Alabama Local Tax

Alabama Local Tax - 31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%. The state of alabama administers over 200 different city and. Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. There are a total of 372 local tax. In addition to the state sales tax, local sales taxes are also due, and these rates vary. Alabama has recent rate changes (thu jul 01. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,.

Alabama has recent rate changes (thu jul 01. Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. There are a total of 372 local tax. In addition to the state sales tax, local sales taxes are also due, and these rates vary. 31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. The state of alabama administers over 200 different city and.

Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. The state of alabama administers over 200 different city and. 31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. Alabama has recent rate changes (thu jul 01. In addition to the state sales tax, local sales taxes are also due, and these rates vary. There are a total of 372 local tax.

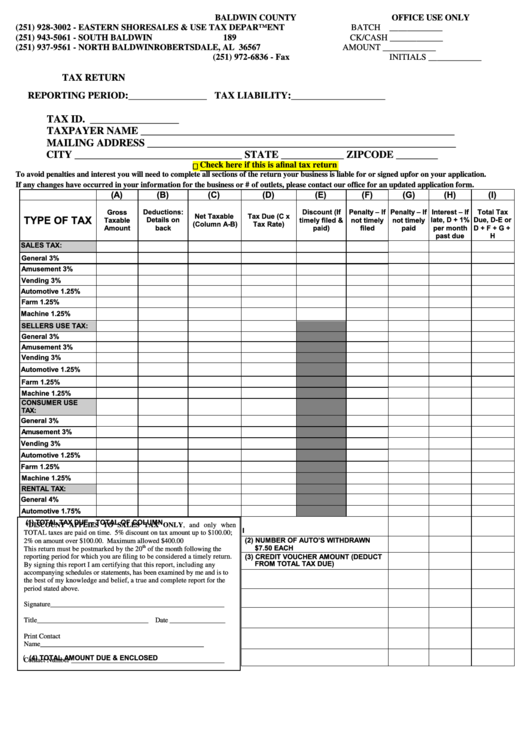

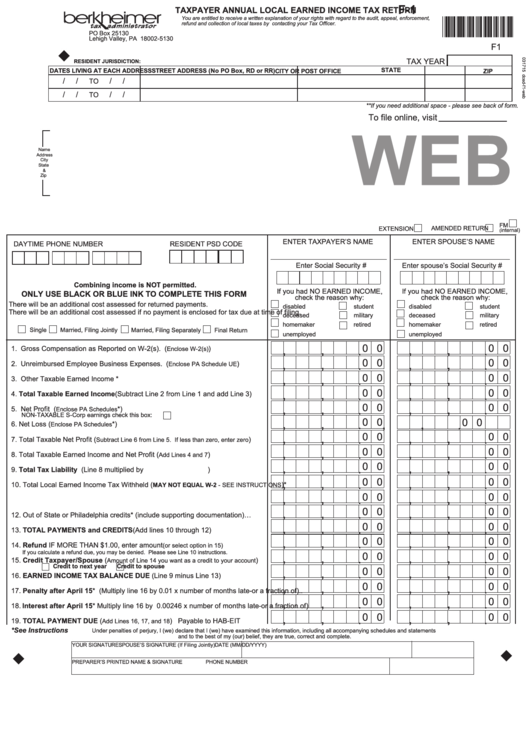

Fillable Tax Return Form Alabama Sales & Use Tax Department printable

The state of alabama administers over 200 different city and. Alabama has recent rate changes (thu jul 01. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. In addition to the state sales tax, local sales taxes are also due, and these rates vary. There are.

Local Finance & Tax Service of Centre Alabama Centre AL

The state of alabama administers over 200 different city and. In addition to the state sales tax, local sales taxes are also due, and these rates vary. Alabama has recent rate changes (thu jul 01. 31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%. There are a total of 372 local tax.

