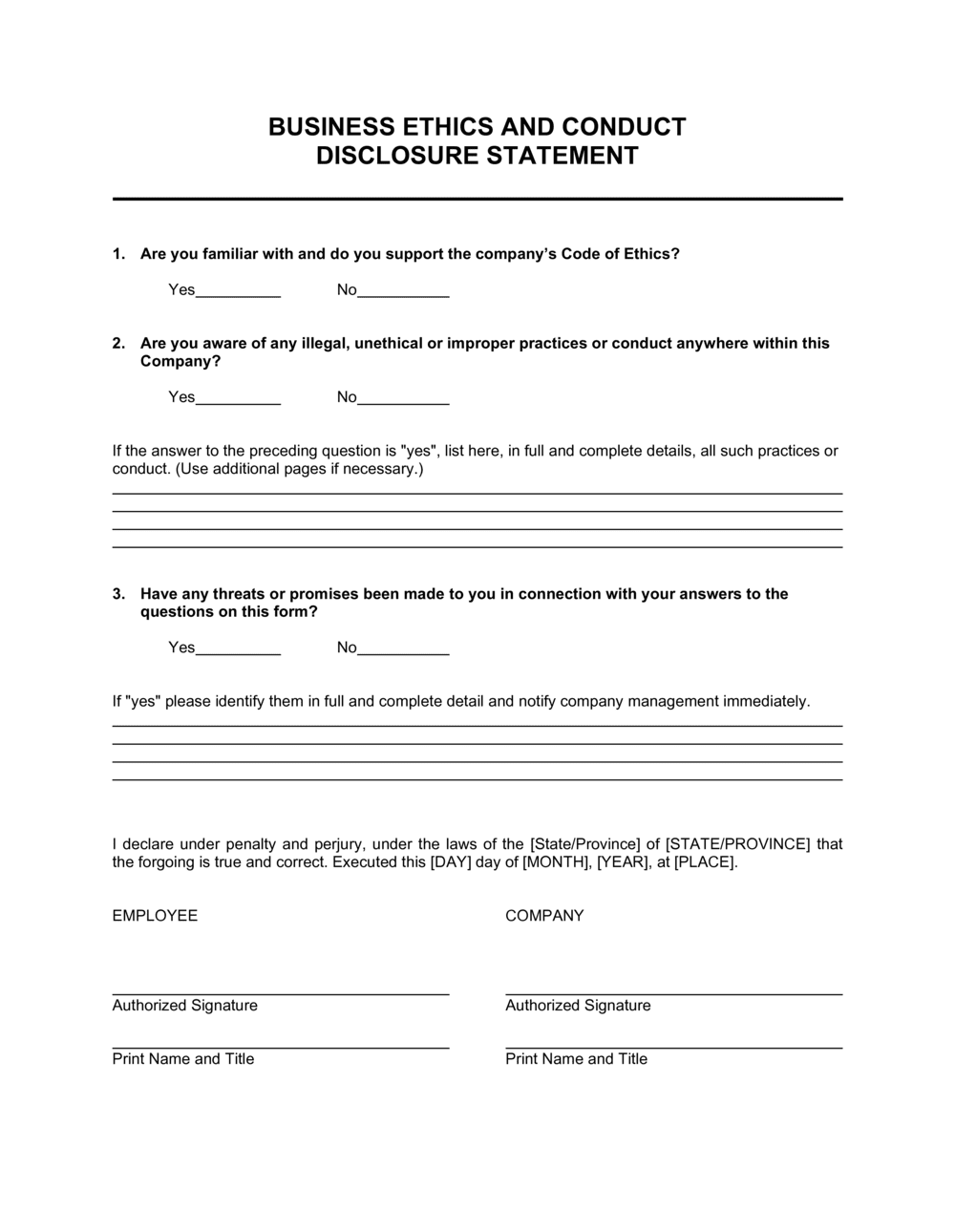

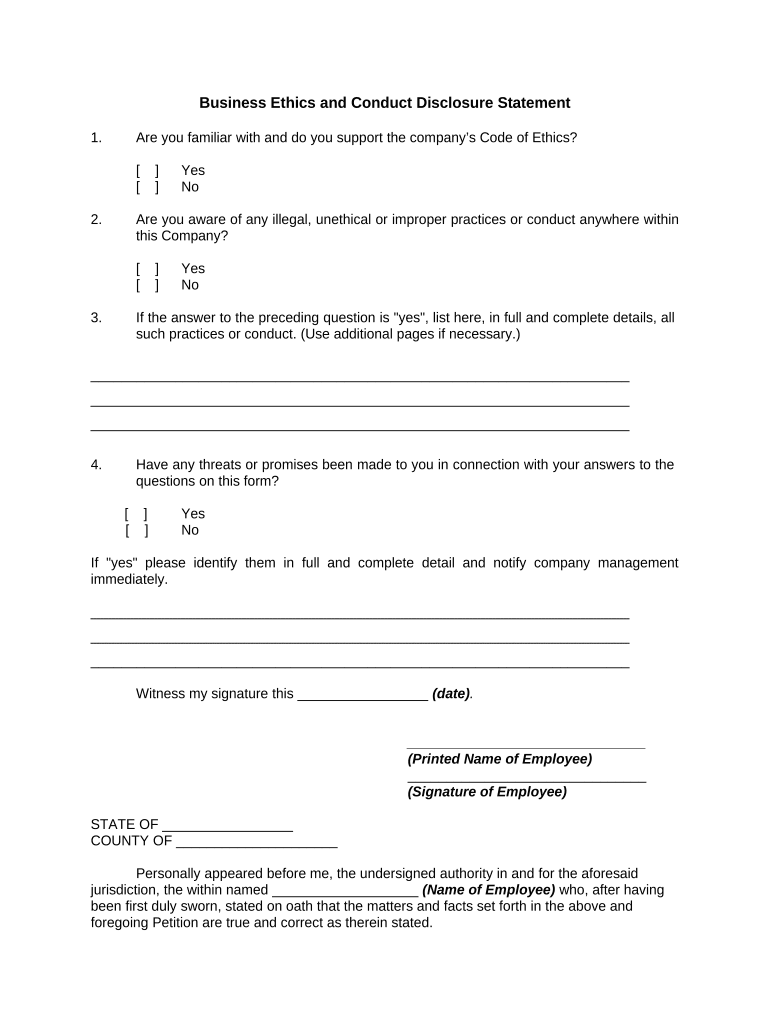

Business Ethics and Conduct Disclosure Statement Template (Download)

General instructions to form 4: The corporate transparency act requires most llcs and business entities to file a boi report. Need to file another type of bsa report? Companies that are required to comply (“reporting companies”) must file their initial. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate.

Free Printable Attorney Confidentiality Agreement Form Printable

To avoid penalties, entities that existed before. 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. Many companies are required to report information to fincen about the individuals who ultimately own or control them. Filing is simple, secure, and free of charge. When creating an outside business activity (“oba”) disclosure form,.

