Alabama Tax Lien Sales

Alabama Tax Lien Sales - Payment in full is required at least one hour before the end of the sale day. Tax sale property is advertised during the month. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder. Once your price quote is processed it.

Once your price quote is processed it. Payment in full is required at least one hour before the end of the sale day. Tax sale property is advertised during the month. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

Tax sale property is advertised during the month. Once your price quote is processed it. Payment in full is required at least one hour before the end of the sale day. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

Alabama Tax Lien Changes 2022

Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder. Once your price quote is processed it. Tax sale property is advertised during the month. Payment in full is required at least one hour before the end of the sale day.

Alabama sales tax exemption certificate Fill out & sign online DocHub

Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder. Payment in full is required at least one hour before the end of the sale day. Once your price quote is processed it. Tax sale property is advertised during the month.

Ultimate Alabama Sales Tax Guide Zamp

Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder. Once your price quote is processed it. Tax sale property is advertised during the month. Payment in full is required at least one hour before the end of the sale day.

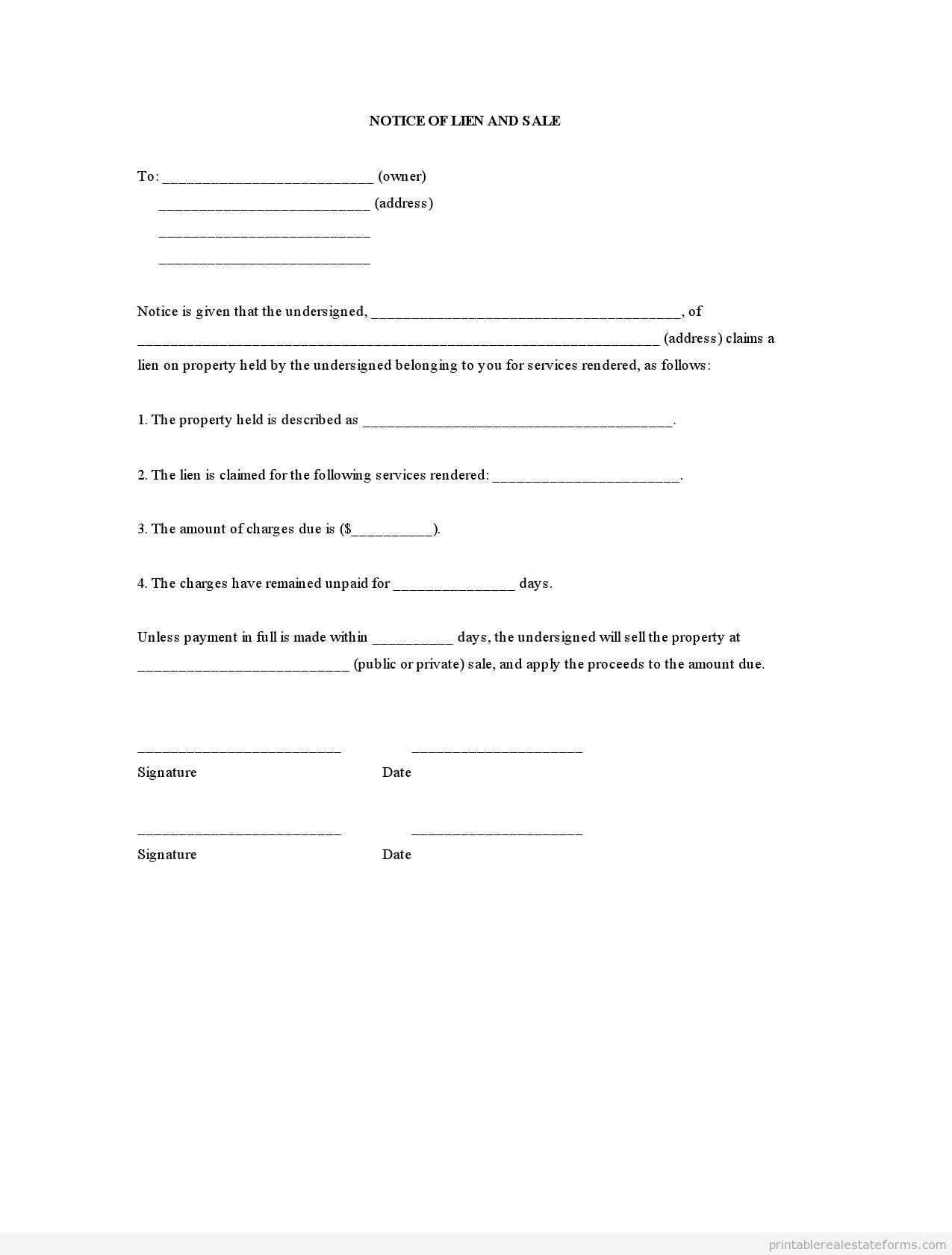

Free Printable Notice Of Lien And Sale Form(PDF & WORD)

Once your price quote is processed it. Payment in full is required at least one hour before the end of the sale day. Tax sale property is advertised during the month. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

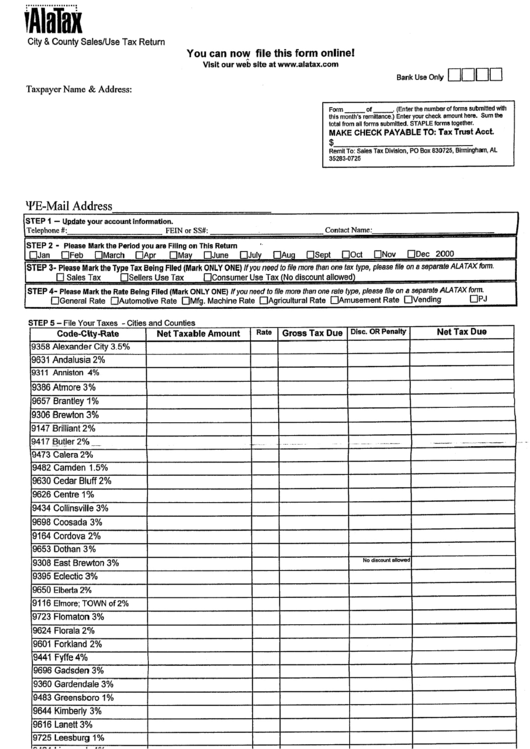

City And County Sales/use Tax Return Form Alabama Sales Tax Division

Payment in full is required at least one hour before the end of the sale day. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder. Once your price quote is processed it. Tax sale property is advertised during the month.

Federal tax lien on foreclosed property laderdriver

Once your price quote is processed it. Payment in full is required at least one hour before the end of the sale day. Tax sale property is advertised during the month. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

Tax Lien Sales Can You Buy Tax Lien Properties to Save Big?

Tax sale property is advertised during the month. Payment in full is required at least one hour before the end of the sale day. Once your price quote is processed it. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Payment in full is required at least one hour before the end of the sale day. Tax sale property is advertised during the month. Once your price quote is processed it. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

alabama tax lien search Cherly Prichard

Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder. Tax sale property is advertised during the month. Once your price quote is processed it. Payment in full is required at least one hour before the end of the sale day.

Alabama's Reliance On Sales Tax Alabama News

Tax sale property is advertised during the month. Payment in full is required at least one hour before the end of the sale day. Once your price quote is processed it. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.

Once Your Price Quote Is Processed It.

Payment in full is required at least one hour before the end of the sale day. Tax sale property is advertised during the month. Each may, tax delinquent property is auctioned off at the morgan county courthouse to the highest bidder.