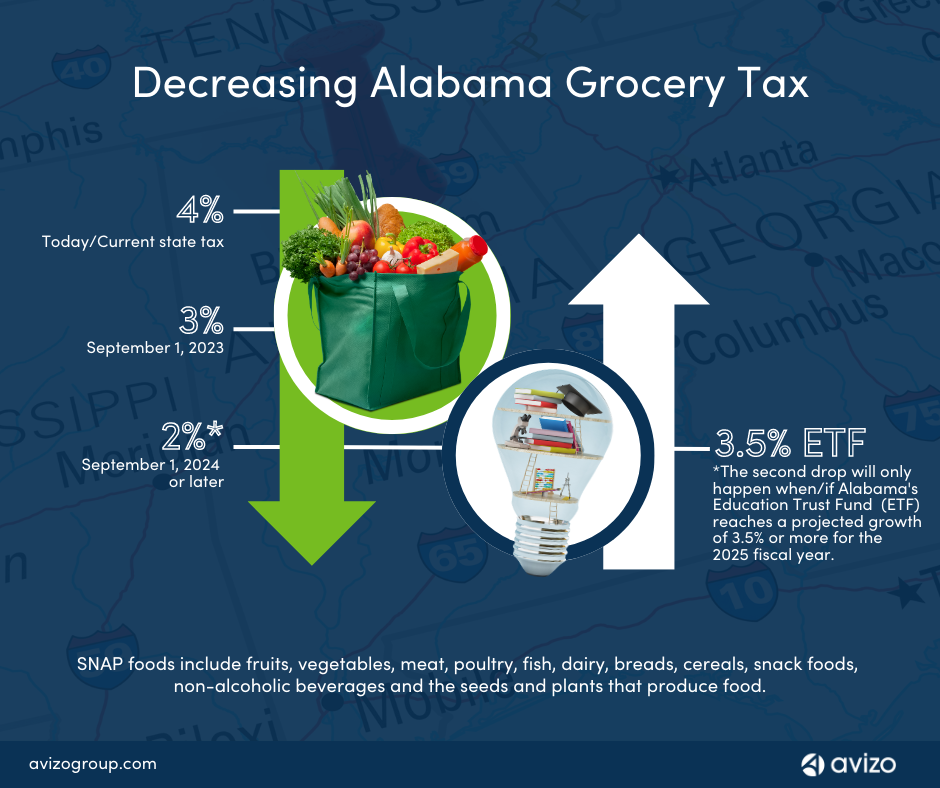

Alabama Grocery Tax Reduction Avizo Group

Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. There are a total of 372 local tax. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. In addition to the state sales tax,.

