28 Percent Rate Gain Worksheet

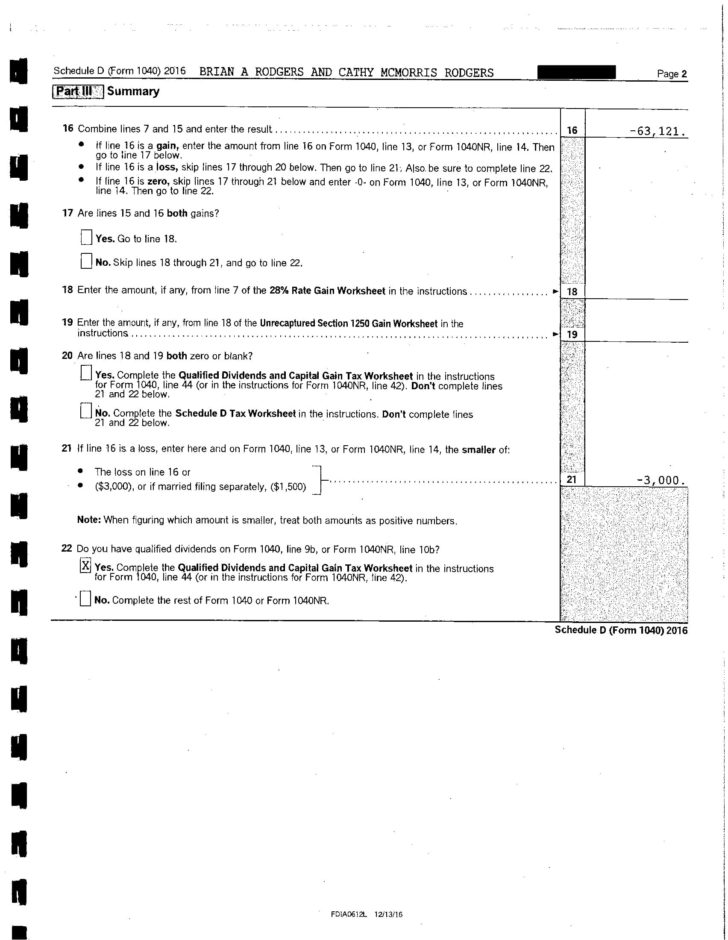

28 Percent Rate Gain Worksheet - Find out the tax rates,. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out when to use form 8949,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof).

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out the tax rates,. Deferral of gain invested in a qualified opportunity fund (qof). Find out when to use form 8949,.

Find out when to use form 8949,. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out the tax rates,.

28 Rate Gain Worksheet Instructions

Find out when to use form 8949,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof). Find out the tax rates,.

Qualified Dividend And Capital Gain Tax

Deferral of gain invested in a qualified opportunity fund (qof). Find out the tax rates,. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out when to use form 8949,. Learn how to complete schedule d (form 1040) to report capital gains and.

Printable Worksheets

Find out when to use form 8949,. Find out the tax rates,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Enter the total of all collectibles gain or (loss) from form 4684,.

28 Percent Rate Gain Worksheet

Find out when to use form 8949,. Find out the tax rates,. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts.

Fillable Online 28 Rate Gain Worksheet Line 18 Fax Email Print

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Find out when to use form 8949,. Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of all collectibles gain.

Builtin Gains Tax Calculation Worksheet

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Deferral of gain invested in a qualified opportunity fund (qof). Learn how to complete schedule d to report.

28 Percent Rate Gain Worksheet 2023

Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out the tax rates,. Find out when to use form 8949,. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete.

You Can Apply Several Different Worksheet Themes From Which Tab

Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Learn how to complete schedule d (form 1040) to report capital gains and losses from various.

10++ 28 Rate Gain Worksheet Worksheets Decoomo

Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Deferral of gain invested in a qualified opportunity fund (qof). Find out when to use form 8949,. Find out the tax rates,. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684,.

28 Rate Gain Worksheet 2023

Find out when to use form 8949,. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out the tax rates,. Learn how to complete schedule d.

Find Out When To Use Form 8949,.

Enter the total of all collectibles gain or (loss) from form 4684, line 4 (but only if form 4684, line 15, is more than zero); Find out the tax rates,. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Deferral of gain invested in a qualified opportunity fund (qof).