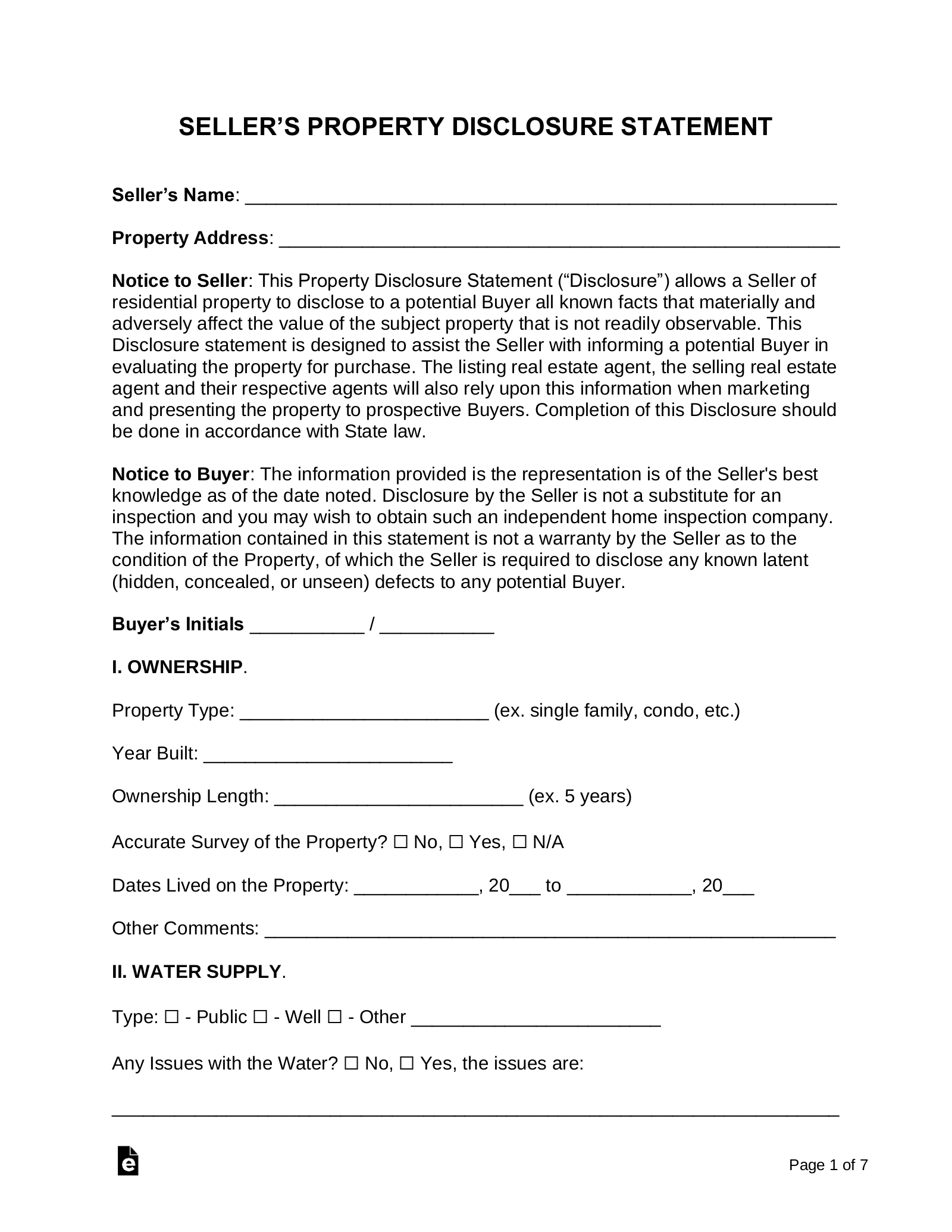

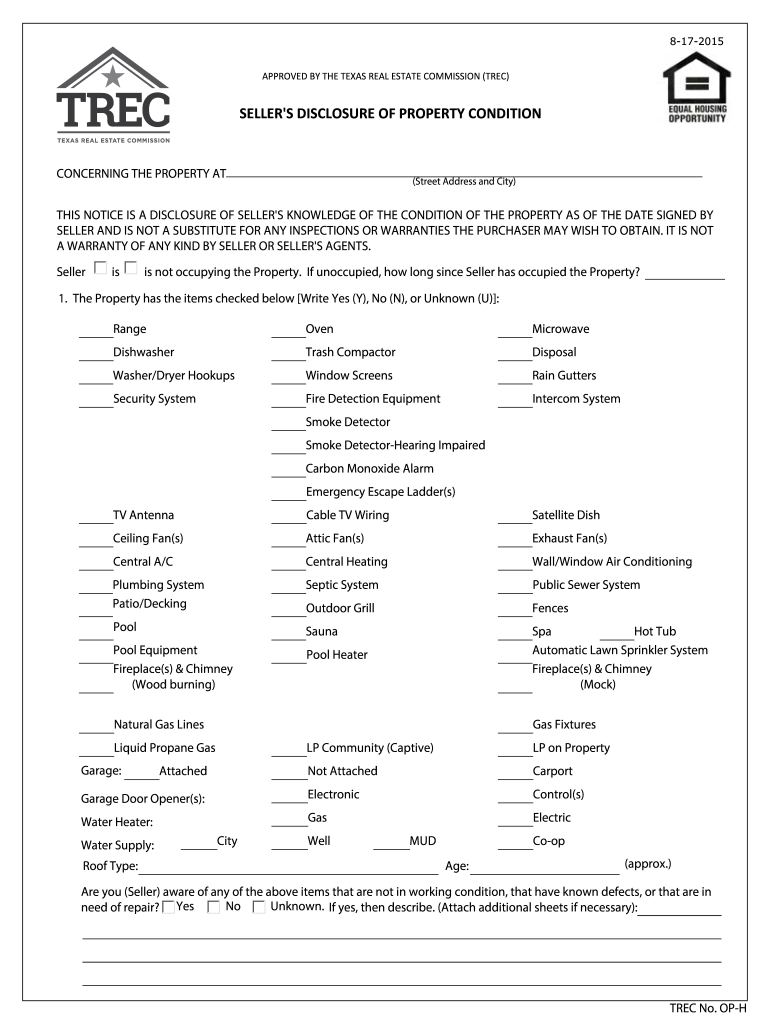

seller property disclosure statment Real estate forms, Legal forms

Need to file a boir? When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Need to file another type of bsa report? Go to the help section in the blue. General instructions to form 4:

Maine Seller S Property Disclosure Form Fillable Free Printable Forms

Filing is simple, secure, and free of charge. Companies that are required to comply (“reporting companies”) must file their initial. Many companies are required to report information to fincen about the individuals who ultimately own or control them. The corporate transparency act requires most llcs and business entities to file a boi report. Go to the help section in the.

Disclosure Face Template

To avoid penalties, entities that existed before. General instructions to form 4: Many companies are required to report information to fincen about the individuals who ultimately own or control them. Go to the help section in the blue. Need to file another type of bsa report?

Business Disclosure Form Sample Complete with ease airSlate SignNow

Filing is simple, secure, and free of charge. Need to file a boir? Many companies are required to report information to fincen about the individuals who ultimately own or control them. General instructions to form 4: Annual statement of beneficial ownership of securities general instructions to form 5:

Texas Real Estate Fillable Seller S Disclosure Form Printable Forms

Many companies are required to report information to fincen about the individuals who ultimately own or control them. Need to file a boir? 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. Companies that are required to comply (“reporting companies”) must file their initial. General instructions to form 4:

Disclosure Statement 7+ Examples, Format, How to Write, PDF

When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. General instructions to form 4: Need to file another type of bsa report? To avoid penalties, entities that existed before. Need to file a boir?

Need To File Another Type Of Bsa Report?

Go to the help section in the blue. 1, 2024, many businesses will be required to report beneficial ownership information to the financial crimes enforcement network. General instructions to form 4: Companies that are required to comply (“reporting companies”) must file their initial.

Under The Act, Small Businesses Across The United States Need To File Beneficial Ownership Information Reports, Also Known As Corporate.

Filing is simple, secure, and free of charge. Annual statement of beneficial ownership of securities general instructions to form 5: When creating an outside business activity (“oba”) disclosure form, it's important to understand how finra defines an outside. Many companies are required to report information to fincen about the individuals who ultimately own or control them.

To Avoid Penalties, Entities That Existed Before.

Need to file a boir? The corporate transparency act requires most llcs and business entities to file a boi report.