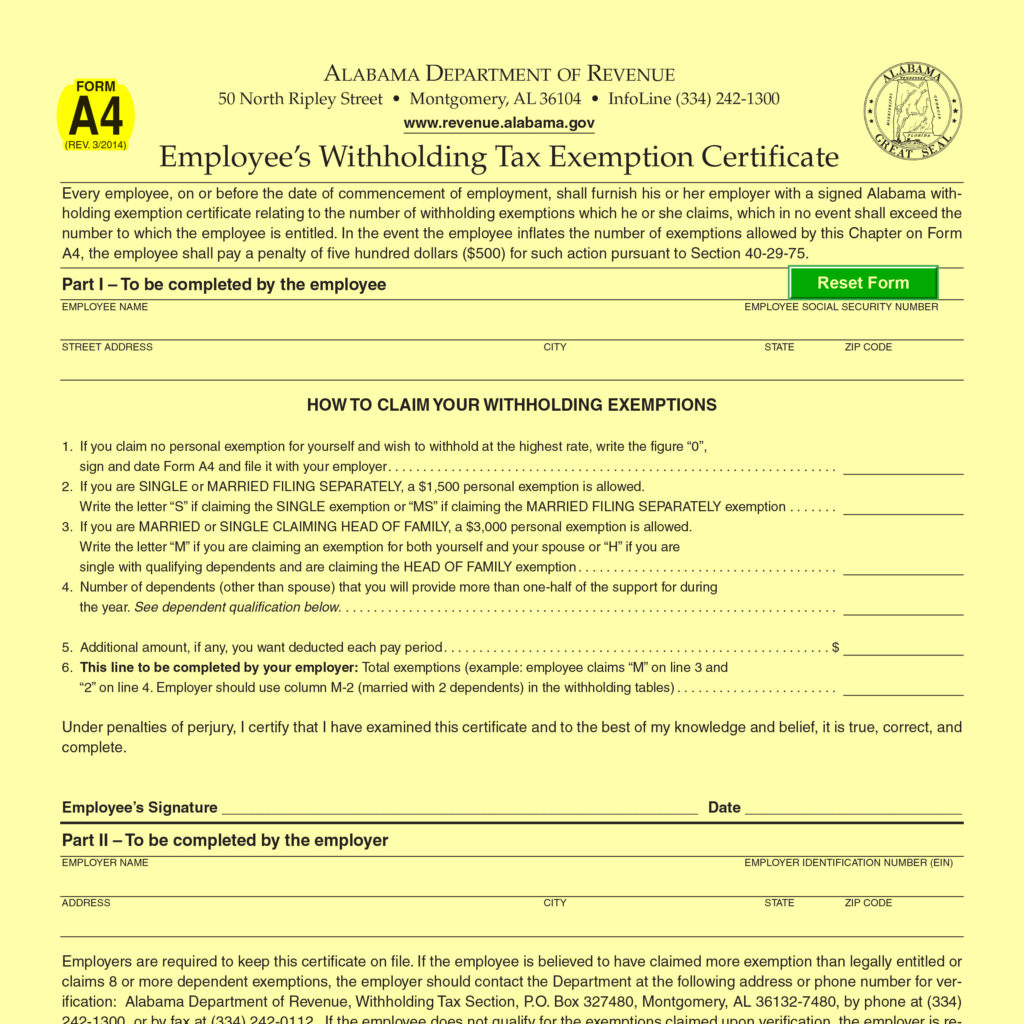

Alabama State Tax Withholding Form 2022 W4 Form

There are a total of 372 local tax. Alabama has recent rate changes (thu jul 01. In addition to the state sales tax, local sales taxes are also due, and these rates vary. The state of alabama administers over 200 different city and. 31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%.

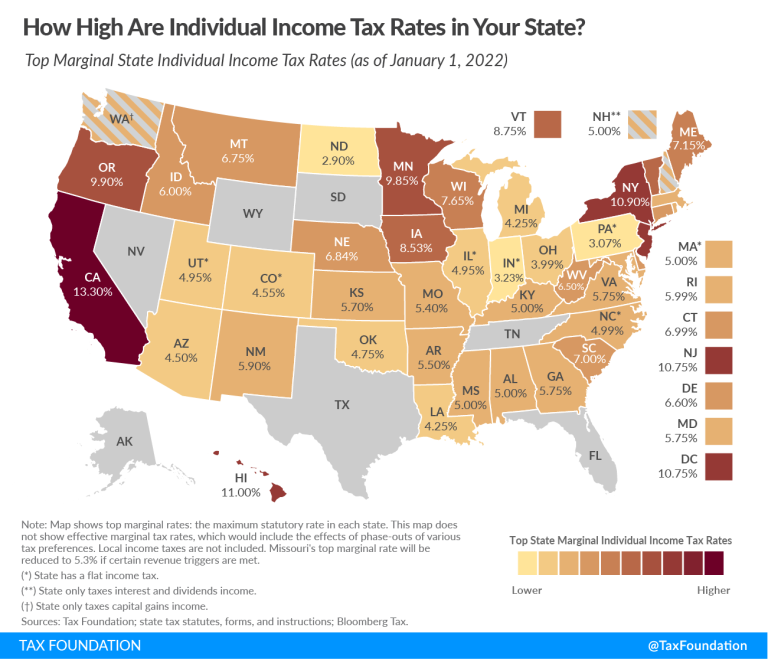

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation Fillable Form

Alabama has recent rate changes (thu jul 01. 31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%. In addition to the state sales tax, local sales taxes are also due, and these rates vary. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type.

