2.5 Tax $679 Semimonthly Find The Local Tax Deducted

2.5 Tax $679 Semimonthly Find The Local Tax Deducted - Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Item 1 find the amount of the fica. Also, use a 0.05 significance level and state the conclusion about the null hypothesis. Explanation the given question is related to math. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Find the local tax deducted., 1 3/4% tax, $43210. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: The local tax deducted is $16.98. This can be done by multiplying $679 by 0.025. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the.

Explanation the given question is related to math. Also, use a 0.05 significance level and state the conclusion about the null hypothesis. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: Item 1 find the amount of the fica. This can be done by multiplying $679 by 0.025. Find the local tax deducted., 1 3/4% tax, $43210. Identify the given values in the question. The local tax deducted is $16.98.

Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Find the local tax deducted., 1 3/4% tax, $43210. Explanation the given question is related to math. This can be done by multiplying $679 by 0.025. Identify the given values in the question. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Also, use a 0.05 significance level and state the conclusion about the null hypothesis. Item 1 find the amount of the fica. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the.

Soda Tax TaxEDU Glossary

Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary.

Ultimate Guide to Tax Deducted at Source in GST

This can be done by multiplying $679 by 0.025. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. The local tax deducted is $16.98. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Explanation the given question is related to math.

Combined State and Average Local Sales Tax Rates Tax Foundation

Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. This can be done by multiplying $679 by 0.025. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: Also, use.

Tax Deducted at Source Form 26 AS What and How?

Explanation the given question is related to math. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Also, use a 0.05 significance level and state the conclusion about the null hypothesis. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: Find the.

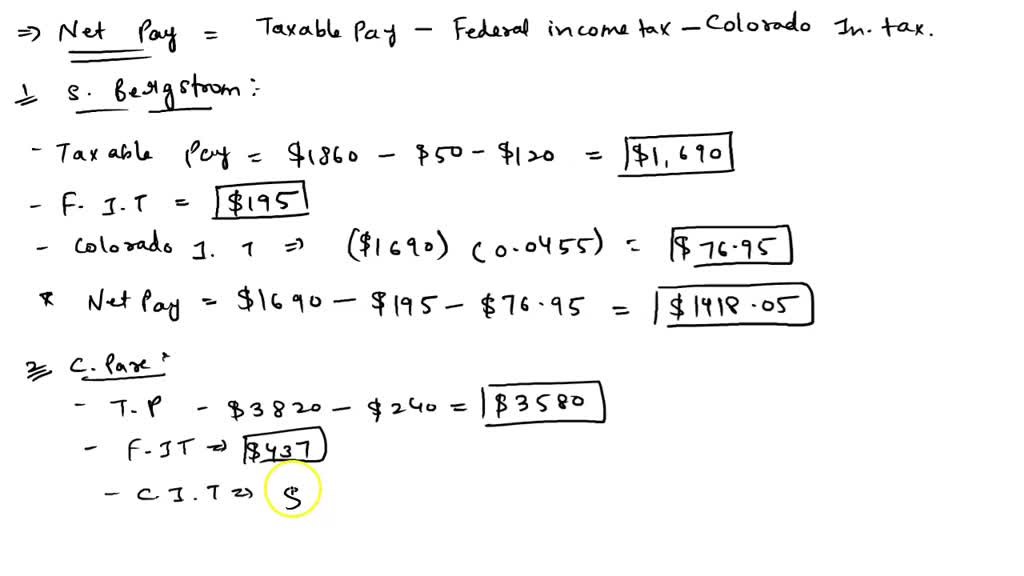

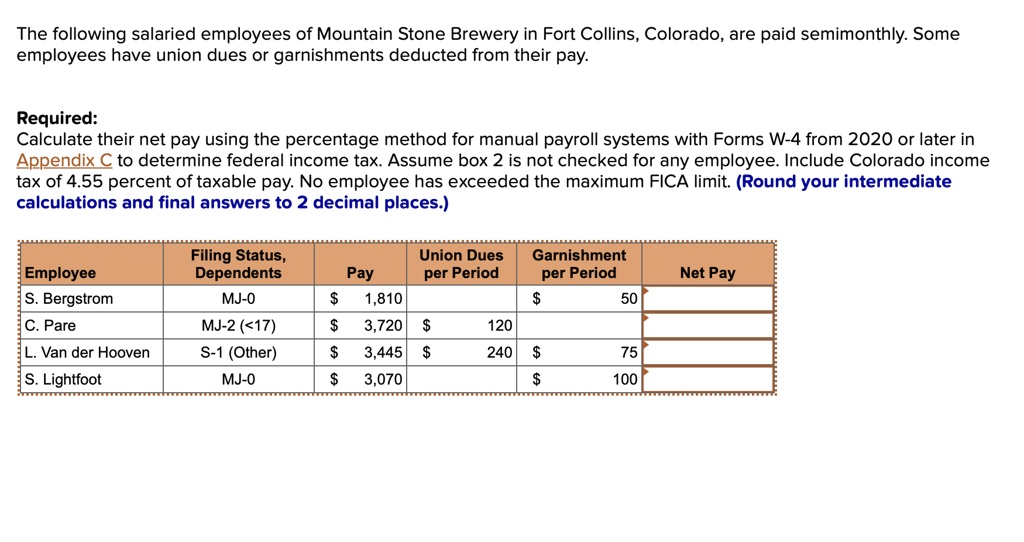

The following salaried employees of Mountain Stone Brewery in Fort

Explanation the given question is related to math. Item 1 find the amount of the fica. Find the local tax deducted., 1 3/4% tax, $43210. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana.

Understanding Tax Deducted at Source (TDS)

Item 1 find the amount of the fica. The local tax deducted is $16.98. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: Identify the given values in the question. Find the local tax deducted., 1 3/4% tax, $43210.

How to get refund of Tax Deducted under section 195 Legal Suvidha Blog

View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. For question #2 to find the amount of social security tax.

Perbandingan Local Tax Berbagai Negara PDF Taxes Property Tax

To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Explanation the given question is related to math. The local tax deducted is $16.98. View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Identify the given values in the question.

Frequently asked questions on Tax Deducted at Source (TDS) the

Also, use a 0.05 significance level and state the conclusion about the null hypothesis. Find the local tax deducted., 1 3/4% tax, $43210. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the..

The following salaried employees of Mountain Stone Brewery in Fort

To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Also, use a 0.05 significance level and state the conclusion about the null hypothesis. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly: The local tax deducted is $16.98. Study with quizlet and memorize flashcards containing terms like find.

Find The Local Tax Deducted., 1 3/4% Tax, $43210.

The local tax deducted is $16.98. To find the local tax deducted, we need to calculate 2.5% of the semimonthly salary of $679. Explanation the given question is related to math. For question #2 to find the amount of social security tax deducted from the given pay period you would need to multiple to the.

Identify The Given Values In The Question.

This can be done by multiplying $679 by 0.025. Study with quizlet and memorize flashcards containing terms like find the amount of social security deducted from the check: View 3.02 quiz payroll deductions 2.docx from math 1001 at pontificia universidad javeriana. Study with quizlet and memorize flashcards containing terms like 2.5% tax, $679 semimonthly:

Also, Use A 0.05 Significance Level And State The Conclusion About The Null Hypothesis.

Item 1 find the amount of the fica.

.png)