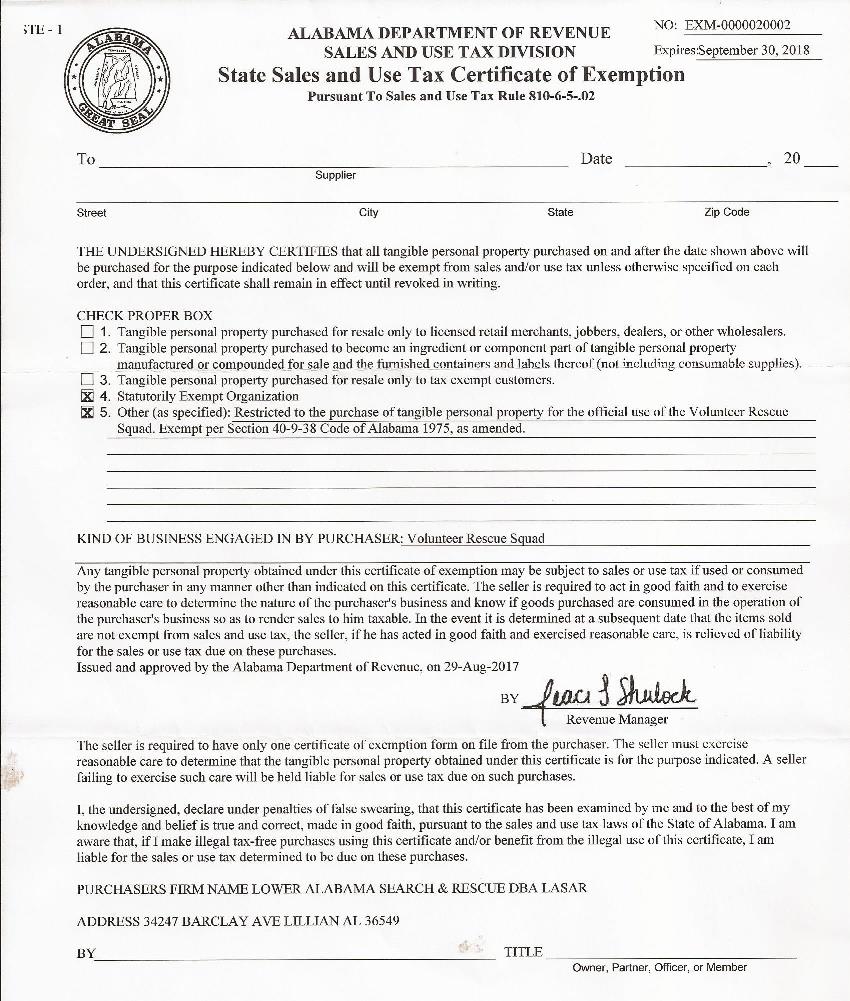

LASAR Forms

Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. In addition to the state sales tax, local sales taxes are also due, and these rates vary. Alabama has recent rate changes (thu jul 01. 31 rows with local taxes, the total sales tax rate is between 5.000%.

Fillable Alabama Local Tax Return Form 9501 Printable Forms Free Online

The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. The state of alabama administers over 200 different city and. There are a total of 372 local tax. Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of.

Ultimate Alabama Sales Tax Guide Zamp

The state of alabama administers over 200 different city and. There are a total of 372 local tax. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of.

Alabama's state, local tax collections per person secondlowest in U.S

The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. Alabama has recent rate changes (thu jul 01. Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. In addition to the state sales tax,.

LASAR Forms

The state of alabama administers over 200 different city and. There are a total of 372 local tax. The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,. Alabama has recent rate changes (thu jul 01. Alabama has state sales tax of 4%, and allows local governments.

There Are A Total Of 372 Local Tax.

31 rows with local taxes, the total sales tax rate is between 5.000% and 11.500%. Alabama has state sales tax of 4%, and allows local governments to collect a local option sales tax of up to 8.5%. The state of alabama administers over 200 different city and. In addition to the state sales tax, local sales taxes are also due, and these rates vary.

Alabama Has Recent Rate Changes (Thu Jul 01.

The form also provides certain areas for insertion of information or tax requirements specific to a particular jurisdiction (e.g., type tax, tax rate,.